Bitcoin Shatters $100K Support Level as Bearish Momentum Intensifies

BITCOIN PLUNGES BELOW CRITICAL $100K THRESHOLD

The digital gold standard faces its toughest test yet as bears seize control of the market. That psychological support level everyone was banking on? Gone in a flash of red candles.

Technical Breakdown: What's Next?

Market structure fractures as Bitcoin fails to hold the $100,000 line that institutional investors considered sacrosanct. Trading volumes spike while liquidation cascades ripple through derivatives markets. The 'number go up' thesis faces its most significant challenge since the last cycle's downturn.

Institutional Response

Major holders reposition portfolios while retail traders face margin calls. Traditional finance analysts suddenly remember they 'always had concerns' about cryptocurrency volatility—conveniently forgetting their bullish predictions from three months ago.

Long-term Outlook

History shows Bitcoin has weathered worse storms. Every major correction eventually became a buying opportunity in hindsight. The fundamentals remain unchanged: limited supply, growing adoption, and a monetary policy that doesn't depend on central bankers printing their way out of trouble.

This dip either terrifies you or excites you—and your reaction says everything about your conviction in decentralized finance's future.

Read us on Google News

Read us on Google News

In brief

- Bitcoin has fallen back below $100,000, a key psychological and technical threshold for the market.

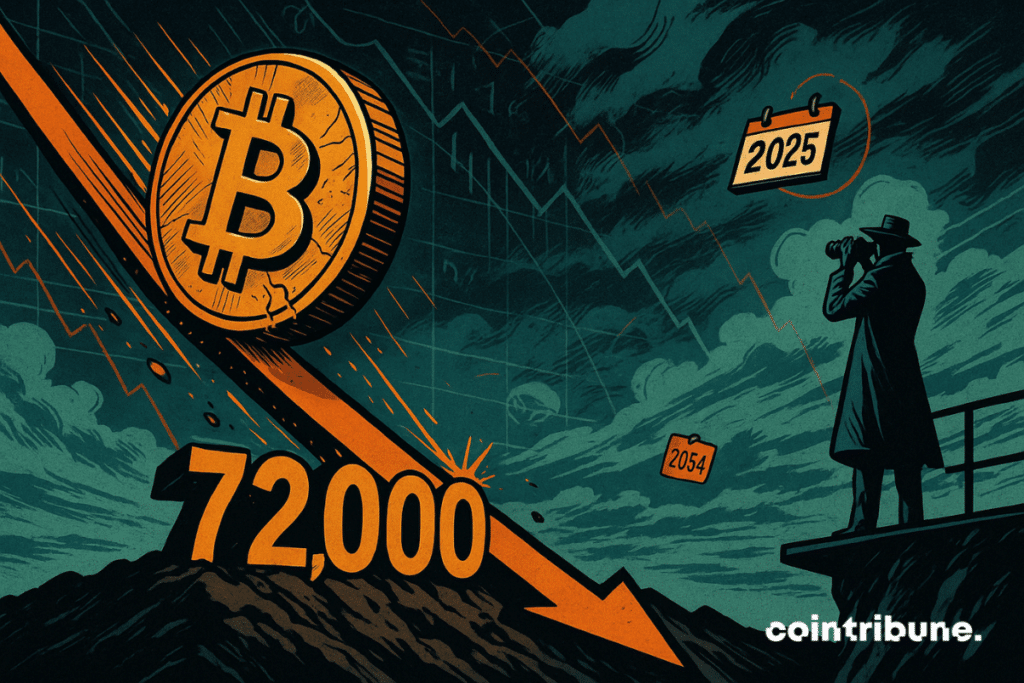

- CryptoQuant warns: a drop to $72,000 is possible within two months if this level doesn’t hold.

- The pressure is explained notably by the massive liquidation on October 10 and a weakening spot demand.

- Key indicators, such as ETF flows and the Bull Score Index, confirm a persistent bearish momentum.

Bitcoin could fall to $72,000

Bitcoin is collapsing and extreme fear is back on the market. “If the price fails to hold around $100,000 and breaks downward, the risks of a return to $72,000 within one to two months become very real,” said Julio Moreno, research director at CryptoQuant.

The warning comes as BTC dropped to $100,582 this Tuesday afternoon, marking a decline of more than 5.6 % in 24 hours, and falling back under $100,000 for the first time since June. This drop fits into a global market movement: the GMCI 30 index also fell more than 9 % over the same period.

This brutal reversal is largely explained by the domino effect triggered by the record liquidation on October 10, described by CryptoQuant as the largest in market history. Indeed, more than $20 billion of Leveraged positions were liquidated that day. Since then, several indicators have signaled a general weakening of the upward momentum :

- Spot demand declining, especially in the United States ;

- Negative ETF flows, signaling a growing disinterest from institutional investors ;

- The Coinbase premium has turned negative, revealing persistent selling pressure in the US markets ;

- CryptoQuant’s Bull Score Index is at 20, a level reflecting decidedly bearish market conditions.

Combined, these factors reveal a possible extension of the ongoing correction, with the $72,000 threshold now identified as a target level in case of confirmed break of $100,000.

An increasingly heavy macroeconomic and structural climate

Beyond technical indicators and on-chain movements, the pressure on Bitcoin also fits into an unfavorable macroeconomic context. Gerry O’Shea, head of global analysis at Hashdex, points out that several external factors amplify the current crypto decline.

“Recent speculation that the FOMC might forgo a new rate cut this year, combined with concerns over tariffs, credit conditions, and stock market valuations, has contributed to market declines,” he analyzes. These uncertainties weigh as much on cryptos as on stocks or commodities, reinforcing a trend of investor disengagement.

Other more structural factors also influence the current trajectory of BTC. According to O’Shea, a growing share of selling pressure comes from long-term investors: historic holders taking profits in a context of past price increases—a phenomenon expected at this stage of market maturity.

However, he insists that this correction does not invalidate the long-term bullish scenario. “ETF flows and institutional adoption remain very strong this year. Major financial institutions continue building infrastructure dedicated to crypto,” he adds.

Thus, even if the $100,000 threshold remains a major psychological barrier, its break does not necessarily seal bitcoin’s long-term fate. The gradual end of US monetary tightening, combined with an acceleration of corporate adoption, could even provide a favorable base for a future rebound. However, in the short term, signals from the market advocate caution and reinforce the relevance of the warning issued by CryptoQuant.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.