Bitcoin Defies Gravity: Strong Support Holds—Will $116K Breakout Trigger the Next Mega Rally?

Bitcoin isn't asking for permission—it's building foundations. Again.

The Dip That Didn't Collapse

While traditional markets waffle over interest rates and earnings reports, BTC's price action scoffs at hesitation. Every test of lower levels gets met with buy orders thicker than a Wall Street prospectus.

The $116K Line in the Sand

Technical traders are glued to that magic number. A clean breakout could send algorithms into a buying frenzy—just in time for the next 'expert' to claim they predicted it all along.

The Cynic's Corner

Let's be real: if Bitcoin actually nails this rally, hedge funds will suddenly 'discover' crypto again—right after finishing their third martini lunch.

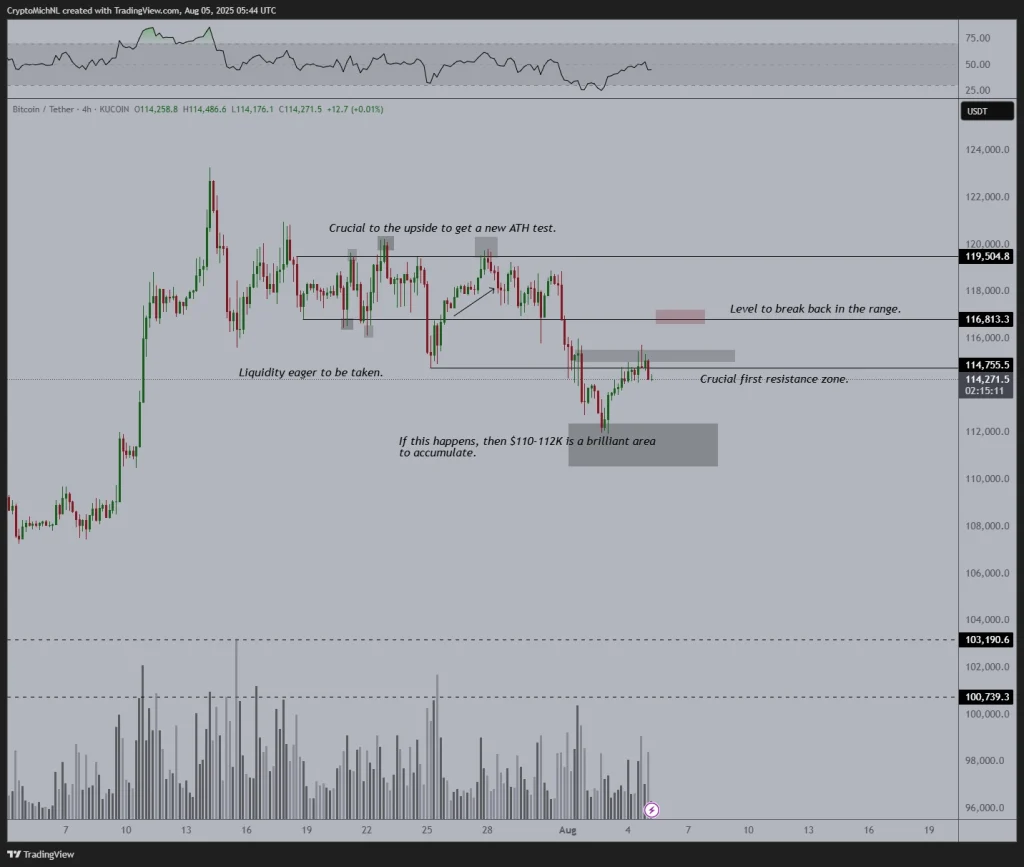

Bitcoin price is trading in a tight range, coiled between heavy accumulation and strong resistance. As the price hovers around $114k, both technical and on-chain data suggest an inflection point is near. With demand from long-term holders soaring and short-term momentum indicators showing weakness, the crypto market braces for a decisive move. The $116k level is now the focal point for bulls and bears alike. Join me as I take you through on-chain metrics and analyst views in this write-up.

