RWA Crypto Projects Explode: AVAX, Zexpire, and VeChain Turbocharge Real-World Asset Adoption

Real-world asset tokenization hits escape velocity as blockchain protocols bridge trillion-dollar traditional markets with digital finance.

The Infrastructure Play

Avalanche's subnet architecture cuts settlement times for property tokenization from weeks to minutes. Institutional players bypass legacy systems by deploying custom blockchains for specific asset classes—commercial real estate, commodities, even intellectual property rights.

Supply Chain Revolution

VeChain's dual-token system tracks luxury goods from manufacturer to consumer while Zexpire's zero-knowledge proofs verify authenticity without exposing sensitive commercial data. The tech eliminates billion-dollar counterfeit markets that traditional auditors somehow keep missing.

Regulatory Tightrope

SEC scrutiny intensifies as tokenized Treasury products hit record volumes. Banking giants reluctantly embrace blockchain settlement while lobbying against the very technology saving them operational costs—because why simplify processes when you can charge for complexity?

The tokenization wave doesn't just disrupt markets—it exposes how much value traditional finance leaves trapped in illiquid assets. Maybe that's why Wall Street suddenly loves 'innovation' right after missing the first decade of crypto growth.

Real-world asset tokenization initiatives are moving to the forefront as AVAX, Zexpire, and VeChain drive fresh adoption across capital markets and industry supply chains. Their recent rollouts highlight a growing appetite for bringing physical goods, compliance data, and traditional financial products onto public blockchains, aiming to cut costs, reduce settlement times, and widen investor access.

Avalanche’s AVAX network is attracting attention for hosting tokenized equity pilots and on-chain carbon credit programs, while newcomer Zexpire is debuting an end-to-end framework that links expiring assets such as warehouse receipts and perishable commodities to verifiable digital records.

VeChain, long focused on logistics, is expanding its partnerships in manufacturing and retail, enabling traceable product tokens that feed directly into enterprise resource systems. Together, these developments underscore a shift from experimentation to practical deployment, signaling a decisive phase in the mainstreaming of asset-backed digital tokens.

VeChain’s Big 2025 Upgrade Push Could Spark Fresh Crypto Buzz

VeChain is a blockchain built for real business use. It tracks food, fashion, and cars with tiny chips that speak to the internet. BMW blocks odometer fraud, Walmart checks where mangoes came from, and LVMH proves a bag is real.

The network runs on VET, a coin for voting and value moves, while a second token, VTHO, pays the fees. Proof-of-Authority keeps the ledger fast and green by letting known, trusted nodes add blocks. Founders Sunny Liu and Jay Zhang aim to boost both profits and the planet, calling for teamwork on big issues like climate change.

A fresh roadmap brings three upgrades—Galactica, Hayabusa, and Intergalactic—set to speed apps, shrink energy use, and LINK more devices through the Internet of Things. This clear path and real-world reach give VeChain an edge over rivals that still chase pilots. As markets eye blockchains tied to physical goods, VET’s mix of live clients and upcoming tech makes it an interesting pick for the next cycle.

Zexpire Introduces One-Click Simplicity to Capture Crypto Options Boom

Crypto options has become one of DeFi’s fastest-growing segments, as its daily trading volumes. Traditionally, this market has long been dominated by professionals, but now it’s starting to open up to a broader audience.

Zexpire, the first 0DTE DeFi protocol, removes the complexity of options trading and turns it into. The process is reduced to a binary choice: users bet on whether the price will stay within a defined range or break out in the next 24 hours

Simply put, trading with Zexpire works like this: Guess right, and you win. Guess wrong, and your loss is capped at your stake. No margin calls. No cascading liquidations.

$ZX Serves the Fuel Behind Simplified Options Trading with Zexpire

To earn on volatility with Zexpire, you need its. It serves as a governance token and provides its holders with.

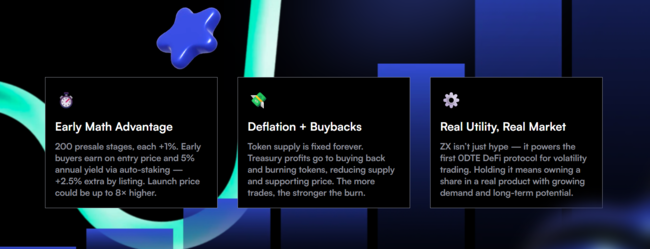

Before its exchange debut, $ZX is available in in seed access at just $0.003, nearly 800% cheaper than the planned listing price of $0.025.

Besides the reduced price, early participants get more advantages such as:

- Staking rewards up to 5% before a TGE

- Loyalty bonuses

- Airdrops and beta access

Zexpire has also built in a deflationary mechanism. 20% of platform fees will be burned, and a buyback program is designed to support demand. $ZX is available across multiple chains including Base, Solana, TON, and TRON and can be purchased directly with a card.

Why $ZX Could Be the Next Breakout Token

Options trading has become one of crypto’s biggest growth stories. BTC options volumes regularly hit billions, yet participation is dominated by pros. Zexpire is making a contrarian bet by stripping it all down to a fast, gamified format.

HYPE became one of this cycle’s strongest tokens by riding the derivatives boom on Hyperliquid. Zexpire is aiming to do the same in the options niche, but with an even broader retail angle: fixed-risk mechanics and gameplay simplicity that make it accessible to anyone.

If Zexpire can capture even a fraction of the momentum that HYPE did, $ZX could be DeFi’s next breakout token.

Avalanche AVAX: The Snow-Speed Network Challenging Ethereum

Avalanche is a young but lively blockchain born in 2020 with one clear goal: run smart contracts faster and cheaper than the big names. It relies on proof-of-stake, so holders help keep the system SAFE instead of power-hungry miners. Every time someone uses the chain, a small bit of AVAX disappears forever, making the supply tighter over time.

Developers feel at home because they can reuse the same Solidity code they wrote for Ethereum, yet see it move at turbo pace—up to 6,500 transactions each second versus Ethereum’s double-digit limit. Avalanche also lets teams spin up “subnets,” custom mini-networks that lift heavy traffic off the main road and keep things smooth.

Lower fees, quick finality, and an active community have turned the platform into a hotspot for games, NFTs, and decentralized finance. As the wider market hunts for greener, high-speed chains that scale with real-world demand, AVAX stands out as a sleek, snowballing option worth watching.

Conclusion

AVAX and VET keep showing solid progress as more firms bring real-world assets on-chain. Their networks run fast, cost little, and give clear records, making them good picks for builders and investors alike.

Zexpire goes a step further. It makes market swings a profit tool through one click: predict if Bitcoin stays in range or breaks out today. Losses are capped, no liquidations, no margin calls. Every move uses $ZX, the native token with fee cuts, buybacks, and built-in demand that reward early buyers. VET represents a promising opportunity too.

Get more information about Zexpire ($ZX) here:

- Site: https://zexpire.com/

- Telegram: https://t.me/zexpire_0dte

- X: https://x.com/Zexpire_0dte