Bitcoin’s 145,000 New Millionaires in 12 Months: The Unprecedented Wealth Revolution

Digital gold creates more millionaires than traditional markets combined.

The Millionaire Factory

Bitcoin isn't just disrupting finance—it's printing millionaires at industrial scale. While Wall Street hedgies were rebalancing portfolios, crypto's flagship asset minted 145,000 new millionaires in a single year. That's not market growth—that's wealth redistribution on steroids.

Protocol Over Privilege

The blockchain doesn't care about your Ivy League degree or family connections. It cuts through traditional gatekeepers and bypasses legacy financial infrastructure. While bankers were debating inflation metrics, Bitcoin was quietly building the largest wealth transfer mechanism in modern history.

The New American Dream

Forget the white picket fence—the digital frontier offers something better: financial sovereignty. The 145,000 new millionaires represent more than just numbers—they're proof that code can create wealth faster than centuries-old institutions. Though traditional finance will probably dismiss this as 'speculative frenzy' while quietly increasing their own crypto exposure.

This isn't just bull market behavior—it's systemic change. The genie's out of the bottle, and even the most cynical bankers are starting to realize they can't put it back.

Read us on Google News

Read us on Google News

In brief

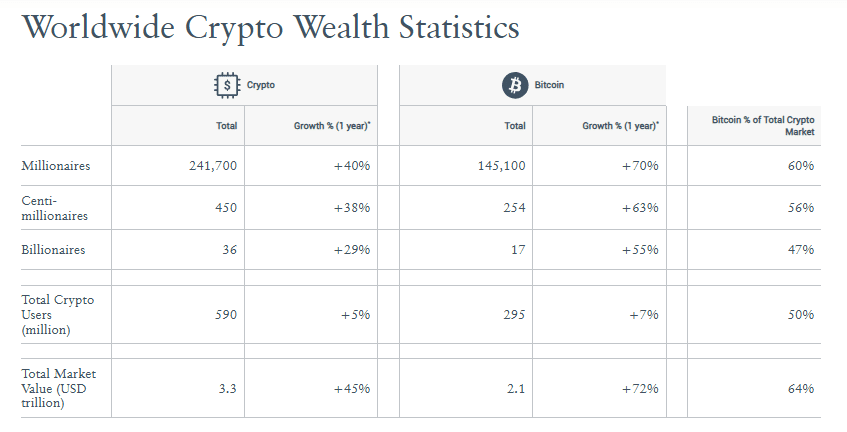

- In one year, Bitcoin created 145,100 new millionaires, marking an unprecedented global growth.

- The total number of crypto millionaires now reaches 241,700, an impressive annual increase.

- The crypto market jumped to 3.3 trillion dollars, confirming the scale of the phenomenon.

- At the top, 254 BTC centimillionaires and 17 BTC billionaires shape a new international financial elite.

Bitcoin, engine of a new global elite

There were already 219 million bitcoiners in 2023, but the year 2025 changed scale. The data is spectacular: 241,700 crypto millionaires recorded in 2025, 40% more than in 2024. In this wave, bitcoin plays a central role, with 145,100 new millionaires (+70%). ethereum and other cryptos do not compete. Even more striking, the concentration at the top: 254 BTC centimillionaires (+63%) and 17 BTC billionaires (+55%).

Philipp Baumann, founder of Z22 Technologies, insists:

Bitcoin becomes the foundation of a parallel financial system, where it is no longer just a speculative investment on the rise of fiat currencies, but the base currency for accumulating wealth.

The era when Bitcoin was just a risky bet is over. It becomes a benchmark patrimonial currency, used by a globalized elite that chooses jurisdiction, residence, and taxation as strategic variables.

Crypto ETFs, discreet catalysts of the financial explosion

This new crypto aristocracy was not born by chance. It relies on a major institutional turning point. In 2025, American spot bitcoin ETFs rose from $37.3 billion to $60.6 billion in assets under management. Ether experienced a rapid growth, its ETFs quadrupling to reach $13.4 billion. Large investors – hedge funds, asset managers, private equity firms – multiplied their positions.

Townsend Lansing, from CoinShares, confirms:

Driven by favorable regulatory winds, institutional adoption has not only arrived — it is exploding.

These massive flows changed the game. Traditional finance, long skeptical, has implicitly endorsed bitcoin. Result: the total capitalization of the crypto market jumped to $3.3 trillion in June 2025.

A striking contrast remains: the crypto user base increased by only 5%, reaching 590 million, while it is the institutional capital that drives the momentum.

Bitcoin versus fiat: a scarcity that attracts wealth

Beyond the numbers, the issue is philosophical. Bitcoin, limited to 21 million units, opposes programmed scarcity to the inflation of fiat currencies. Samson Mow, CEO of JAN3, emphasizes that in the long term, fiat currencies are condemned to infinity, while bitcoin, on the contrary, is strictly limited to 21 million units.

This asymmetry attracts wealthy crypto investors. It transforms BTC into intergenerational wealth insurance, an asset that escapes borders and classic tax regimes. The Henley Crypto Adoption Index shows that Singapore, Hong Kong, the United States, Switzerland, and the Emirates are the favorite destinations of these digital fortunes.

Five key markers of 2025

- 241,700 crypto millionaires counted worldwide;

- 145,100 new bitcoin millionaires in one year;

- $3.3 trillion global crypto market valuation;

- $60.6 billion: Assets under management of US Bitcoin ETFs;

- 590 million crypto users worldwide (+5%).

This dynamic demonstrates a tipping point: bitcoin and other cryptos are no longer marginal but central in global finance.

Bitcoin continues to produce fortunes. Michael Saylor is a living example: the recent surge of his holdings boosted his fortune in the Bloomberg Billionaires Index, rising to 491st worldwide. A wealth creator, bitcoin confirmed in 2025 its ability to reshape the economic hierarchy.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.