How to Freeze Stablecoins? This Tether Lawsuit Could Set a Precedent

Regulatory showdown puts stablecoin freezing powers under microscope

The Legal Precedent in Motion

A landmark lawsuit against Tether tests whether authorities can actually freeze stablecoin assets—and sets the stage for global regulatory battles. The case challenges the fundamental nature of what makes stablecoins 'stable' versus traditional banking controls.

When Digital Assets Meet Real-World Law

Regulators worldwide watch closely as this case could establish legal frameworks for seizing or freezing cryptocurrency assets during investigations. The outcome might force stablecoin issuers to build backdoors into their systems—or face being shut down entirely.

The Technical Reality Check

Freezing mechanisms already exist in centralized stablecoins through admin keys and smart contract controls. The real question becomes: who controls the freeze function—and under what circumstances can they pull the trigger?

Market Impact and Investor Implications

A ruling favoring regulatory freeze powers could send shockwaves through DeFi ecosystems that depend on stablecoin liquidity. Suddenly, the 'stable' in stablecoin might start looking more like 'conditional'—with all the fine print that implies.

Because nothing says financial freedom like needing permission to access your own money—welcome to banking 2.0, now with extra steps and the same old controls.

Read us on Google News

Read us on Google News

In brief

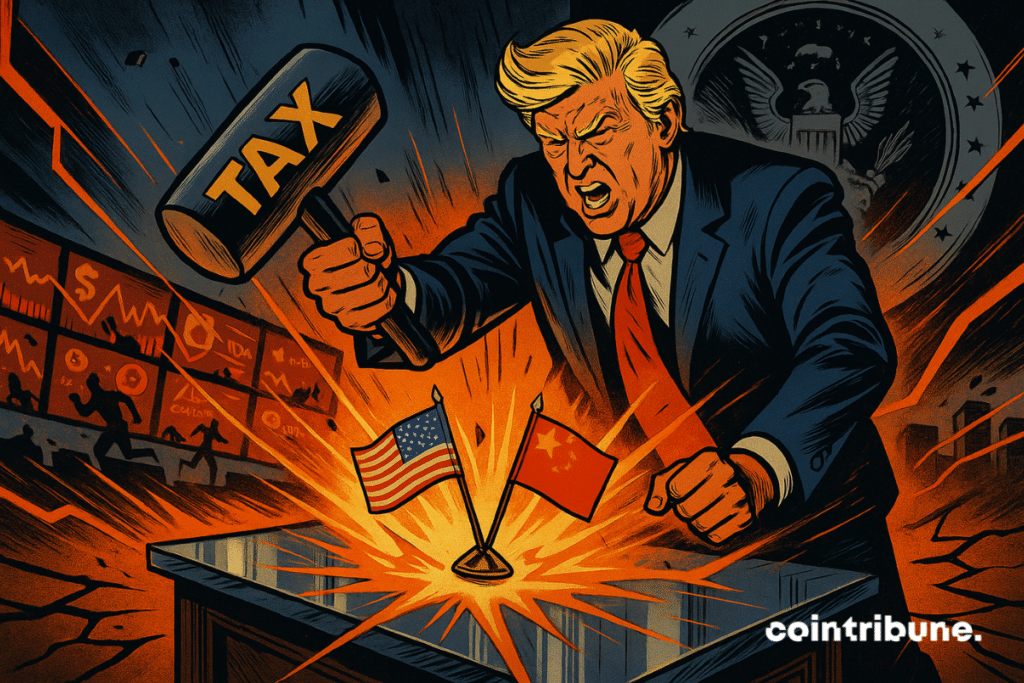

- Donald Trump confirms that the United States is officially engaged in a trade war with China.

- This statement follows a threat of 100 % tariffs on all Chinese imports.

- Washington reacts to Beijing’s tightening of controls on the export of strategic rare earths.

- This new geopolitical escalation poses a lasting risk to the global crypto market balance.

An unequivocal statement : Trump chooses confrontation

The American president confirmed that the United States is no longer just preparing an economic response. They are now fully engaged in a trade conflict with China. This stance follows a threat to raise tariffs to 100 % on all Chinese imports, mentioned a few days earlier on social media.

“Well, we are already in a trade war”. These words, spoken by Donald TRUMP in front of journalists at the White House, ended all ambiguity.

🚨 JUST IN: President Trump declares the United States is in a TRADE WAR with China

"We're in one now!"

"We have 100% tariffs."

"If we didn't have tariffs, we WOULD have no defense. They've used tariffs on us."pic.twitter.com/o360DtdsaQ

Trump justified this stance by imperatives of economic sovereignty and national security, declaring : “if we didn’t have tariffs, we would have no defense. They (China) have used them against us”.

Trump’s statement fits into a context of rising economic tensions, triggered by a decision from Beijing to restrict the export of rare earths, materials essential for semiconductor manufacturing.

In response, Washington has adopted an offensive posture, supported by U.S. Treasury Secretary Scott Bessent. He denounced China’s economic practices and warned of their potentially counterproductive effects. Here are the key points to remember :

- Trump confirmed that the United States is already engaged in a trade war with China ;

- He threatened to impose 100 % tariffs on all Chinese imports ;

- He considers these measures essential for national economic defense ;

- Beijing has tightened restrictions on rare earths, which Washington sees as a form of pressure ;

- Scott Bessent declared that “if some within the Chinese government want to slow the global economy (…), the Chinese economy will suffer the most” ;

- He concluded by stating : “it’s not just the United States against China. It’s China against the world”.

This direct confrontation lays the groundwork for a prolonged clash, whose implications will far exceed the bilateral framework and affect the global economic balance.

Crypto put to the test by the conflict

While Trump’s remarks confirmed the opening of a new economic front, the crypto market did not wait for his official declaration to react. It was his message posted last Friday on social media, threatening China with 100 % tariffs, that triggered a sharp drop in bitcoin.

Within a few hours, BTC fell from $121,560 to under $103,000, marking one of the most significant declines in several months. The sudden drop was seen as a combined reaction to rising trade tensions and excess leverage on derivative markets.

On a more structural level, the mining sector in the United States is also affected by this new trade dynamic. Tariffs on mining machines (ASICs) have been sharply raised: 57.6% on equipment from China, and 21.6% for those from countries like Indonesia, Malaysia, or Thailand.

These additional costs complicate operations for American companies in the sector, which have to cope with a sharp rise in import prices. Administrative hurdles add to this. Last year, thousands of machines were seized by customs, suspected of being non-compliant radio frequency devices. To date, no major mining player has relocated its activities, but the economic equation becomes more complex.

While the immediate market reaction has stabilized, the BTC price recorded a slight increase of 0.1% one hour after the statement, uncertainty remains high. The trade war could lead to lasting tensions on mining supply chains and weigh on investment in American crypto infrastructure. Moreover, indirect effects on global markets, including stocks and commodities, could fuel a new phase of volatility for bitcoin, often seen as both a speculative and safe-haven asset.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.