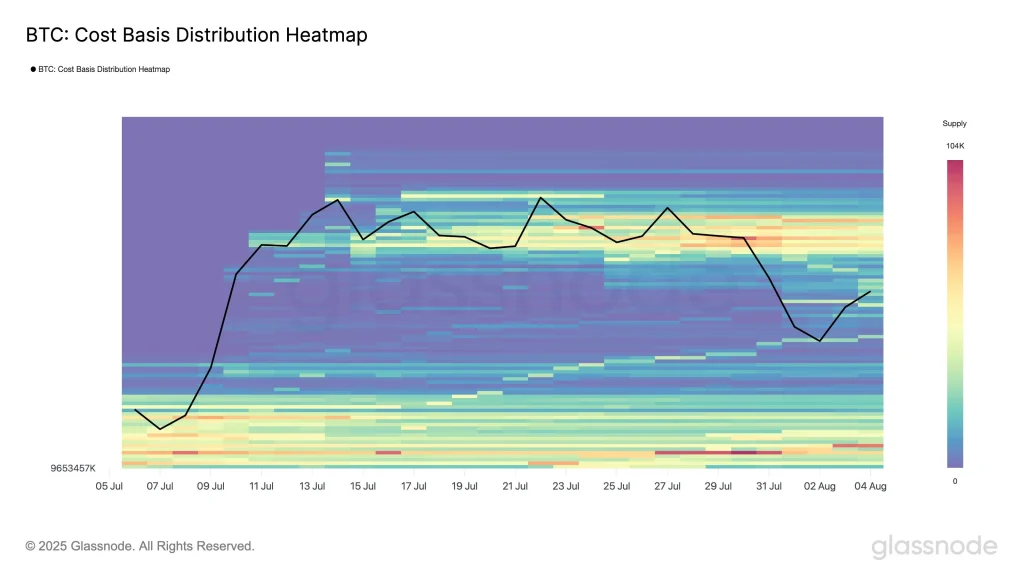

BTC Cost Basis Heatmap:

Glassnode’s Cost Basis Distribution Heatmap shows a staircase-like pattern between $109k and $116k, filled progressively over the last month. This steady buying pressure illustrates growing investor confidence, especially as dips into this range are consistently absorbed. Meanwhile, the $118k–$120k zone shows little sign of distribution, implying that holders are not willing to exit at these levels, suggesting a “wait-and-hold” mentality.

According to Alva, BTC is in a classic squeeze zone, compressed between stepwise support and a thick resistance wall. Options activity is heating up, indicating at an imminent move. Although recent ETF outflows and miner profit-taking NEAR $117k caused some hesitation, macro narratives like BTCFi adoption and traditional finance interest continue to offer strong tailwinds. The AI warns that if BTC doesn’t reclaim the $116k mark soon, oversold indicators like the CRSI could invite volatility and a swift drop to lower support levels.

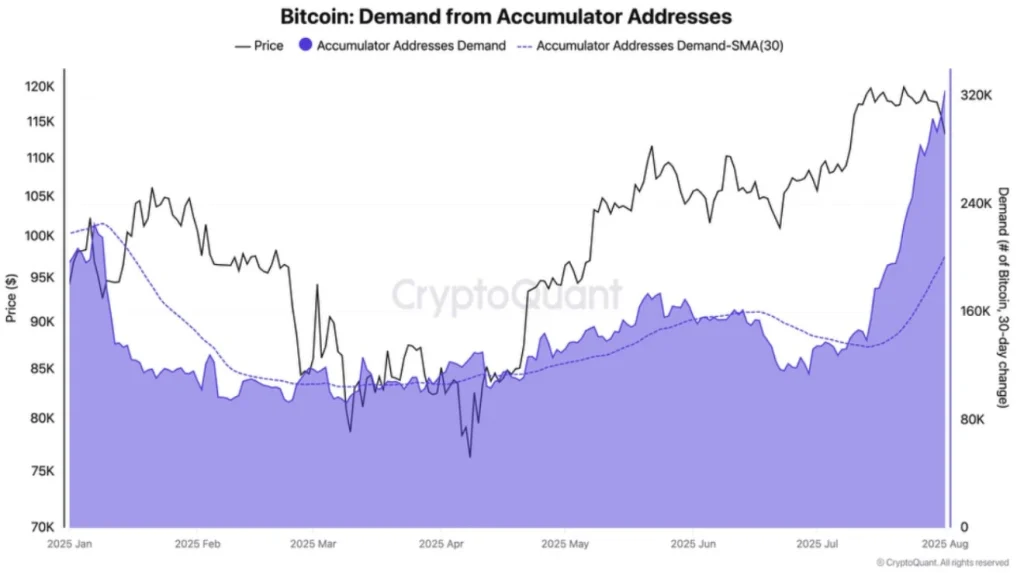

Demand from Accumulator Addresses:

CryptoQuant data shows that accumulator addresses are more active than ever in 2025. The 30-day net accumulation has surged past 320k BTC, showing renewed confidence in BTC’s long-term upside. Since May, price action has closely followed the trajectory of accumulator demand. This strong base of buyers provides a safety net, especially if price revisits the $110k–$112k range. Which Glassnode and the AI agent both view as a “brilliant” accumulation zone.

The alignment of increasing long-term demand and layered cost basis support reinforces the argument for an upward breakout, should BTC cross above the $116k threshold.

Michael Pope: Eyes on $115k–$116k Resistance

Crypto analyst Michael Pope highlighted BTC’s recent failure to crack $115k, calling it the “first real resistance.” While the structure looks bullish, a confirmed breakout above $116k is essential to shift momentum. Pope notes that the previous rejection was minor and suggests another attempt is likely. If successful, BTC could swiftly MOVE back into the $118k–$120k range, reigniting talk of a new all-time high.

FAQs

Why is the $116k level crucial for Bitcoin?It represents the top of strong on-chain support and could trigger a breakout toward $120k.

What does rising accumulator activity mean?It signals growing long-term holder confidence, reinforcing price support on dips.

What’s the risk if BTC fails to hold $114k–$116k?BTC could revisit $110k-$112k, which analysts view as a strong accumulation opportunity.