Tether Targets Massive $20B Funding Round as Valuation Skyrockets Toward $500 Billion Mark

Tether's monumental funding push signals seismic shift in stablecoin dominance

The $20 Billion Gambit

Tether's eyeing a funding round that would make traditional finance bankers blush—aiming to secure a staggering $20 billion while racing toward a half-trillion dollar valuation. This isn't just growth; it's financial territory expansion at warp speed.

Valuation Vertigo

Nearing the $500 billion mark puts Tether in rarified air, competing with legacy financial institutions that took decades to build similar valuations. The stablecoin giant keeps printing numbers while traditional banks keep printing excuses.

Market Implications

This capital infusion could reshape the entire digital asset landscape, giving Tether unprecedented firepower to expand beyond simple dollar-pegged tokens into broader financial infrastructure. Because nothing says stability like a stablecoin company worth half a trillion dollars—what could possibly go wrong?

Tether's funding ambition demonstrates crypto's relentless march toward mainstream financial dominance, leaving skeptics watching from the sidelines while the digital economy builds its own banking system—with or without Wall Street's permission.

Read us on Google News

Read us on Google News

In brief

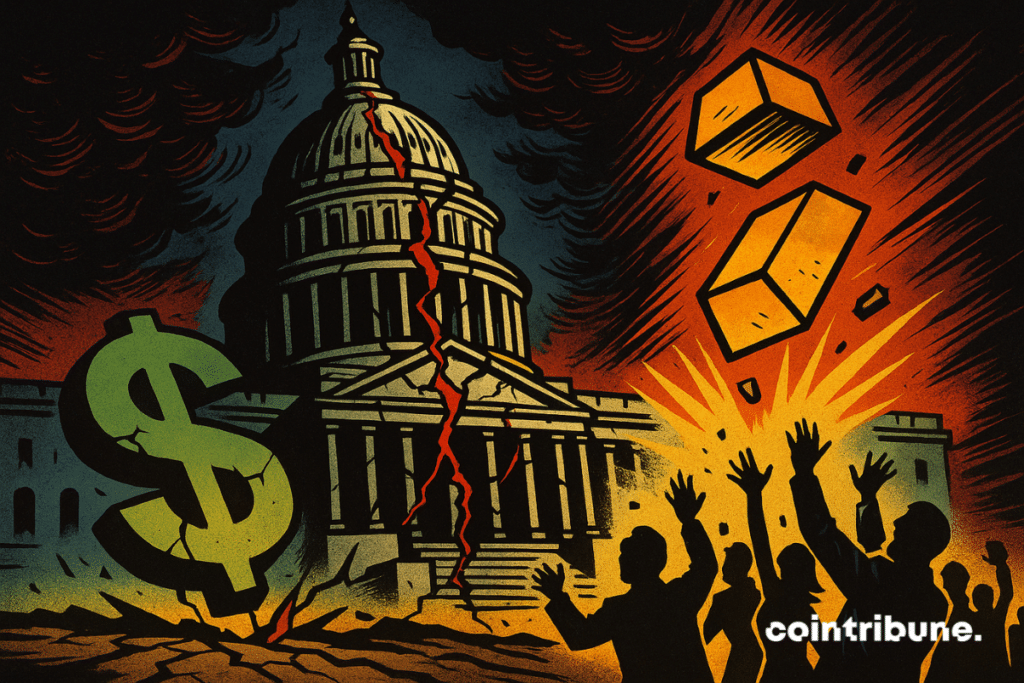

- The budget deadlock in Washington threatens to cause a federal shutdown as early as Wednesday.

- Financial markets react: gold reaches an all-time high, the dollar declines, stocks move cautiously.

- Investors adopt a defensive stance amid US political uncertainty.

- A prolonged shutdown could suspend the release of key economic data, such as the employment report.

Markets in motion: gold in the spotlight, the dollar loses ground

As the specter of a federal shutdown becomes clearer in the United States, investors cautiously redirect their market positions.

Gold reached a new all-time high at 3,819 dollars an ounce, supported by a dollar decline and increasing concerns related to the US budget deadlock. In this context, safe haven assets are favored, while currencies and stock markets show more moderate movements.

Here are the main developments observed this Monday, September 29:

- Gold: the ounce of gold crossed a historic record, reflecting strong demand for hedging amid political uncertainty;

- The dollar: the dollar index fell by 0.2%, to 97.952. Against the yen, the greenback dropped by 0.6%, to ¥148.61, erasing part of its gains from the previous week. The euro appreciated slightly, gaining 0.1% to reach $1.1709, but the currency remains in a low range;

- Stock markets: the global MSCI All-World index rose by 0.16%, signaling a cautious reaction from global markets. In Europe, the STOXX 600 gained 0.3%, heading towards a monthly performance of +1.1%, its third consecutive month of increases;

- A positive seasonality: Analysts highlight that the fourth quarter is historically favorable for stocks, with the S&P 500 rising in 74% of cases during this period;

- Bond yields: the 10-year Treasury yields stabilized around 4.16%, after being pushed higher by a series of encouraging economic data the previous week.

These adjustments reflect a climate of vigilance. Thus, investors favor a defensive approach, awaiting crucial political decisions in Washington in the coming hours.

A government at a standstill

The stakes of the shutdown go beyond immediate considerations. If no agreement is reached by Wednesday, many federal agencies WOULD cease to operate, resulting in a halt in the release of on-chain economic data, particularly the September employment report.

In a note published Monday, Bank of America analysts warned: “If the shutdown lasts beyond the Fed meeting, the Fed will rely on private data for its policy decisions”.

At this stage, markets still anticipate a 90% probability of a rate cut in October, and 65% for a second one in December. However, Bank of America tempers this optimism: “on the margin, this could reduce the likelihood of a cut in October, but only marginally.”

The prospect of a prolonged shutdown raises greater social concerns. The same analysts highlight that each week of shutdown would cost about 0.1 percentage point of GDP, a limited impact certainly, but prone to intensify “if the government took the opportunity to proceed with permanent layoffs,” with effects on employment and consumer confidence.

In this context, the next hours will be decisive. Although markets maintain a form of apparent calm, the combination of a possible statistical blackout, a Fed deprived of reliable benchmarks, and a tense political climate could quickly reshuffle the cards. A prolonged deadlock could revive the appeal for alternative assets and uncorrelated values, while the crypto market has just picked up colors again.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.