BREAKING: Ethereum Plunges Below $4,000 Threshold - Market Watchers Stunned

Ethereum's brutal selloff sends shockwaves through crypto markets as the asset breaches critical psychological barrier.

The $4,000 Breakdown

Traders watched in disbelief as ETH sliced through the $4,000 support level like a hot knife through butter. The sudden drop triggered cascading liquidations across derivatives platforms—yet another reminder that crypto markets move faster than traditional finance bureaucrats can draft regulations.

Volatility Strikes Again

This isn't your grandfather's stock market. While Wall Street frets over basis points, digital assets redefine price discovery in real-time. The dip represents both danger and opportunity—something traditional investors still struggle to comprehend while obsessing over dividend yields.

Market structure remains fundamentally sound despite the plunge. If history repeats, this could be another classic 'buy the fear' moment before the next leg up. After all, when has betting against Ethereum's long-term trajectory ever worked out for the skeptics?

Read us on Google News

Read us on Google News

In brief

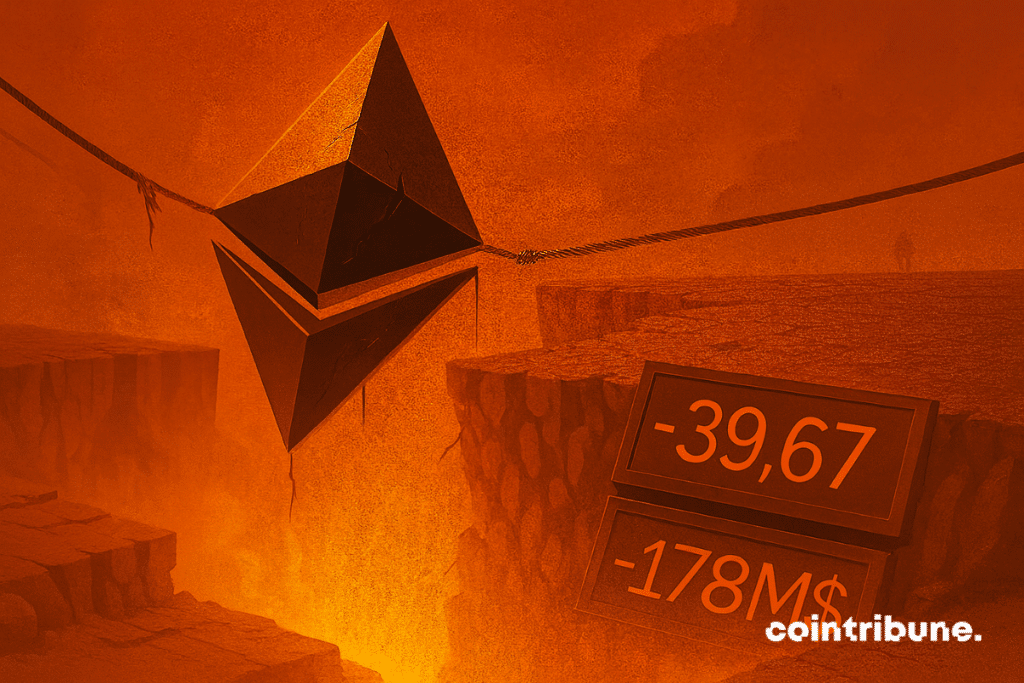

- Ethereum falls below $4,000 leading to massive liquidations and a general retreat in the crypto market.

- Despite the drop, institutional players are quietly accumulating hundreds of millions in ETH.

Liquidations, indicators in decline and withdrawal of institutional investors

Ethereum hasto reach $3,967. At the same time, more than $178 million have been liquidated. $489 million are long positions according to data from multiple platforms. This decline continues a slide of:

- 12.5% over the week;

- 10% over the month.

The shock also extends across the entire market. Bitcoin and XRP also retreated, amid fears of a US government shutdown. This macroeconomic pressure increases distrust towards risky assets.

Technical indicators confirm the shift:

- The RSI falls to 34.5, close to the oversold zone.

- The MACD remains in negative territory.

Ethereum also barely holds above the lower band of its Bollinger Bands, while the price falls below the 20 and 50 day moving averages.

Negative funding rates (–0.0021) indicate a dominant sell bias on perpetual contracts. Spot ETFs add pressure, with $79.4 million in net outflows over three days. The largest outflows come from Fidelity (–$33.3 million) and BlackRock (–$26.5 million).

Discreet accumulation in a tense market

In this tense context, some players are taking advantage of the drop. In six hours,through Kraken, BitGo, Galaxy Digital, and FalconX. This represents about $862 million according to the current price of Ethereum.

That’s not all! The supply of ETH on centralized exchanges also reaches a nine-year low. This suggests a long-term accumulation strategy rather than short-term speculation.

Technically, Ethereum is therefore struggling around the $4,000 support. A rebound could. In case of a breakdown, however, the $3,850 and $3,392 levels will come into play. These correspond to the 200-day moving average.

In any case, the battle at $4,000 is now open. The future of Ethereum will depend as much on macroeconomic conditions as on crypto investors’ behavior.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.