XRP Takes a Hit: Wall Street Turns Bearish as RBLK Steals the Spotlight with Institutional Demand

Wall Street's love affair with XRP sours—analysts slash ratings while an underdog token quietly racks up institutional backing. Here's why the smart money's shifting.

### The XRP Backlash: A Classic Case of Crypto Whiplash

Once the darling of payment-coins, XRP just got downgraded by suits who probably still think 'blockchain' is a spreadsheet feature. Meanwhile, RBLK—a dark horse with actual utility—is drawing hedge fund attention like a DeFi yield farm in a bull market.

### Institutional Players Place Their Bets

Forget moonboys and memes. The real action? Big funds quietly accumulating positions in projects that solve problems—not just hype cycles. Bonus jab: Nothing moves markets faster than bankers pretending they 'get' crypto this time.

The latest Ripple news is shaking the market, but it’s the quiet accumulation in GambleFi upstart Rollblock that could matter more right now. As Ripple deals with a new downgrade and a high-profile Wall Street jab, Rollblock continues to attract the kind of big-money accumulation rarely seen in early-stage presale projects.

Top analysts see RBLK as a serious contender forreturns in 2025, making it one of the top cryptocurrencies to watch in the months ahead.

Rollblock Sees Surge in Whale Activity

Savvy whales and institutional players are quietly building significant positions in Rollblock (RBLK), drawn to its blend of Web3 innovation, deflationary tokenomics, and consistent revenue generation.

The platform’s 12,000+ AI-powered games span poker, blackjack, and live sports prediction leagues, all backed by a Gaming Anjouan license and a SolidProof audit for maximum transparency. Deposits can be made via Apple Pay, Google Pay, Visa, and Mastercard, with every payout locked into the ethereum blockchain to guarantee fairness and complete transparency.

RBLK’s staking crypto model is designed to keep supply tight while generously rewarding loyal holders. Up to 30% of the platform’s revenue is used to buy back tokens from the market – 60% of these buybacks are burned to reduce the total supply, and the remaining 40% funds are used for staking rewards of up to 30% APY.

With a hard cap of one billion tokens, it’s a low market cap crypto positioned superbly for long-term value appreciation, and this built-in scarcity is exactly what sets the presale apart from the flood of other iGaming tokens that lack both supply discipline and a true deflationary model.

• Over $15 million in bets processed

• Revenue-backed, deflationary buyback-and-burn cycle

• Fully regulated with transparent operations

• Presale is selling fast at $0.068, raising $11.4 million

• Major exchange listings due later this year

Watch the full lowdown from Freddie Finance right here: https://youtu.be/qztj3p8uy_c?si=U1TVQ94C6Anvi6Vp and see what has him so excited!

XRP Battles the Critics

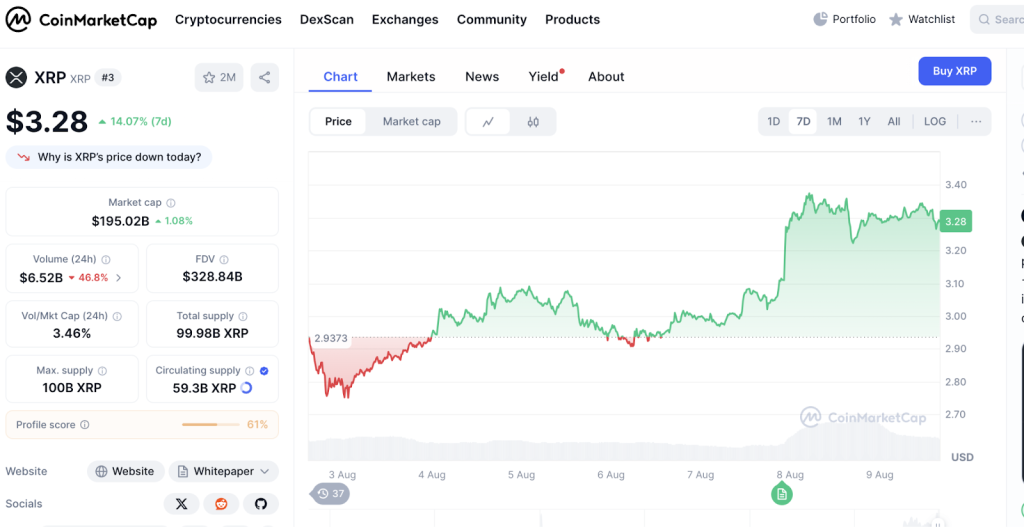

XRP is trading at $3.28 today https://coinmarketcap.com/currencies/xrp/, up 13.77% in the last week of trading despite a round of criticism from Wall Street veteran Fred Krueger. In a post that lit up social media, he claimed “not one actual human being” uses XRP for anything real.

His comments triggered a wave of community pushback, with former Ripple director Matt Hamilton replying: “I literally just sent some XRP to help out a friend. I am in the UK, they are in the US. It was the easiest, cheapest, and fastest way.”

This public spat has reignited the debate over Ripple’s cryptocurrency use case. Supporters point to XRP’s ledger transactions for NFTs and DeFi tokens, while critics argue these are niche activities.

For investors comparing the top altcoins, the question now is whether XRP can grow adoption fast enough to compete with high-potential crypto plays like Rollblock.

Ripple Vs. RBLK Comparison

| Token | Price | Market Cap | Revenue Share | Potential Upside |

| RBLK | $0.068 | Low | 30% | 50x+ |

| Ripple | $3.28 | Very High | None | 2x–4x |

Could Rollblock Outperform Ripple?

While Ripple dominates news headlines for its community’s defense against Wall Street critics, Rollblock is pulling in whales with its scarcity, revenue model, and institutional-ready structure. In a year where capital is chasing the best altcoins and the next big crypto plays, the gap between sentiment and fundamentals could not be clearer.

For investors seeking the best low market cap crypto with a legitimate path to 50x returns, the smart money already knows which way to move.