Solana Soars: TVL Hits $12.27B as ETF Momentum Builds

Solana rockets upward as institutional interest converges with booming ecosystem growth.

Total Value Locked Milestone

Hitting $12.27 billion in TVL signals massive capital influx—developers build, investors pile in, and the network flexes its scaling muscles without breaking a sweat.

ETF Speculation Heats Up

Wall Street's latest crypto crush isn't just about Bitcoin anymore. Traders bet big on Solana landing the next spot ETF approval, because nothing makes traditional finance embrace decentralization faster than the chance to package it into a fee-generating product.

Market Momentum Builds

Price action feeds optimism, optimism fuels more buying—classic crypto cycle behavior, but this time with sharper infrastructure and fewer excuses. Solana isn't just riding the wave; it's helping shape it.

In the latest solana news, CME Group is expanding its crypto lineup by launching options on SOL and XRP futures starting October 13, 2025. This comes on the back of record open interest of $895 million for Solana.

Wondering why it matters?

![]() Attracts more institutional capital into SOL and XRP

Attracts more institutional capital into SOL and XRP![]() Boosts trading volume and market volatility

Boosts trading volume and market volatility![]() Signals growing confidence from major players beyond BTC and ETH

Signals growing confidence from major players beyond BTC and ETH

Against this backdrop, Solana has been on an impressive run, with its price action, TVL growth, and network upgrades all aligning to strengthen its fundamentals. Join me as I give you more insights on Solana network and SOL price in this analysis.

Key Drivers Behind Solana’s Rally

Drivers of the rally include:

- ETF momentum: SEC delayed decisions (BlackRock Oct 30, Franklin Templeton Nov 14), but Bloomberg analysts see 90–95% approval odds.

- Network upgrades: The Alpenglow consensus upgrade on Sep 3 reduced transaction finality to 150ms, improving DeFi usability. Earlier in July, SIMD-0256 boosted TPS by 20%, now averaging 1,700–1,800.

Overall, Solana’s mix of ETF optimism, institutional inflows, and technical improvements creates a supportive backdrop for price growth.

Solana TVL Stats

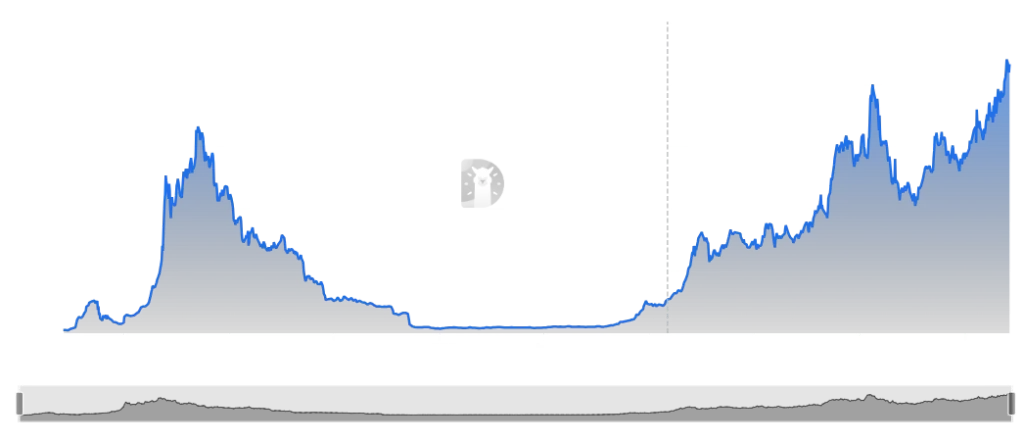

Solana’s TVL has surged to $12.27 billion, up 57% QoQ, marking its strongest growth phase since 2021. Successively, Raydium has grown 32% in monthly TVL, while Jupiter DEX is averaging over $500 million in daily trading volume.

This signals rising developer traction and user adoption. With SOL functioning as both a gas token and a staking asset, this growth directly fuels network demand. Institutional inflows, paired with ecosystem activity, underline why Solana continues to stand out in the DeFi space.

Solana Price Analysis

As of now, SOL price trades at $244.46, up 3.08% in the past day and 9.12% in the past week. Its market cap stands at $132.4 billion, with 24-hour trading volume surging 42.23% to $10.89 billion. The daily range has been between $232.77 and $247.47, while the all-time high remains at $294.33.

From the charts, SOL is hovering below resistance at $252.01. A breakout above this could open the path to $300, while strong support sits at $231.87. RSI is around 61.98, suggesting bullish momentum without being overbought.

FAQs

What is driving Solana’s recent price surge?ETF approval optimism, network upgrades, and institutional inflows are key drivers.

Can Solana break its all-time high soon?If SOL clears $252 and sustains momentum, a push toward $294–$300 is possible.

Why is TVL growth important for Solana?Rising TVL reflects stronger ecosystem adoption, which increases SOL’s demand as gas and staking token.