Crypto Bloodbath: What’s Crushing the Market on August 12, 2025?

Crypto markets are taking a beating today—here's why traders are sweating.

Macro Mayhem Hits Digital Assets

Global risk-off sentiment spills into crypto as traditional markets wobble. No safe havens here—just leveraged longs getting liquidated.

Regulatory Ghosts Return

Whispers of fresh G20 crypto框架 discussions trigger PTSD from 2023's compliance winter. Institutions hit pause on deployments.

Tech Wobbles Amplify Pain

Ethereum's latest upgrade gas fee volatility coincides with exchange API outages. Perfect storm for algo traders to eat their young.

Meanwhile, Bitcoin maximalists are—shockingly—blaming 'shitcoin contagion.' Because clearly, the asset that moves 4% when MicroStrategy sneezes is a bastion of stability.

This too shall pass. Until the next 'black swan' that was totally predictable if you'd just bought their newsletter.

The crypto market today is facing a pullback, with its total valuation falling 2.54% to $3.96 trillion. Meanwhile, the intraday trading volume has climbed 11.01% higher to $192.79 billion, hinting at growing activity despite the drop. That being said, Bitcoin’s dominance remains at 59.7%, while Ethereum is up a notch higher at 13.1%.

Talking about market sentiment, it stays in the “Greed” zone at 60 on the Fear & Greed Index. The correction comes after a strong monthly rally, as profit-taking, heavy token unlocks, and macroeconomic caution weigh big on prices.

Profit-Taking Dominance Pressures Prices

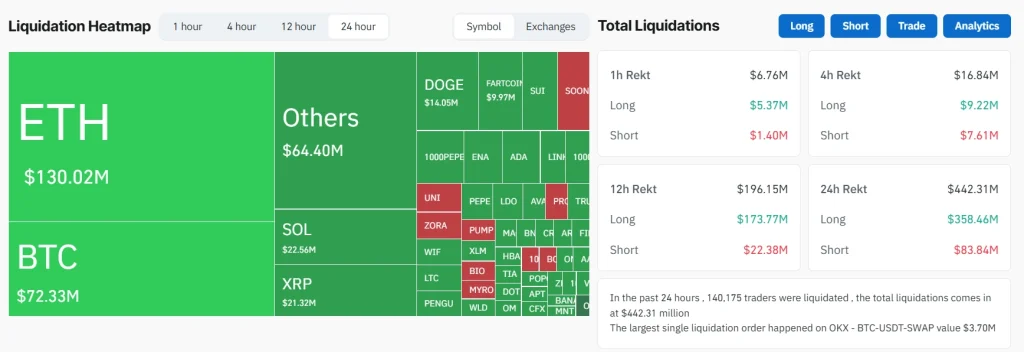

The top crypto Bitcoin’s price decline to $118,883 triggered $72 million in long liquidations. Thereby contributing to $442.31 million in total crypto liquidations in the past 24 hours. Successively, ethereum was hit the hardest with $130.02 million liquidated, followed by Bitcoin.

Despite bullish headlines, such as Metaplanet’s $61 million BTC purchase and ongoing inflows into BlackRock’s ETH ETF, traders opted to mark gains after BTC’s 4% weekly rise. The market stalled NEAR its yearly high of $3.98 trillion, with the RSI(7) at 88.6 signaling overbought conditions. Traders are now awaiting the U.S. CPI report, which could determine the industry’s next move.

Altcoin Supply Flood Deepens Losses

This week’s $653 million in token unlocks has pressured altcoins, especially in thin liquidity. Dogecoin dropped 5.81% following a 95.49 million DOGE unlock worth $22 million. This was compounded by whale wallets moving 1 billion DOGE to exchanges.

Arbitrum, on the other hand, fell 6.76% amid a 37% rise in open interest, while sui lost 6.28%. Unlocks quickly increase supply, making it harder for prices to hold during already bearish conditions.

Equity Market Drag and Macro Caution

Weakness in U.S. equities has added to crypto’s struggles. After President Donald TRUMP granted a 90-day extension on China tariffs, the Dow Jones slipped 0.5%, the S&P 500 dropped 0.2%, and the Nasdaq lost 0.3%. Meanwhile, Nasdaq futures dipped 0.3% ahead of CPI data.

Bitcoin’s 24-hour correlation with gold hit +0.75, but crypto traded more like a risk-on asset, trailing behind the tech stocks rather than safe-haven flows. Gold rose 0.75% to $3,355 as inflation concerns boosted demand.

Conclusion

Today’s market drop echoes natural consolidation after an 8.27% monthly rally. BTC’s $118k support and the CPI report will be crucial. Successively, cooler inflation could revive the shopping spree, while hotter data may send the market toward the $3.2T 200-day EMA.

FAQs

Why did crypto prices fall today?Due to profit-taking after recent gains, token unlocks are increasing supply, and broader market caution ahead of U.S. CPI data.

Which coins saw the biggest liquidations?Ethereum led with $130M in liquidations, followed by Bitcoin with $72M.

What’s next for the market?BTC’s $118k level is key. CPI results will likely determine whether the market rebounds or slides further.