What’s Holding Cardano (ADA) Back From Shattering the $1 Barrier?

Cardano's stubborn resistance at the dollar mark has traders scratching their heads—while traditional finance still can't tell the difference between a blockchain and a bicycle chain.

The Technical Ceiling

ADA keeps bumping against that psychological barrier like a crypto moth to a dollar-shaped flame. The network's methodical development pace—often praised for its academic rigor—might be playing against retail's hunger for moonshots.

Market Dynamics at Play

Volume patterns suggest institutional players are accumulating while retail hesitates. Whales keep stacking satoshis, but the retail FOMO that typically catapults prices just isn't igniting—yet.

Ecosystem Acceleration Challenges

While DeFi projects multiply on-chain, user adoption curves haven't quite mirrored Ethereum's explosive growth. The smart contract capability is there—but dApp traction remains a work in progress.

Regulatory Headwinds

Global regulatory uncertainty continues casting shadows across altcoins. Until clearer frameworks emerge, traditional money will keep treating crypto like that risky cousin at family gatherings.

Breaking through dollar resistance requires more than tech—it needs narrative fuel and that irrational exuberance Wall Street pretends to disdain while secretly chasing.

Cardano has been fighting to reclaim the psychological $1 level, a price point that has long symbolised strength and investor confidence. Despite steady development, ecosystem growth, and a loyal community, ADA price continues to face resistance that keeps it trapped below this crucial barrier. With market sentiment improving and Bitcoin’s momentum spilling over into altcoins, many are wondering: what’s really stopping Cardano from smashing $1—and could the next rally finally push ADA past this milestone?

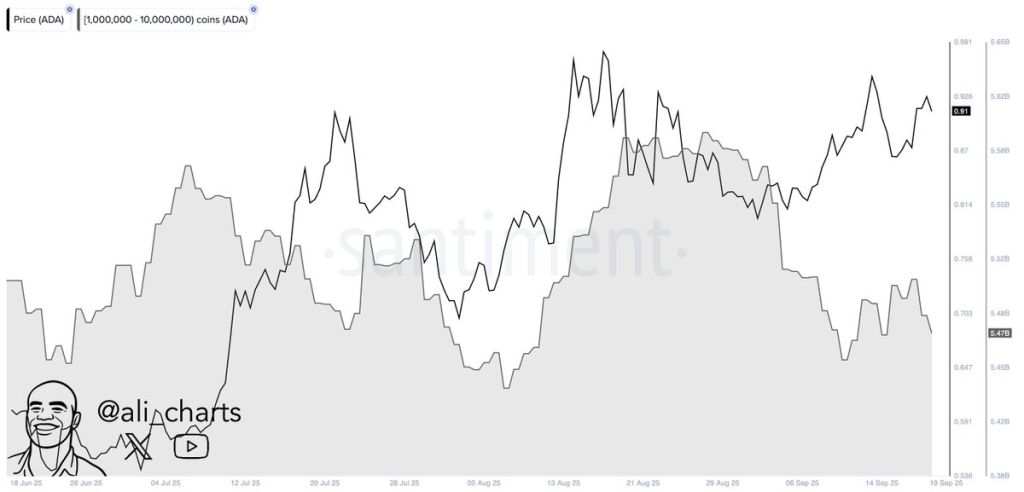

Whales Unloading Cardano

The whale activity is closely monitored by the investors, as it is considered a major indicator for the upcoming price action. The Santiment data shared by a popular analyst, Ali, highlights a key dynamic in Cardano’s price action: while ADA has been steadily climbing toward the $1 mark, large holders, or “whales,” controlling between 1 million and 10 million ADA, have been reducing their balances. Currently, this group holds about 5.47 billion ADA, signalling that many are taking profits as the token approaches a critical psychological barrier.

This divergence—where price rises but whale holdings decline—often points to short-term selling pressure, which can limit upward momentum. The $1 level carries strong psychological weight for retail traders and institutions alike, meaning profit-taking by whales could trigger hesitation and consolidation before any decisive breakout. On the flip side, if demand continues to grow and absorbs this selling activity, Cardano could still power through resistance. In fact, whale distribution might even strengthen the market over time by spreading ADA into more hands, paving the way for a more sustainable rally ahead.

Cardano (ADA) Price Analysis for September

Cardano has shown impressive resilience in September, climbing steadily toward the long-awaited $1 mark. After weeks of consolidation, ADA is now trading around $0.91, its highest level in months, sparking renewed optimism across the market. This rally has largely been fueled by broader crypto market strength and improving sentiment around altcoins.

However, whale activity tells a more cautious story. Large holders holding between 1 million and 10 million ADA have been trimming their positions, currently sitting on around 5.47 billion ADA. This distribution trend often introduces short-term selling pressure, making it harder for the token to break cleanly past $1.

Cardano (ADA) is trading NEAR $0.90 within an ascending wedge pattern, pressing against key resistance just below $1.00. A breakout above this level could trigger a rally toward $1.10–$1.20, while failure risks a pullback to $0.85. The Chaikin Money Flow (CMF) shows mild positive inflows, suggesting modest buying pressure, while the MACD remains in bullish territory, indicating upward momentum. Overall, ADA sits at a decisive point, where volume and market sentiment will determine its next breakout direction.

Overall, September remains a make-or-break month for ADA. Sustained demand and easing whale selling will be key to determining whether cardano can finally turn $1 into solid support.