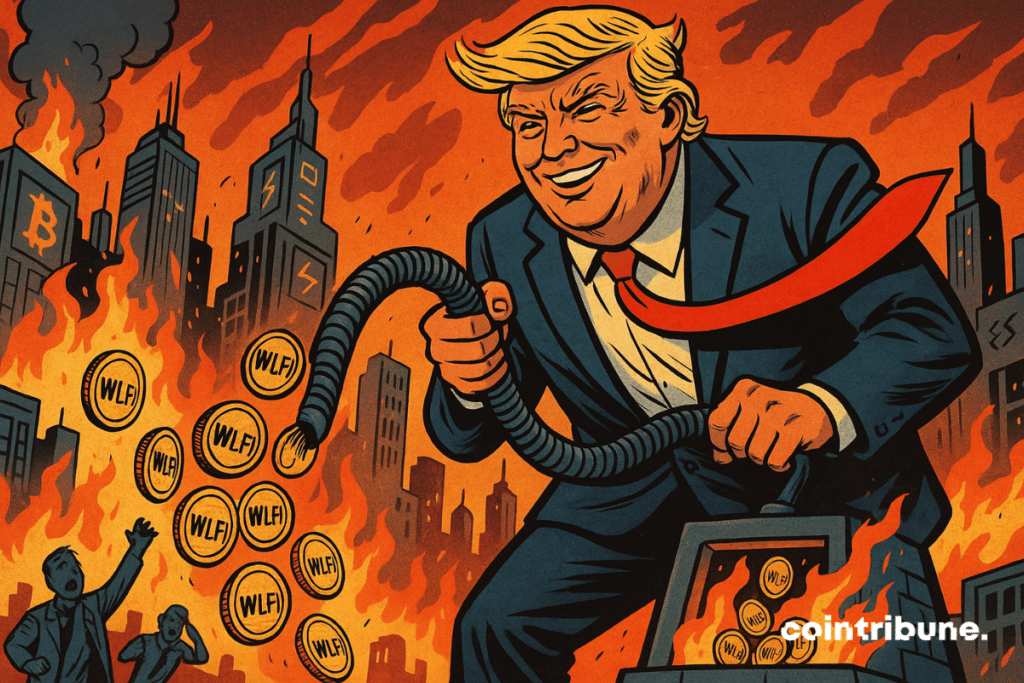

BREAKING: Trump-Backed WLFI Token Launches Massive Buyback - Market Braces for Impact

Trump-endorsed cryptocurrency WLFI just dropped a bombshell announcement that's shaking up the crypto sphere.

MASSIVE BUYBACK OPERATION ACTIVATED

The token backed by the Trump political machine is deploying serious capital to scoop up its own supply from open markets. This isn't just a token gesture - we're talking about a strategic move that typically signals strong internal confidence and creates immediate supply shock.

WHY THIS MATTERS RIGHT NOW

Buybacks historically create upward price pressure by reducing circulating supply. When a project with political heavyweight backing makes this play, it sends shockwaves through both crypto and traditional finance circles. The timing suggests either anticipation of major developments or response to recent market conditions.

MARKETS REACT

Traders are positioning aggressively as the announcement hits wires. Liquidity pools are seeing unusual activity, and derivatives markets are pricing in increased volatility. This could be the catalyst that breaks WLFI out of its recent trading range.

THE BIGGER PICTURE

Political tokens continue to blur lines between digital assets and ideological investments. While traditional finance purists scoff at the concept, the market clearly responds to high-profile endorsements - even if it sometimes feels like betting on celebrity tweets rather than fundamentals.

This move either demonstrates unprecedented confidence or desperate optics management - either way, it's going to be fascinating to watch.

Read us on Google News

Read us on Google News

In brief

- WLFI dropped 41% in September, despite its image tied to Donald Trump.

- The community voted 99% for a buyback and token burn.

- WLFI’s liquidity fees are used to continuously buy and burn tokens.

- No official estimate of the number of tokens burned has been released yet.

Buyback & Burn: WLFI’s secret weapon to calm the market

Faced with a lightning-fast collapse of its price, the World Liberty Financial crypto project did not hesitate to react. On September 25, WLFI confirmed the immediate launch of a buyback & burn strategy. The principle is simple: use 100% of the fees from its liquidity positions on Ethereum, solana and the BNB Chain to buy back WLFI tokens, then send them to a dead address.

Result: a direct reduction of the circulating supply.

This choice was ratified by a community vote, with over 99% approval. The project promises total transparency: ” The team will start implementing this initiative this week, and all buybacks and burns will be transparently published once completed “.

Project supporters see this as a way to absorb selling pressure while supporting the crypto price in an uncertain climate. This initiative also fits into a logic of alignment between the asset’s adoption and its progressive scarcity.

But this operation has its limits: only liquidity directly held by WLFI is concerned. Community pools are excluded from the scheme. In other words, the impact will depend on the volume actually burned over time. Without official figures at this stage, it is hard to assess the real extent of the gesture.

Crypto investors demand more burning

Despite the rapid execution of the buyback plan, uncertainties remain about its long-term effectiveness. No official data has yet been released on the exact number of WLFI tokens to burn. Some speculation mentions 4 million tokens destroyed per day, or nearly 2% of the annual supply. But nothing guarantees that this pace will be maintained or even reached.

The lack of clear projection leaves crypto investors divided. On X, some active members go further. Ghost, a regular contributor, proposes to also buy back the 80% of tokens from the presale still frozen. He suggests a hybrid system: those who wish could resell their tokens to WLFI for destruction, while others WOULD follow a linear vesting of 40% per year.

This strategy would have the merit of further limiting selling pressure, while offering progressive liquidity to early investors. For now, the WLFI team remains discreet on this point, focusing on implementing the initial plan.

What to remember about WLFI

- WLFI lost 41% of its value in September 2025 (source: CoinGecko);

- 100% of liquidity fees controlled by WLFI will be used to buy back and burn tokens;

- The measure was approved by more than 99% of voters;

- Community liquidity pools are excluded from the scheme;

- No official data on the volume of tokens destroyed has been published yet.

While WLFI is going through a turbulent phase, it remains a crypto project with strong potential. Moreover, the TRUMP family’s fortune has recently risen to $1.3 billion, thanks to the rise of their projects such as ABTC and, of course, World Liberty Financial. This will keep the market’s interest alive for a long time.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.