Ethena Skyrockets 40% in a Week as Total Value Locked Smashes $10B Milestone

Ethena's native token defies gravity with a blistering 40% rally—just as its protocol locks down a jaw-dropping $10 billion in TVL. DeFi's latest darling isn't just growing; it's staging a full-scale breakout.

The Numbers Don't Lie

That double-whammy of price action and capital inflow screams institutional FOMO. Traders are piling in like it's 2021 again—only this time, the 'stablecoin yields' come with extra side of existential risk.

When Fundamentals (Almost) Keep Up With Hype

For once, the token surge aligns with actual protocol traction. No vaporware here—just the beautiful chaos of crypto's perpetual motion machine. Of course, Wall Street won't notice until they've missed the first 300% move.

Another day, another DeFi protocol printing gains while traditional finance struggles to hit 5% APY. The revolution will be collateralized.

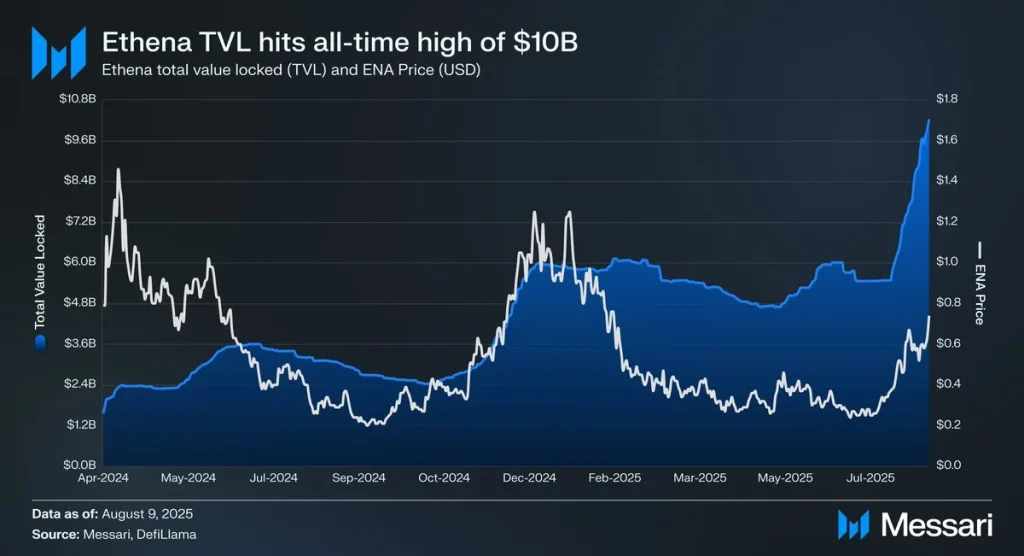

Ethena price has staged a strong 40.03% rally this week, and 11.59% in the last 24 hours, trading at $0.8406. The moonish surge aligns with Ethena’s TVL hitting a record $10 billion, alongside a major milestone for its synthetic dollar, USDe. Which recently became the 3rd largest stablecoin by market capitalization.

Successively, $5M daily ENA buybacks are reducing circulating supply, creating scarcity. Plus, whale addresses holding 100k-1M ENA grew 12% in July, now controlling ~30% of supply. Wondering where the ENA price could head next? Join me as I decode the same in this analysis.

On-Chain Analysis

Ethena’s TVL has reached an all-time high, surpassing $10B as of August 9, 2025, according to Messari. This marks a significant influx of capital into the protocol, reflecting growing investor confidence and adoption of its DeFi products. The TVL rise has tracked closely with ENA’s price recovery from multi-month lows, suggesting that capital inflows may be leading price action.

ENA Price Analysis

ENA’s recent price breakout came on August 10th, when it surged 13.7% from $0.64 to $0.7277, breaking out of a bullish flag pattern. The rally has since extended toward $0.8493, today’s high, with the price currently consolidating around $0.84.

Technical indicators point to strong momentum, the RSI-14 at 74.76 suggests the market is nearing overbought levels, though not yet extreme. This is while the shorter-term RSI-7 at 81.81 indicates high short-term enthusiasm. MACD, on the other hand, has confirmed a bullish crossover with the histogram turning positive at +0.010557.

Talking about price targets, the key upside targets are at $0.8741 at Fibonacci 127.2% and one at $1.02. However, $29.8M worth of ENA moved to exchanges on August 9–10, which could introduce near-term volatility. On the downside, a close below $0.7046 could trigger profit-taking toward lower supports at $0.5638 and $0.4764.

FAQs

Why is the ENA price surging now?Strong TVL growth, USDe’s stablecoin milestone, buybacks, and whale accumulation have boosted ENA’s price.

What are the key levels to watch for the Ethena price?Upside targets are $0.8741 and $1.02; support sits at $0.7046, $0.5638, and $0.4764.

Is ENA overbought?RSI shows it’s approaching overbought territory but still has room for short-term continuation.