ETH Defies Gravity: Holds Firm Above $4.5K as Institutional Floodgates Open

Ethereum isn't just holding—it's flexing. While traditional markets wobble, ETH stands rock-solid above the $4.5K psychological barrier, signaling something bigger brewing beneath the surface.

Wall Street's New Darling

Institutional money isn't just dipping toes anymore—it's diving headfirst into Ethereum's liquid markets. Major funds are allocating unprecedented percentages to ETH, treating it less like a speculative asset and more like digital gold 2.0. The $4.5K support level isn't technical analysis—it's institutional conviction made visible.

The Real Signal Everyone Missed

Forget price charts. The real story unfolds in custody solutions seeing record inflows and futures markets pricing in sustained demand. This isn't retail FOMO—this is sophisticated capital positioning for what comes next. Meanwhile, traditional finance still can't decide whether to regulate us or copy our homework.

Ethereum's proving that real value doesn't need bailouts—just better technology. Take notes, Wall Street.

The ETH price has shown remarkable price action in recent weeks after it reached an ATH. Now, when writing, it is holding steady today above $4,500 while institutional demand strengthens.

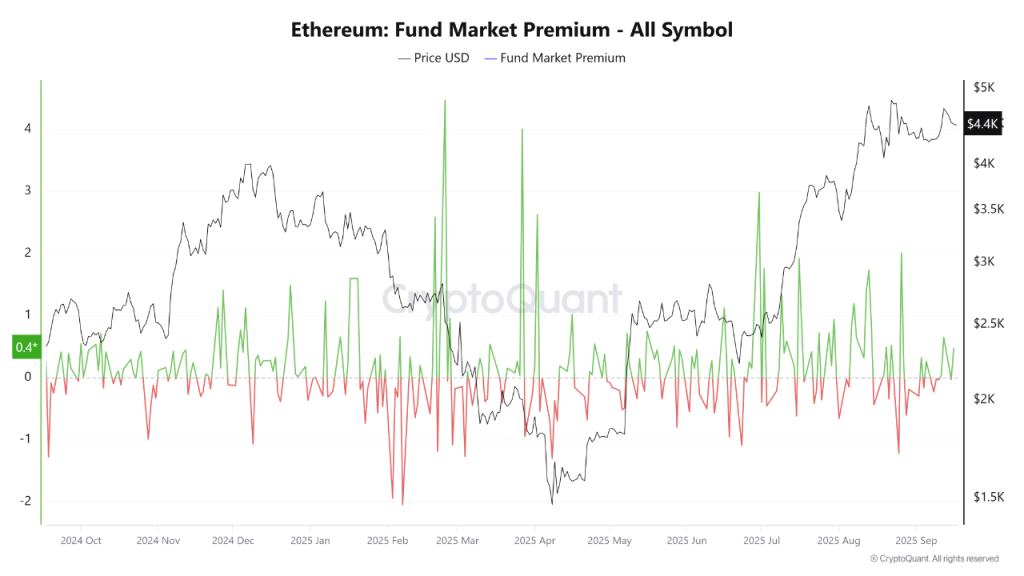

The onchain data is turning positive, as the specific metric “Fund Market Premium ” (FMP) suggests that the curve is shifting back into positive territory and on-chain activity is climbing.

Therefore, the current market environment has brought renewed excitement to the ETH market, as today’s important decision from the FOMC WOULD set the trajectory for the rest of the year.

But, opinions are tilting on the bullish side that could support a potential rally toward the $6,800 zone.

Positive Fund Market Premium Supports ETH Price Momentum

The Fund Market Premium (FMP) on CryptoQuant, which measures the price gap between futures contracts and spot markets, has been turning positive again.

Whereas, when the premium is positive, it means that for an asset, futures are trading at a premium over and above its spot market. It even represents the added demand from institutional investors that results in stronger, sustainable rallies.

That said, this trend was last played out in November 2024 until January 2025, during which a large pump was seen. After long months of waiting, now, once again, from July 2025 to now, as ETH continued its ascent.

This suggests that institutional confidence is returning, with buyers showing a willingness to pay a premium to secure positions in ethereum crypto.

Rising Activity and FOMC Outcome Could Drive Further Upside

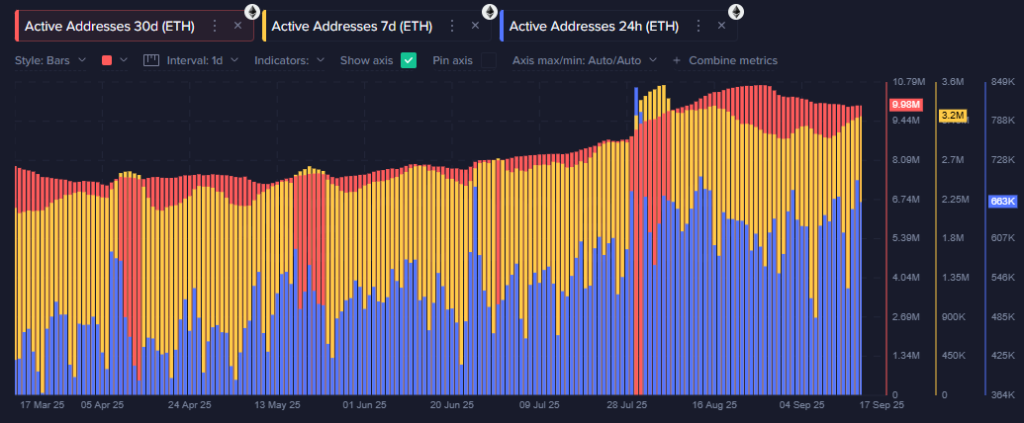

Another noteworthy factor supporting the bullish stance for the ETH price today is the rise in active addresses throughout Q3, based on on-chain data from Santiment.

This growing user activity clearly reflects broader participation on Ethereum’s network.

Additionally, macro event could further influence momentum and set the tone for sessions and even months ahead.

Today’s scheduled FOMC meeting has been speculated to be the most important meeting of the month, where a critical decision on interest rate cuts will take place.

If rates are reduced, it would be very good news for assets like Bitcoin and Ethereum, which will likely receive more capital inflow, boosting buying pressure that should take the ETH price to $6,800 within a few weeks.