Whales Gobble Up Cardano Dip: $1.00 Price Target Imminent for August?

Crypto whales just made their move—loading up on Cardano as prices dipped. Now, all eyes are on whether ADA can smash through the $1.00 barrier this month.

Why the sudden frenzy? Whale wallets ballooned while retail investors panicked. Classic buy-the-fear play—or just another pump waiting to dump on the little guys?

Technical signals scream bullish: key resistance levels shattered, trading volume spiking. But let’s not pretend this isn’t crypto—where ‘fundamentals’ often mean ‘which influencer tweeted last.’

One hedge fund manager yawned: ‘We’ve seen this script before. Whales feast, FOMO kicks in, then…’ He mimed a crashing plane. Charming.

Either way, August just got interesting. Buckle up.

The Cardano price action has taken a bullish turn with technical patterns confirming long-term optimism. As ADA consolidates near key support, and on-chain metrics are improving, experts now believe the long run rally could explode big.

EMA Structure Points to Healthy Support

Cardano price today sits at $0.7283, up 0.37% intraday, with a trading volume of $866.11 million. Early August saw ADA take support from its 200-day EMA, and it now moves within the 20-day and 50-day EMA bands, which shows a consolidation before a breakout.

Zooming out on the ADA price chart, a clear 7-month falling wedge pattern emerges. July served as a breakout month, while the pullback in late July to early August appears to be a strategic reload phase. This movement suggests more buyers may be preparing for the next leg up, which could be parabolic.

Ascending Channel Shapes ADA’s Near-Term Trajectory

From a shorter frame starting in April, ADA has formed an ascending channel. July’s rally, which surged from the $0.55–$0.60 zone to a peak of $0.92, was a liquidation grab towards the upper channel boundary. The current pullback has now taken ADA to the lower channel border, which means a strong reaccumulation zone.

If price rebounds from this area, the next targets in the cardano price forecast suggest it could revisit July highs or breach $1.00, with potential upside even beyond. The ADA price USD trajectory from here hinges on this consolidation giving way to breakout volume.

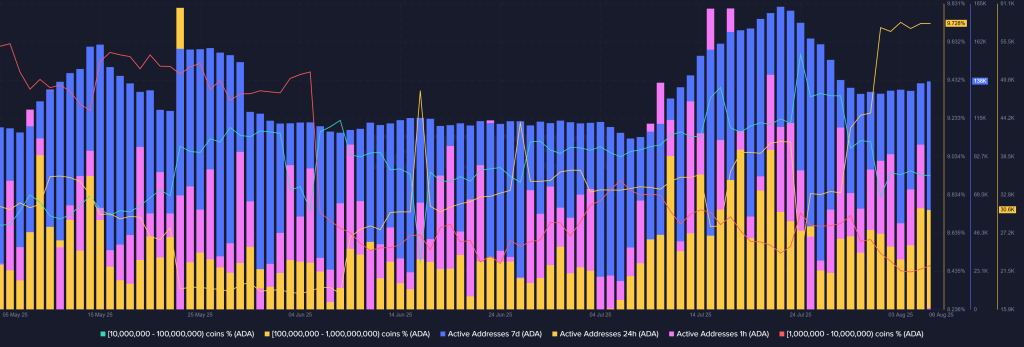

On-Chain Whales Strengthen Long-Term Outlook

On-chain data from Santiment shows a unique trend. While addresses holding 1M–100M ADA are declining, larger whales (100M–1B ADA) are absorbing the selloff.

This shows a strong sign of quiet yet confident accumulation by smart money.

Additionally, ADA network activity has spiked across all active address metrics (1H, 24H, 7D), suggesting growing retail involvement.