SEC Accelerates Crypto Innovation with Unprecedented Exemption - Regulatory Watershed Moment

The SEC just dropped a regulatory bombshell that could reshape crypto's future overnight.

Breaking Down the Barrier

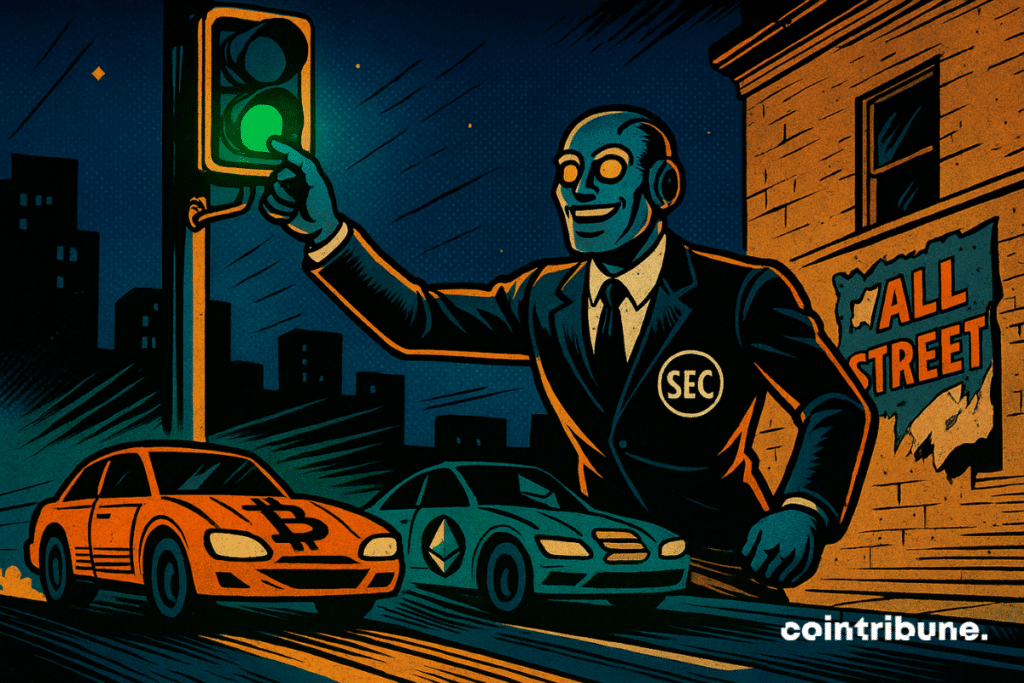

Regulators are bypassing traditional roadblocks with an exemption that cuts through years of bureaucratic gridlock. The move signals a fundamental shift in how Washington views digital assets—no longer as threats but as innovations worth fast-tracking.

Wall Street's Cold Sweat

Traditional finance institutions are watching nervously as crypto gets the regulatory green light they've spent decades lobbying against. The exemption effectively creates a parallel track for digital assets—moving at blockchain speed rather than bureaucratic pace.

Market Implications

This isn't just paperwork—it's rocket fuel for development teams who've been operating in regulatory limbo. Projects can now build with certainty instead of constantly looking over their shoulders for enforcement actions.

The fine print still matters of course—because when has Wall Street ever missed a chance to overcomplicate something simple for their own benefit?

Read us on Google News

Read us on Google News

En bref

- Paul Atkins is preparing an “innovation exemption” to accelerate the launch of crypto products under lighter supervision.

- The first US multi-crypto ETP, including Bitcoin and Solana, marks a regulatory turning point.

- The SEC and CFTC are now coordinating their efforts to harmonize the regulation of digital assets.

Paul Atkins facing Gensler’s legacy: a SEC in rupture

Under Gary Gensler, the SEC repeated that the majority of tokens should be considered as financial securities. This strict reading of the Howey Test hampered innovation. Paul Atkins breaks with this doctrine. According to him, very few tokens are securities; it all depends on how they are structured and distributed.

This change of tone represents a real reversal for the American crypto industry.

To bring this vision to life, Atkins launched in July Project Crypto. The objective: to adapt rules designed in the 1930s to the reality of digital assets. An approach aimed at modernizing market law and preparing a favorable environment for tokenized products.

In an interview on Fox Business, he explained:

We are looking to implement an innovation exemption by the end of the year. A lot is happening and I am really very excited about giving this industry a solid foundation in America, so that the country can lead through innovation, as the President requested.

This philosophy was reflected by a strong signal: the recent approval of the first American multi-crypto ETP, which allows investing at once in Bitcoin, Ethereum, XRP, Solana, and Cardano. With the “innovation exemption“, Atkins wants to extend this momentum by giving crypto companies a testing ground under lighter oversight. This measure WOULD act like a pressure valve, offering the necessary flexibility to test new products without immediately facing legal burdens.

With Atkins, the SEC no longer blocks; it opens doors. For investors as well as companies, the climate changes radically.

Harmonizing crypto regulation: SEC and CFTC hand in hand

Another major project for Atkins is to end the rivalry between the SEC and the CFTC. For years, the two agencies disputed jurisdiction over digital assets. Result: legal uncertainties, delayed products, and crypto startups preferring to set up abroad.

Atkins wants to put an end to these turf wars. He stated bluntly:

[…] We need to give certainty to the market. It is the American investor and the American economy who will benefit from a joint effort of the two agencies working hand in hand, and I look forward to continuing on this path.

This harmonization accompanies a broader evolution. The GENIUS Act, recently adopted, for the first time legally recognizes stablecoins in American law. The next milestone: fall 2025, with the expected Congressional vote on market structure reform.

This step must provide a lasting legal basis for initiatives already underway.

Key landmarks of the new direction

- April 2025: Paul Atkins takes the presidency of the SEC;

- July 2025: launch of Project Crypto to adapt regulation to digital assets;

- September 2025: approval of the first American multi-crypto ETP;

- Fall 2025: expected vote on market structure reform;

- Adoption of the GENIUS Act, first legal recognition of stablecoins.

Finally, Atkins wants to democratize access to private markets. He proposes that ordinary savers, through 401-Ks, be able to diversify their portfolios with investments formerly reserved for the wealthy and institutional funds. For him, crypto regulation must become a tool for financial mobility and not a brake.

Admittedly, jumping on the crypto train means accepting a new paradigm for some traditional players. But the air has changed: even among Democrats, long skeptical, joining the American crypto revolution is no longer taboo.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.