Whales Are Gobbling These 3 Altcoins—Here’s What They See That You Don’t

Crypto's biggest players are making moves—and retail is scrambling to keep up.

While Main Street debates rate cuts, whales deploy capital with surgical precision. Their current targets? Three altcoins flashing bullish on-chain signals.

Ethereum: The Institutional Darling

Whales stack ETH like it's digital gold—staking yields, ETF momentum, and an ecosystem that keeps eating finance.

Solana: The Speed Demon

High-frequency traders and degens flock to SOL for raw throughput. Network upgrades cut latency, while retail still complains about meme coin congestion.

BNB: The Quiet Powerhouse

Binance’s token thrives under regulatory radar. Exchange revenue, burn mechanisms, and launchpad exclusives create a vicious cycle of demand—almost like a loyalty program with upside.

Remember: Whale accumulation often precedes retail FOMO. But in crypto, catching a wave beats predicting the tide. Just ask the guys who bought Bitcoin at $60k—wait, too soon?

The crypto market is beginning to steady after a volatile week. Total market capitalization climbed by $13 billion in the past 24 hours, now standing at $3.82 trillion. Importantly, the $3.81 trillion level is holding as support, acting as a base for broader market stability.

Bitcoin trades at $111,477, with resistance at $112,500 and a stronger push expected if it breaks above $115,000. Still, RSI readings suggest short-term caution.

Whales Accumulate Altcoins WLD, AAVE, UNI

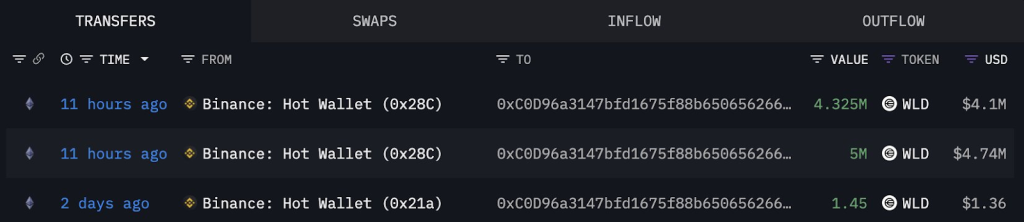

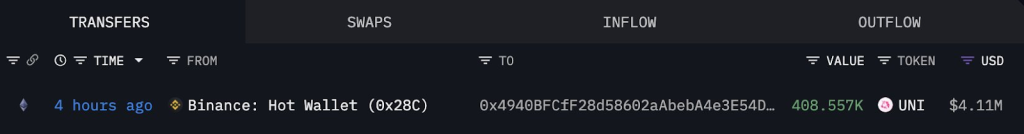

While Bitcoin consolidates, whales are shifting focus to select altcoins. Lookonchain data reveals large withdrawals of Worldcoin (WLD), Aave (AAVE), and Uniswap (UNI) from centralized exchanges. The scale of these moves signals accumulation rather than profit-taking, often a bullish sign for long-term positioning.

A major wallet, 0xF436, withdrew 43,123 AAVE worth $13.87 million over two days. Such heavy outflows suggest whales are holding AAVE for the long run or planning to deploy it into DeFi protocols, reflecting strong confidence in Aave’s future.

A newly created wallet, 0xC0D9, pulled 9.325 million WLD (about $8.86 million) from Binance just 11 hours ago. The size of this transaction and its MOVE into a fresh wallet highlight growing high-net-worth or institutional interest in Worldcoin, a project already under the spotlight due to its biometric identity system.

- Also Read :

- Exclusive: Trump’s Bitcoin Reserve, Wall Street ETFs, and GENIUS Act Stablecoin Push Explained by Expert

- ,

Another whale wallet, 0x4940, withdrew 408,557 UNI, valued at $4.11 million, from Binance only four hours ago. With Uniswap still dominating as a decentralized exchange protocol, this activity shows strong belief in UNI’s role as a key player in DeFi.

Crypto Implications of Whale Buying

Whale accumulation is widely seen as bullish, as it reflects confidence in the medium- to long-term value of an asset. The clustering of whale activity around WLD, AAVE, and UNI suggests big players are positioning early for a potential altcoin upswing. Traders will be watching closely to see if this momentum spills into price action in the coming days.

Never Miss a Beat in the crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Are whales also targeting meme coins?Yes. Meme coins like Little Pepe (LILPEPE), Dogecoin (DOGE), shiba inu (SHIB), Pudgy Penguins (PENGU), SPX6900, and Bonk (BONK) are seeing major whale inflows.

What is Reddit saying about whale accumulation?Many users point out whales are quietly loading up on ETH and altcoins, reflecting strong institutional interest.

Which altcoins are whales are buying right now?Beyond WLD, AAVE, and UNI from your news, whales are also showing interest in LINK, XRP, ENA, and meme tokens like LILPEPE, DOGE, SHIB, PENGU, SPX6900, and BONK.

Will altcoin season start soon?If Bitcoin breaks $115K and whales keep accumulating, altcoins could see an explosive upside in the next cycle.