CryptoQuant Data Signals: Altcoin Season Nearing Its Final Chapter

Altcoin party hitting last call? On-chain metrics suggest the rally's running out of steam.

Market Pulse Shifts

CryptoQuant's latest dashboard flashes warning signs—capital rotation patterns show investors pulling profits from altcoins back into Bitcoin. The data reveals declining network activity across mid-cap tokens while BTC dominance creeps upward.

Whale Movements Tell the Story

Large holders are quietly repositioning. Exchange inflows for major altcoins hit three-month highs this week—classic distribution behavior before a downturn. Retail FOMO meanwhile keeps pumping low-cap gems straight into resistance zones.

Institutional Gravity Returns

When BTC dominance breaks key levels, altcoins historically underperform. This cycle's no different—ETF flows and macro uncertainty make big money retreat to relative safety. Another case of Wall Street's 'risk-on' meaning 'Bitcoin-only' while Main Street bags altcoin promises.

The altcoin carnival might be packing up, but seasoned traders know—this just sets the stage for the next accumulation phase. Because nothing says 'financial innovation' like watching your portfolio swing 40% on a meme coin while traditional bankers clutch their pearls.

After weeks of strong gains, the crypto market is slowing down, with major altcoins like Ethereum, XRP, Solana, and Dogecoin seeing sharp declines. Indicating that traders and investors start shifting focus from aggressive altcoin plays to safer positions.

On-chain data provider CryptoQuant suggests that the recent altcoin rotation may be coming to an end, marking a more cautious phase in the market.

Altcoin Rotation Comes to an End

According to CryptoQuant, the altcoin rotation that dominated September is now fading. Earlier this month traders had been rotating out of Bitcoin into altcoins seeking faster gains.

This trend was seen in rising trading volumes, falling bitcoin dominance, and several new highs across mid-cap and meme coins.

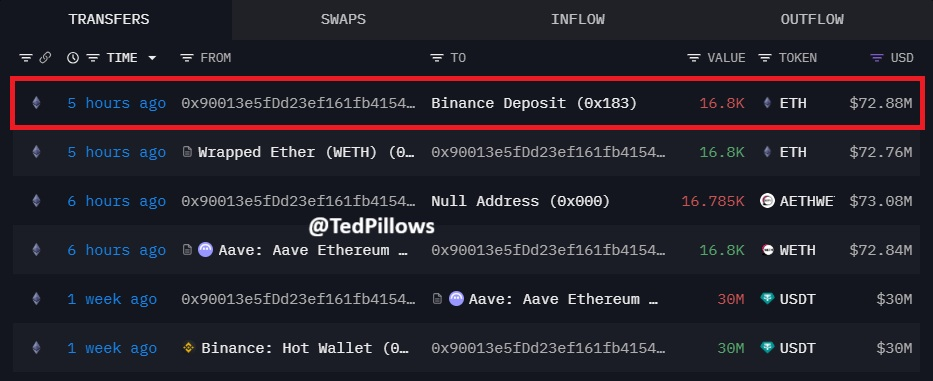

Ethereum led the early rally but has now corrected over 6%, trading below $4,200, extending its pullback from recent highs. On-chain data also shows large holders reducing risk. One whale sold $72.88 million in ethereum just before the market dip.

Additionally, over 420,000 ETH moved off exchanges last week, indicating that while selling pressure is easing, investors are rotating out of riskier positions and securing profits.

Why This Time Feels Different

Back in June, many feared a large correction might shake the market. But CryptoQuant pointed out at the time that there were no significant changes in Ethereum withdrawal data, which suggested stability. That argument helped calm nerves and the market avoided a steep fall.

Now, the situation looks different. The altcoin rotation has lasted longer than expected, and the pattern of capital moving away from Ethereum has become clearer.

Altcoin Season Index Declines

The sign of dropping altcoin rotation can clearly be seen through struggle altcoin season index. After soaring to 88 earlier this month, the index has now dropped to 65.

This decline indicates that fewer altcoins are outperforming Bitcoin, signaling the end of the aggressive altcoin season and a shift toward more cautious, selective trading.

What Next for Altcoin Market?

As Q4 about to begins, both traders and institutions appear to be prioritizing safety over chasing quick gains.

Even Bitcoin is finding it hard to reach its previous highs, showing that the market is cautious. Any big price rise will likely depend on the Fed lowering interest rates, but for now, the recovery is still uncertain.