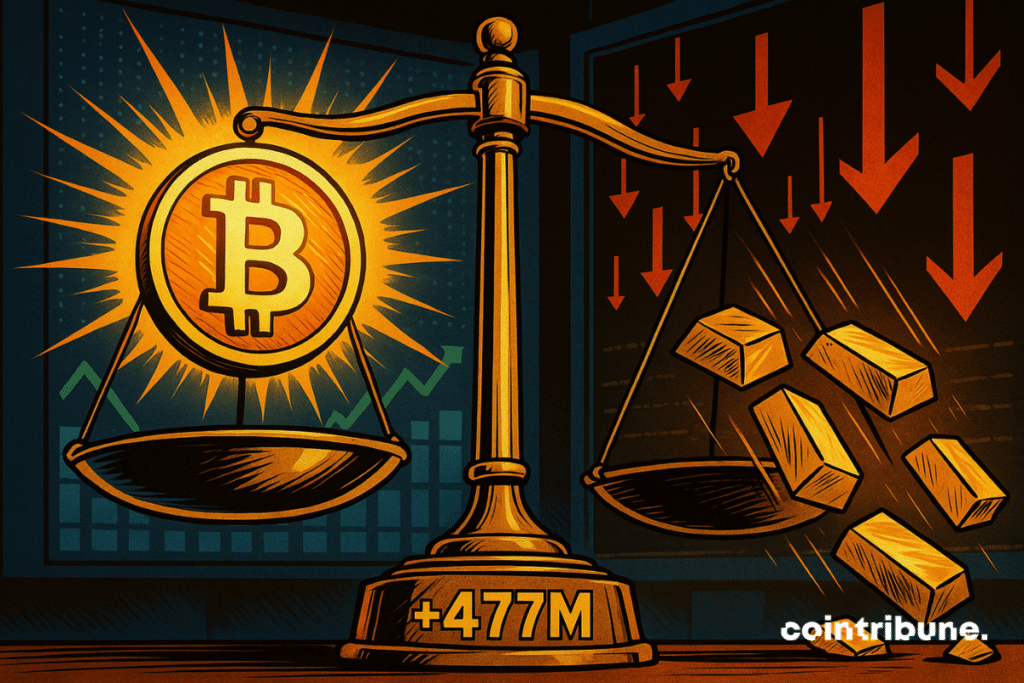

Bitcoin ETFs Soar with $477 Million Inflows as Gold Crumbles - Digital Dominance Accelerates

Wall Street's crypto embrace hits new highs while the old guard stumbles. Bitcoin ETFs just vacuumed up nearly half a billion dollars in fresh capital - $477 million to be precise - as gold investors scramble for the exits.

The Great Rotation Accelerates

Traditional safe havens are looking anything but safe these days. While gold prices tumble, digital gold keeps shining brighter. Institutional money isn't just dipping toes anymore - it's diving headfirst into Bitcoin exposure through regulated vehicles.

Numbers Don't Lie

That $477 million inflow represents more than just capital movement - it's a statement of intent from smart money. Meanwhile, gold's decline reads like a cautionary tale for assets stuck in the analog age. The pattern's becoming impossible to ignore: when traditional stores of value wobble, digital alternatives strengthen.

Finance's New Reality

Watching gold investors nervously eyeing Bitcoin charts has become the ultimate role reversal in wealth preservation. Maybe those Wall Street suits finally figured out that digital scarcity beats digging rocks out of the ground. The future's looking increasingly binary - adapt to digital or watch your portfolio gather dust.

Read us on Google News

Read us on Google News

In brief

- Gold falls 5.9% in one day, hitting its worst record in ten years.

- Bitcoin ETFs gather $477 million, driven by IBIT, ARKB, and FBTC.

- Three billion dollars in bitcoins migrate to BlackRock ETF following an SEC rule.

- Ethereum captures $141 million via its ETFs, consolidating its role as a solid alternative to Bitcoin.

Bitcoin vs Gold: the shift accelerates in markets

Portfolios adjust, assets pivot. Gold, a historic safe haven, dropped 5.9% in one session — its worst slide in over a decade. This suggests its last peak may have started the next big stage for bitcoin. The queen of cryptos, in contrast, saw investors flock. bitcoin ETFs recorded $477.2 million in net inflows on October 21, according to SoSoValue data. Nine out of twelve funds were green, notably $210.9M at IBIT (BlackRock), $162.8M for ARKB (Ark & 21Shares), and $34.15M for FBTC (Fidelity).

Nick Ruck, director at LVRG Research, analyzes the trend:

The return to positive net flows yesterday suggests a possible stabilization of institutional sentiment after recent volatility, indicating renewed confidence in crypto as a portfolio diversification tool amid economic uncertainties.

The message is clear: the curve reverses. The yellow metal stumbles, Bitcoin moves forward by leaps and bounds. And in its wake, other cryptos are forging a path.

The integration of whales: Bitcoin converts to the ETF world

The old bitcoin whales — those large crypto fortunes — no longer want to keep their BTC under the mattress. Over $3 billion in bitcoins have been transferred to BlackRock’s IBIT ETF. This MOVE is facilitated by a recent SEC decision that allows “in-kind” conversions, meaning without converting to cash.

Robbie Mitchnick, head of digital assets at BlackRock, notes that large bitcoin holders now prefer to integrate it into their traditional portfolios. This choice gives them easier access to conventional financial services without sacrificing their crypto market exposure.

This change slowly undermines the old crypto slogan: “Not your keys, not your coins.” The ideology of self-custody is gradually fading in favor of full and assumed integration into classical finance. Cryptos become building blocks in tax, yield, and hedging strategies. Bitcoin institutionalizes, without shame.

Cryptos in numbers: an overview of flows, prices, and winners

It’s not only bitcoin that attracts. Other digital assets benefit from the shift, notably Ethereum. Fidelity’s FETH fund captured $59M, ahead of BlackRock, VanEck, and Grayscale.

Some key figures to remember:

- Bitcoin was trading at $107,970 at the time of writing;

- Bitcoin ETFs have traded $7.41 billion in 24h;

- The IBIT ETF exceeds $88 billion in assets under management;

- Ethereum attracted $141.6M in ETFs on the same day;

- The average volume of crypto ETFs doubled between September and October.

This dynamism does not go unnoticed. Even lending platforms are beginning to align with these institutional flows. And while Gold suffers from a post-Diwali slump, cryptos reinvent themselves. It’s no longer a geeks’ world: it’s a marketplace in full transformation.

Bitcoin evolves, but the market remains fragile. Despite positive signals, some analysts explain the overall collapse by FLOW withdrawals, strategic selling, or geopolitical repositioning. While gold wobbles, cryptos resist — or at least adapt. The real test will be time.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.