SharpLink’s $3.5B Crypto Gamble Sparks Market Frenzy

SharpLink just dropped a crypto bomb that's shaking Wall Street to its core.

The $3.5 Billion Bet

They're throwing serious weight behind digital assets—enough to make traditional finance veterans choke on their morning coffee. This isn't just dipping toes in the water; it's a full-scale cannonball into the crypto pool.

Market Impact

The move sends shockwaves through trading floors worldwide. While regulators scramble to keep up, SharpLink's massive position demonstrates institutional confidence in crypto's staying power—despite what the skeptics in their expensive suits might claim.

Future Implications

This could trigger a domino effect among other major players sitting on the sidelines. When one whale moves, the entire ocean notices.

Sometimes the biggest risks yield the biggest rewards—or leave you wondering why you trusted that guy from the golf course with your investment strategy.

Read us on Google News

Read us on Google News

In brief

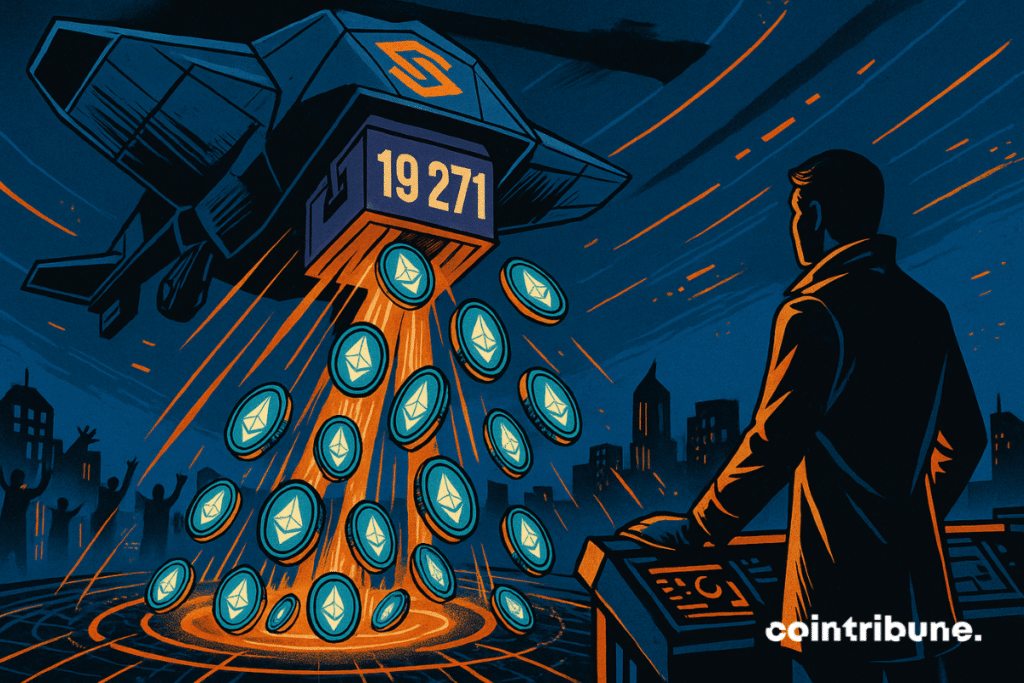

- SharpLink Gaming makes a major acquisition of 19,271 ETH at an average price of $3,892, totaling more than 75 million dollars.

- With a total of 859,853 ETH, the company now holds the equivalent of 3.5 billion dollars in Ethereum.

- This operation propels SharpLink among the largest ETH holders worldwide, across all categories.

- The company claims to conduct disciplined treasury management, with ETH concentration doubled since June.

SharpLink Becomes One of the Largest ETH Holders in the Market

While Trump’s tariffs sowed chaos in the crypto market, SharpLink Gaming announced having “acquired 19,271 ETH at an average price of $3,892” in a message published on X, adding that this operation brought its total reserves to “859,853 ETH, valued at 3.5 billion dollars as of October 19, 2025”.

NEW: SharpLink acquired 19,271 ETH at an average price of $3,892, bringing total holdings to 859,853 ETH valued at $3.5B as of October 19, 2025.

Key highlights for the week ending October 19, 2025:

– Raised $76.5M at a 12% premium to market

– Added 19,271 ETH at $3,892 avg.… pic.twitter.com/Y4Ewu4EiuF

This statement fits into a context of gradual return of institutional interest in cryptos. To date, SharpLink is among the largest ethereum holders worldwide, across all entities, a particularly notable fact given that the company operates not in traditional finance, but in the gaming sector.

The publication provides several numerical details that better clarify the scale and method behind this operation :

- $76.5 million was raised specifically to support this acquisition ;

- It was done at “a 12 % premium to the market price”, indicating strong investor appetite;

- 859,853 ETH, equivalent to 3.5 billion dollars ;

- 36.4 million dollars are still available in the treasury.

These on-chain data reveal rapid but structured execution. The size of the operation, the displayed transparency, and the premium offered to investors show strong confidence in the company’s long-term strategy regarding Ethereum. At this stage, no other actor of similar profile appears engaged at such a scale.

A Structured and Assumed Crypto Accumulation Strategy

Beyond the massive ETH purchase, SharpLink revealed that this accumulation strategy is not limited to mere asset holding. In the same message, the company states it generated “5,671 ETH in staking rewards since June 2, 2025”.

This figure shows that the acquired ETH is integrated within an optimized financial strategy framework. Moreover, the level of ETH concentration in their treasury is now “4.0, up 100% since June”. According to the wording used, this metric is interpreted by SharpLink as reflecting an “accretive execution” and “disciplined treasury management”.

This second part of communication reveals a logic of integrating cryptos within the company’s financial balances. It is not a speculative stunt but a built, progressive strategy where ETH becomes a central element of the reserve policy. The discipline mentioned seems to echo approaches observed in some companies that previously institutionalized bitcoin. In SharpLink’s case, Ethereum clearly takes the favored position.

Beyond its immediate impact on SharpLink’s brand image in the Web3 ecosystem, this announcement could serve as a reference or example for other companies in the technology or gaming sector seeking to reposition their asset strategy. If Ethereum continues its consolidation trajectory as a decentralized infrastructure layer, SharpLink’s bet might prove more visionary than bold.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.