🚀 Bitcoin Defies Gravity as Hash Rate Hits All-Time High: $125K Breakout Looms

Bitcoin's network strength just flexed harder than a Wall Street trader's ego—hash rate surges to unprecedented levels while price holds firm. The stage is set for a potential moonshot.

Mining Machines Go Brrr, Price Stays Chill

Miners are pouring unprecedented computational power into the network (ATH hash rate alert!), yet BTC's price refuses to buckle. This eerie stability smells like consolidation before liftoff.

The $125K Countdown Begins

Technical analysts are circling August 2025 on their calendars—a decisive breakout above key resistance could trigger a FOMO cascade toward six figures. Meanwhile, traditional finance still thinks 'blockchain' is a new type of yoga.

When the hash ribbon indicator starts flashing green while institutional money hesitates, history suggests retail gets the last laugh. Buckle up.

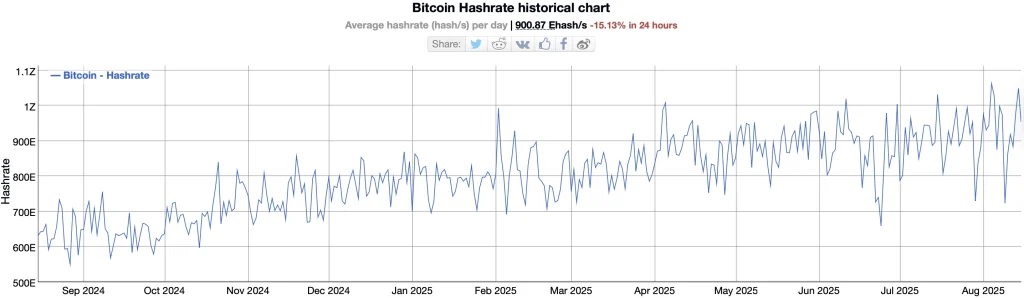

Bitcoin’s price has entered a consolidation phase, holding steady after its strong rally to new highs earlier this year. This “pause” is typical after big rallies, as traders take profits and new catalysts are awaited. Consolidation phases often precede major breakouts, making this a crucial period for both short-term traders and long-term holders. While traders debate whether the next move will be upward or downward, another critical metric is quietly surging: the Bitcoin network hash rate has been setting new all-time highs. This divergence between price and network strength has caught the attention of analysts and long-term investors alike.

Hash Rate Soars to Record Levels

In contrast to the sideways price action, Bitcoin’s hash rate continues to climb, reaching unprecedented levels. The hash rate measures the computational power securing the network—essentially the combined strength of all miners. A rising hash rate means more miners are dedicating resources, improving security and showing confidence in Bitcoin’s long-term profitability.

Historically, surging hash rate has often followed periods of price growth, as higher BTC prices attract new mining investment. Importantly, miners tend to think long-term, so continued growth in hash rate during price consolidation signals underlying Optimism in Bitcoin’s future value.

Historical Perspective: Price Leads, Hash Rate Follows

Looking back, Bitcoin’s hash rate and price show a strong correlation—often above 70% on multi-year scales. However, the relationship isn’t perfectly aligned:

- Price usually leads, as higher profitability encourages new miners to join.

- Hash rate lags due to the time required to set up equipment and infrastructure.

- Divergences happen, such as during the 2021 China mining ban, which caused a sharp hash rate drop despite strong prices.

Still, whenever the hash rate kept climbing during price consolidation (e.g., 2019–2020), it was often a precursor to major bull runs.

What This Means for bitcoin TodayThe current setup—sideways price with record-high hash rate—can be interpreted as follows:

- Network Fundamentals Stronger than Ever: Bitcoin is more secure and resilient with each high hash rate.

- Miner Confidence Signals Long-Term Bullishness: Miners wouldn’t pour capital into hardware and electricity if they expected sustained price weakness.

- Potential Breakout Ahead: Historically, similar divergences have preceded major upward price movements.

Bitcoin Price Analysis: Will BTC Price Rise Back to $130K?

Although the price faces a minor correction, breaking the local support, the token remains within the pattern. Bitcoin bulls are leaving no stone unturned in defending the pivotal support around $116,500. Currently, the price has rebounded from the lows below $117,000; however, a rise above a certain range could validate a rise above the bearish influence.

As seen in the above chart, the BTC price continues to trade within a rising wedge, and the latest correction has dragged the levels below an important resistance zone between $120,000 and $120,800. The price is finding its support on the BMSB (Bull Market Support Band), which is formed by the 20-week SMA & 21-week EMA. During a bull market, the price is expected to remain above the support level; however, if it dips below the range, it is viewed as a buying opportunity.

Meanwhile, the MACD indicates a decline in buying pressure, and the lines are trending toward a bearish crossover. Therefore, there is a huge possibility of the price breaking the wedge and testing the support at $115,200. However, this may result in a rebound as the miners are showing huge confidence in the Bitcoin (BTC) price rally.

Bitcoin’s current consolidation could be frustrating for short-term traders, but the surging hash rate tells a different story: the fundamentals are stronger than ever. If history repeats, this miner-driven show of confidence could be a leading indicator of the next breakout.