Bitcoin Price Surge: Where Will BTC Land on August 6, 2025?

Bitcoin defies gravity again—bulls charge as institutional money floods in.

Technical breakout or speculative bubble? The charts scream 'buy' while skeptics eye exit doors.

Key levels to watch: Can BTC sustain its parabolic rally or will profit-taking trigger a pullback?

Meanwhile, Wall Street still can't decide if crypto is the future or just a high-risk casino—but they’re trading it anyway.

Bitcoin fell 0.8% to $113,467 early Wednesday, staying close to the one-month low it touched earlier this week. The drop came as U.S. trade tariff threats and signs of slowing global growth weighed heavily on investor confidence, pushing traders away from riskier assets like crypto.

The decline also follows a wave of profit-taking after July’s strong rally. Earlier this week, altcoins briefly surged, but the momentum quickly faded, pulling the broader market lower alongside Bitcoin.

Profit-Taking from Long-Term Holders

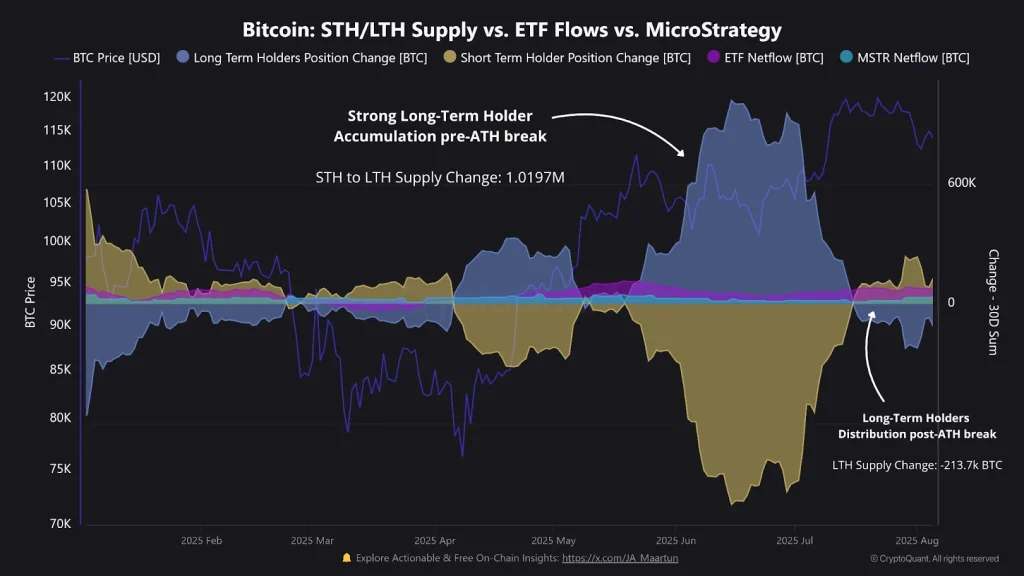

According to on-chain CryptoQuant analyst Maartunn, Bitcoin’s recent slip is being driven largely by selling from long-term holders (LTHs), including the headline-grabbing sale of 80,000 BTC from a Satoshi-era wallet. While that single event made waves, Maartunn stresses that the broader market dynamics are far more significant.

“This isn’t just one whale, it’s a wave of long-term investors cashing out after the ATH breakout,” he explained.

Retail and Institutional Activity

Retail investors have predictably entered the market in force following Bitcoin’s record high, a common pattern during bullish breakouts. Institutional interest has also been visible, with firms like Strategy and Metaplanet adding exposure. However, Maartunn notes that the combined buying power wasn’t enough to maintain prices above $120K, leading to renewed selling pressure.

Short-Term Holders Under Water

The sharpest impact has come from short-term holders (STHs) capitulating at a loss. On-chain data shows realized losses of 52,230 BTC in mid-July, 42,493 BTC later that month, and an extended sell-off of 70,028 BTC after July 31. Maartunn says the last instance stands out for both its size and duration, signaling that short-term sentiment has weakened considerably.

ETF Outflows Add to the Pressure

Bitcoin ETFs have also recorded outflows in recent sessions, although Maartunn describes these as modest compared to past corrections. Still, combined with LTH profit-taking and STH capitulation, they contribute to a market struggling to find fresh upward momentum.

Never Miss a Beat in the crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.