XRP Wealth Gap Exposed: Here’s How Much You Need to Crack the Top 10% and 1%

New data pulls back the curtain on the staggering concentration of XRP holdings—revealing just how deep your pockets need to be to join crypto's elite.

The Whale Threshold

Forget 'diamond hands'—this is about fat stacks. The numbers don't lie: climbing into the top 10% of XRP holders requires a portfolio most retail investors can only dream of. And the 1%? That's hedge-fund territory.

The Cold Hard Math

While Bitcoin maximalists obsess over 'whole coiners,' XRP's wealth distribution paints a harsher picture. The gap between crypto haves and have-nots isn't just widening—it's institutionalized. (But hey, at least your bank charges lower fees for moving monopoly money, right?)

Wake-Up Call

This isn't FUD—it's arithmetic. As regulators circle and ETFs commoditize crypto, these numbers scream one truth: the game's been rigged since the ICO. Play accordingly.

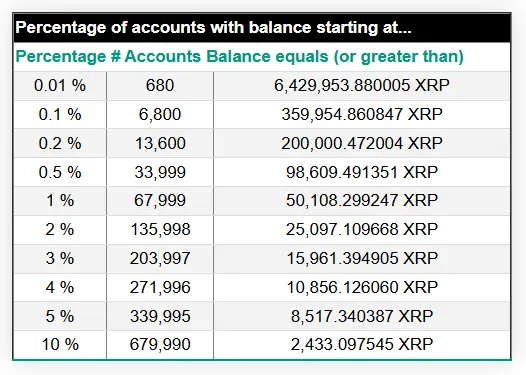

The latest XRP rich list update shows an interesting paradox. While the number of tokens needed to reach the top 10% and top 1% of holders has fallen, the dollar amount needed to buy them has surged.

This is due to XRP’s strong rally alongside the broader crypto market, hitting $3.66 in late July before cooling off slightly. Even after the pullback, XRP remains above $3, up 32% in the past month.

Top Holder Thresholds Shift as Prices Climb

According to data from the community-driven XRP rich list, just 2,433 XRP now puts you in the top 10% of holders — slightly down from 2,486 XRP a month ago. However, while the token count has dropped, the cost to acquire them has jumped from $5,643 in early July to $7,299 now, a nearly $2,000 increase in less than a month.

The same pattern holds for higher tiers. For the top 5%, the requirement fell from 8,758 to 8,517 XRP, yet the cost surged from $19,880 to $25,551. The most dramatic change was in the top 1%, where 50,637 XRP were once needed, now reduced to 50,108 — but the price to enter has jumped by over $35,000, from $115,000 to $150,000.

Analysts say this trend is a warning sign: waiting longer could mean paying significantly more for the same stake. Some commentators believe the market is still early, especially with projections like EGRAG’s $30 XRP target. If that happens, today’s 2,433 XRP for a top 10% spot could be worth $73,000 — pricing out many retail buyers.

A Lower-Cost Alternative While XRP Gets Pricier

While XRP’s rising entry costs might discourage some newcomers, Minotaurus (MTAUR) is offering a far more accessible entry point, and it’s still in its early stages.

Built on the Binance Smart Chain, MTAUR powers a Greek mythology-inspired blockchain game where players control customizable Minotaurs navigating mazes, overcoming traps, and battling creatures for in-game currency and upgrades.

Notably, MTAUR sells at 0.00012051 USDT and has a market cap of 5.6 million. This coin has shown a tendency for impressive performance. It has soared by over 190% over the past year, surging from 0.00004 USDT to its current level. Minotaurus’s low valuation offers significant upside potential for early buyers, with the possibility of reaching multi-million or even billion-dollar territory.

The project integrates a marketplace for skins, consumables, premium tickets, and rare items, with unique characters offering inventory-based effects. Importantly, Minotaurus has been audited by both SolidProof and Coinsult, reinforcing its security credentials, something many early-stage projects overlook.

The Bottom Line

As XRP climbs into ranges that may soon be out of reach for smaller buyers, MTAUR provides an opportunity to secure a position early, before its market matures and valuations potentially follow a similar upward path.

For those who missed XRP’s early days, Minotaurus offers a fresh, lower-cost shot at joining a growing ecosystem — while it’s still affordable. Learn more about MTAUR from the project’s official website.