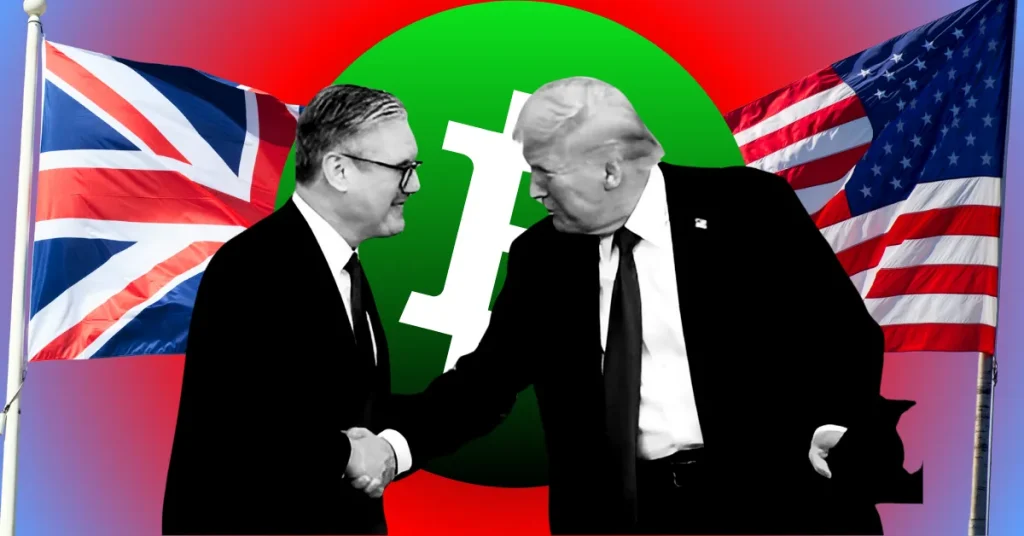

U.S. and U.K. Forge Historic Crypto Alliance: Stablecoins Take Center Stage in Transatlantic Partnership

Breaking: Washington and London just shook hands on a landmark crypto cooperation framework—and stablecoins are stealing the spotlight.

The Regulatory Bridge

Forget fragmented oversight. This bilateral pact aims to create seamless cross-border standards for digital assets, with stablecoins positioned as the test case for synchronized regulation. No more regulatory arbitrage games between the two financial hubs.

Why Stablecoins Matter Now

With trillions in daily volume, dollar and pound-pegged tokens became the obvious starting point. The collaboration focuses on consumer protection, interoperability, and—of course—preventing the kind of meltdowns that make regulators lose sleep.

Global Implications

This isn't just a handshake—it's a power move. Other jurisdictions now face pressure to align or risk getting left behind in the race for digital finance dominance. Because nothing says 'innovation' like two traditional financial giants finally agreeing on something.

Watch for ripple effects across exchanges, wallets, and payment systems. And yes—traditional banks are already sweating over the competition. Because when governments move this fast on crypto, you know they're either terrified or finally see the dollar signs.

The United States and the United Kingdom are exploring ways to cooperate on digital asset regulations and adoption. According to people familiar with the matter, who spoke to the Financial Times, the United Kingdom is seeking to close its crypto regulatory gap with the United States to foster mainstream adoption of digital assets.

Furthermore, the United States has made significant strides in crypto regulations under President Donald Trump. For instance, the TRUMP administration has eliminated Operation Chokepoint 2.0 in addition to enacting the Genius Act into law to enhance stablecoin payments.

What to Expect of the U.S. and U.K. Crypto Cooperation

According to the FT report, the crypto cooperation between the U.S. and the U.K. was discussed on Tuesday between US Treasury Secretary Scott Bessent and Chancellor Rachel Reeves. The two groups discussed crypto cooperation as part of the tariff talks with key attendees including web3 companies led by Coinbase Global Inc. (NASDAQ: COIN), Circle, and Ripple Labs.

According to the U.K. officials, the crypto cooperations will entail regulatory alignment to help attract more U.S. cryptocurrency companies to the country seamlessly. The U.K. -U.S. crypto cooperation talks are expected to continue later this week when President Trump will meet with Britain’s Prime Minister Sir Keir Starmer.

The U.K. is keen on introducing clear crypto regulations to match the United States, especially on stablecoins. Furthermore, the U.S. has led other nations in using stablecoins to retain its global currency dominance.

“On crypto and stablecoins, as on too many other things, the hard truth is this: we’re being completely left behind. It’s time to catch up,” George Osborne, a former Conservative chancellor and now a member of Coinbase’s global advisory council, noted.