Why Bitcoin, Ethereum, and XRP Are Getting Hammered Today - The $117K Rejection That Shook Crypto

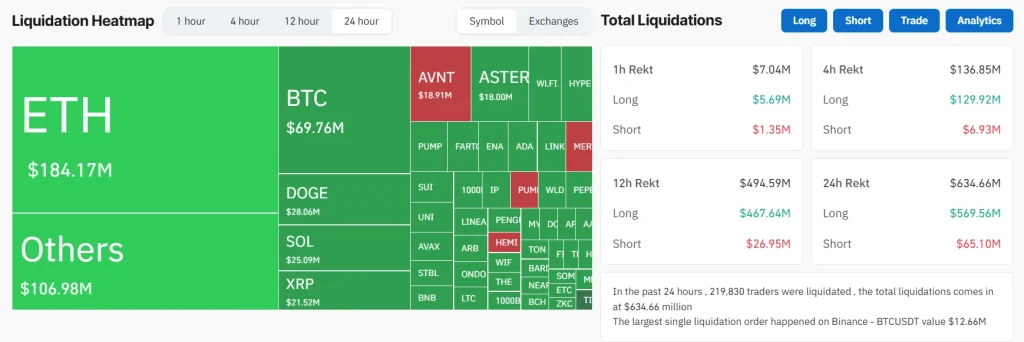

Crypto markets just took a brutal hit as Bitcoin's rejection at $117,000 triggers massive liquidations across the board.

ETH bears pounced with relentless selling pressure, wiping out leveraged positions in minutes. XRP followed suit, proving once again that when BTC sneezes, the entire altcoin market catches pneumonia.

Traders got too greedy chasing that psychological $120K barrier—now they're learning the hard way that crypto doesn't care about your leverage targets. The usual suspects are circling: over-leveraged longs, whale manipulation, and that classic 'buy the rumor, sell the news' mentality that never seems to get old in this space.

Meanwhile, traditional finance guys are probably sipping martinis and muttering 'told you so'—because nothing makes a Wall Street veteran happier than watching crypto traders rediscover gravity.

This isn't a crash—it's a reality check. The market's just doing what it does best: separating the believers from the gamblers.

The cryptocurrency market is ailing under pressure today, with the market cap dropping 1.95% to $3.96 trillion. Trading volume stands at $135.69 billion, reflecting reduced participation compared to recent sessions. Bitcoin dominance has edged higher to 57.6%, while Ethereum holds 13.1%. The Altcoin Season Index stands at 67/100, indicating a partial rotation into BTC. Sentiment remains muted, with the Fear & Greed Index at a neutral 47, while the average crypto RSI at 36.18 suggests the broader market is in oversold territory.

Why the Market is Falling?

The decline comes from a mix of regulatory pressure, Leveraged positioning, and weakness across major altcoins.

Markets reacted negatively to the SEC’s updated ETF guidelines issued on September 21. While they clarified the framework for crypto funds, the stricter compliance checks weighed on sentiment, especially for altcoins. In parallel, the U.S. Treasury opened a comment period for the GENIUS Act, which may impose reserve rules on stablecoins. These updates raised caution about XRP and solana ETF approvals expected later this year. Traders are closely watching the SEC’s ruling on Grayscale’s multi-asset ETF due by September 30.

Perpetual open interest surged 18% to $929.3 billion, while futures hit $3.9 billion. However, funding rates turned slightly negative at -0.0038%, pointing to excessive long leverage. This set the stage for a flush-out. The correlation between Bitcoin and Nasdaq-100 dropped to 0.55, weakening macro support. Analysts warn that a break below the $3.93T total market cap level (50-day EMA) could trigger further algorithmic selling.

Altcoins are bearing the brunt of today’s move. Dogecoin slumped 7.5% as whale accumulation couldn’t offset retail selling. OpenLedger plunged 15% following an airdrop-related unlock. The Altcoin Season Index fell 5.8%, signaling rotation into Bitcoin, which added 0.56% in dominance.

Bitcoin, Ethereum, and XRP Under Pressure

Bitcoin price faced rejection at $117k, with a failed breakout sparking automated selling. Its market cap stands at $2.27 trillion, supported by $31.62 billion in daily volume.

Ethereum price dropped 4.29% to $4,286 after $210 million in futures positions were liquidated. ETF outflows of $196.6 million last month also weighed on sentiment. A break below $4,350 triggered cascading sell orders.

XRP price slipped below $3.00 support, now trading NEAR $2.88. Its ETF debut sparked a sell-the-news reaction, while Bitcoin’s rising dominance drained liquidity from altcoins.

Top Movers:

- Top Gainer: Story IP price jumped 12.4% to $13.87, standing out as the only major asset in the green.

- Top Losers: Aster with -21.4%, PUMP with -18.1%, and CRO with -12.9% led the decline.

FAQs

Why is the crypto market down today?The market is reacting to regulatory uncertainty, excessive leverage in derivatives, and weakness in major altcoins, especially ETH and DOGE.

Which crypto suffered the biggest liquidations?Ethereum saw $210 million in futures liquidations after breaking key support, making it the hardest-hit asset.

Are any tokens performing well today?Story IP is the standout gainer, rising over 12% while most of the market trades in the red.