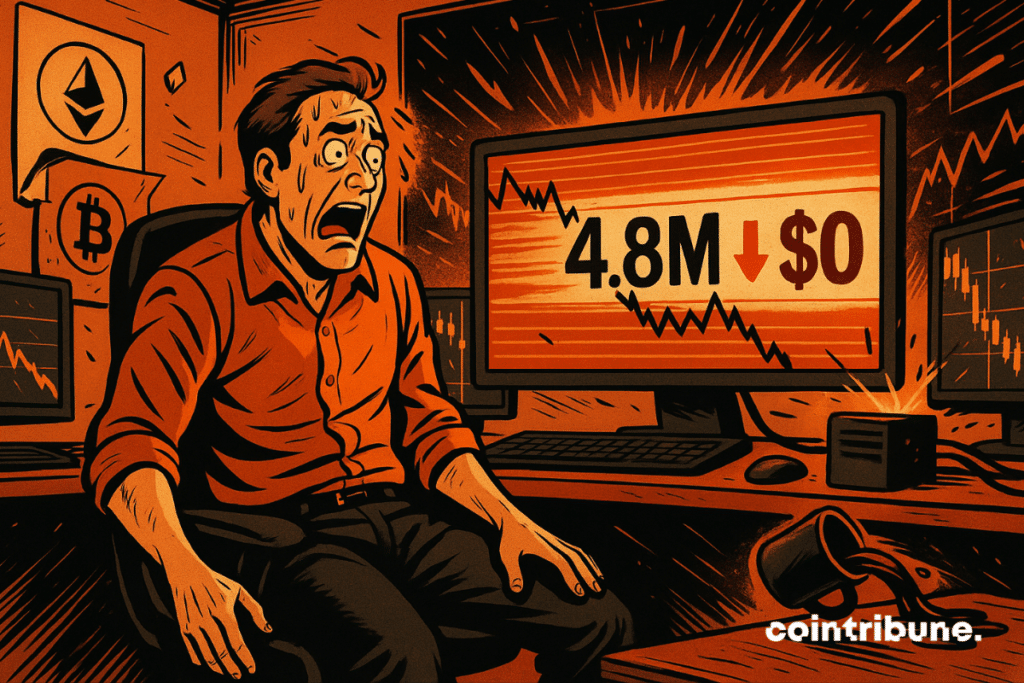

Crypto Trader James Wynn Faces $4.8M Total Wipeout - Again

Another massive blow hits the crypto trading scene as veteran trader James Wynn loses everything for the second time.

The $4.8M Meltdown

Wynn's portfolio evaporated completely in today's volatile market action—marking his second total financial collapse in recent years. The massive loss highlights the extreme risks even experienced traders face in cryptocurrency markets.

Pattern Recognition

This repeat performance raises serious questions about risk management protocols and position sizing strategies. While crypto offers unprecedented upside potential, it demands unprecedented discipline.

Lessons from the Ashes

The wipeout serves as a brutal reminder that past performance guarantees nothing in digital asset markets. Proper diversification and stop-loss protocols remain non-negotiable—even for traders with years of experience.

Because apparently, some Wall Street refugees still think crypto trading is just gambling with better graphics.

Read us on Google News

Read us on Google News

In brief

- James Wynn suffered a $4.8 million liquidation shortly after opening high-leverage positions.

- Wynn’s rapid loss follows a long pattern of massive liquidations that have marked his high-risk trading career.

Fresh Setback for Wynn After Bold Return

According to blockchain analytics firm Lookonchain, Wynn was liquidated for roughly $4.8 million shortly after opening large Leveraged positions on Tuesday. Data showed he deposited $197,000 in stablecoins to back the trades, which also earned him a referral bonus of $2,818. With the collateral in place, he entered long positions across three cryptocurrencies—Bitcoin ($BTC), KingPepe (kPEPE), and HYPE—using aggressive leverage levels.

Here are the key details of Wynn’s latest leveraged trades and the scale of his positions

- Wynn opened positions with 40x leverage on Bitcoin and 10x leverage on KingPepe and HYPE.

- His trades included 34.2 BTC worth about $3.85 million, 122.8 million kPEPE valued at $917,000, and 712.67 HYPE tokens worth $28,000.

- The total exposure reached roughly $4.8 million, greatly increasing both potential profits and the risk of loss.

- Within 24 hours, the market moved against him, resulting in the rapid liquidation of his positions.

Before the liquidation, Wynn had taken to X to announce his return, saying, “back with a vengeance, coming to get what’s rightly mine.” But after his positions were wiped out, Lookonchain remarked that each time he comes back to Hyperliquid to open new trades, the outcome ends the same way—with his positions quickly erased. According to Hypurrscan, the wallet linked to him now holds just $71,031, showing yet another setback in his turbulent trading record.

Wynn and the Cycle of Massive Bitcoin Liquidations

Wynn’s trading record has become well known in the cryptocurrency community, not for steady gains but for the massive scale of his wins and losses. In May, Cointribune reported that the trader lost around $100 million in a similar liquidation event after Bitcoin briefly slipped below $105,000. The decline triggered two successive liquidations, the first involving 527.29 BTC at $104,950 and the second for 421.8 BTC at $104,150. Together, the positions resulted in a combined loss of about $99.3 million.

Following the collapse, Wynn appealed to the broader crypto community for assistance, asking for help to rebuild his account. His call was met with support from at least 24 addresses that sent him funds. With those contributions, he opened another massive $100 million bitcoin position only days after the earlier loss.

Wynn later liquidated 240 BTC, worth around $25 million, to lower the risk of his remaining positions triggering a liquidation. Despite that move, the market turned against him once more, and he ended up losing over 99% of the $100 million he had staked.

Smaller Bets, Big Reputation: The Risk Never Ends

Even after multiple liquidations, he continues to return to the market using leverage. In late September, he took another position on the token ASTER just days after being liquidated on the same asset. The trade, valued at around $16,000 with 3x leverage, was much smaller than his previous positions and reflected his view that the token could become one of the major players in the crypto market.

Wynn’s trading activities have made him one of the most discussed figures in crypto circles. His willingness to take extreme risks has earned him a near-mythic reputation among traders who follow leveraged futures. However, his repeated wipeouts have also become a cautionary example of how rapidly leveraged positions can collapse in the face of even small market swings.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.