Crypto Market Plunge: Are Tumbling U.S. Bond Yields Actually to Blame?

Digital assets just took a nosedive—and everyone's pointing fingers at Treasury yields. But is the bond market really calling the shots here?

The Correlation Conundrum

Traders watched Bitcoin shed value as 10-year yields dipped below key levels. Ethereum followed suit, dragging altcoins into the red. Classic safe-haven moves triggering crypto selloffs? Maybe. Or just Wall Street finding excuses for patterns they don't understand.

Liquidity Games

When bonds sneeze, crypto catches cold—or so the theory goes. Lower yields should push investors toward riskier assets, yet we're seeing the opposite. Some whales might be rebalancing portfolios, but retail holders aren't budging. They've seen this movie before.

The Real Trigger?

Blaming bonds is convenient—lets everyone ignore crypto's own volatility. Markets move on sentiment, leverage, and occasionally, actual fundamentals. Traditional finance types love dragging crypto back to their outdated playbooks—as if decentralized assets care about century-old debt instruments.

One thing's clear: when crypto zig-zags, analysts race to link it to traditional markers. Sometimes a dip is just a dip—not everything needs a Fed narrative attached. But hey, why let reality interrupt a perfectly good correlation fallacy?

The cryptocurrency market starts its week on a bearish note, wiping out nearly 4.5% in value and hundreds of billions in market cap within just 24 hours. Bitcoin led the drop, sliding about 3% to $112,800 and pulling the broader digital asset market lower with it.

While many pointed to weak momentum and profit-taking as the cause, a deeper factor can be found in the bond market, which is quietly shaping global investor sentiment.

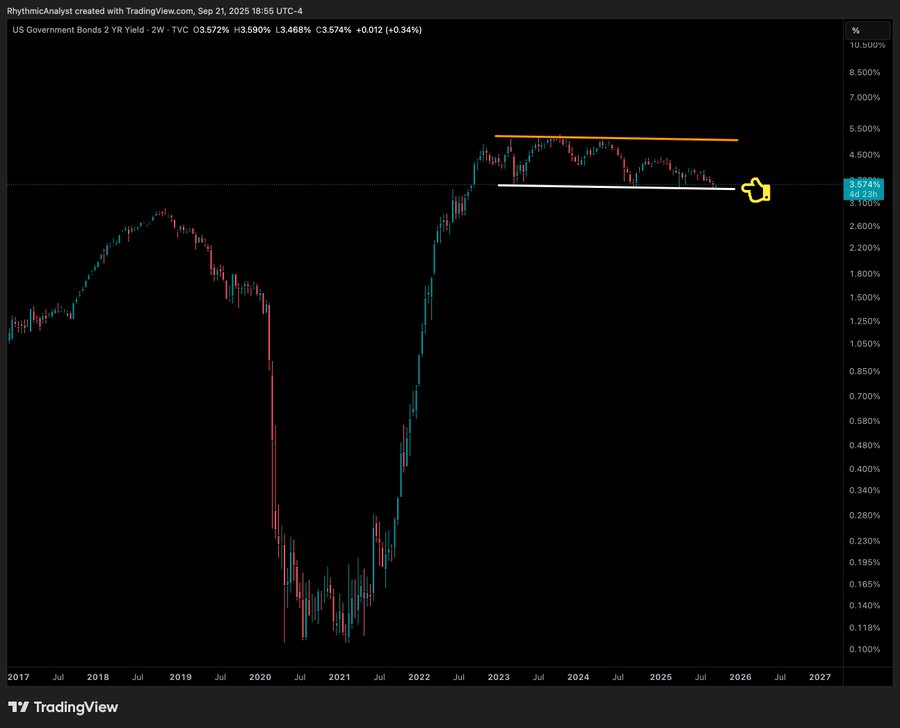

2-Year Bond Yields Sit At Low

Bond yields are more than just numbers for Wall Street, they set the tone for where money flows. According to the market analyst Mihir, U.S. Treasury yields have become one of the strongest signals for both stocks and crypto.

After the COVID money-printing era, yields surged higher, reflecting growing economic uncertainty. Since early 2023, 2-year yields have moved sideways, giving room for risk assets like crypto to rise. However, rising yields usually hurt Bitcoin and altcoins as investors choose safer returns.

But now, they sit at a critical support level, and the 2-year bond yields have already triggered a downtrend, it’s just that a new low hasn’t been made yet. If they drop further, it could shift global markets.

As Mihir noted that the next few weeks will reveal whether this becomes the key driver for crypto prices.

Fed Rate Cut Buzz Fades

This bond pressure came just as the excitement from the Fed’s recent rate cut began to fade. bitcoin and major altcoins dropped late Sunday, as traders grew cautious about future policy moves.

Fed Chair Jerome Powell described the cut as a “risk management” step and hinted there was no rush for further cuts.

That cautious tone added to market nerves, leading to heavy liquidations. In the last 24 hours alone, 403,784 traders were wiped out, with $1.7 billion in total liquidations. The largest hit was a $12.74 million BTC trade on OKX.

Altcoins Take a Bigger Hit

As Bitcoin struggled, altcoins suffered even sharper declines. ethereum fell over 7% to $4,190, its lowest in more than a month. XRP dropped 6% to $2.76, a three-week low. Solana slid 7%, while Cardano sank 9%.

Even meme coins weren’t spared, with Dogecoin plunging 11% and TRUMP falling 9%.