🚀 Bitcoin Price Surge: Can BTC Smash Through $120K to Hit $146K? The Ultimate Breakout Showdown

Bitcoin's bulls are back—and they're aiming for the stars. After weeks of consolidation, BTC is flirting with a historic breakout that could send it soaring toward $146K. But first, it’s gotta chew through the $120K resistance wall. Here’s the playbook.

### The $120K Gauntlet: Make-or-Break Moment

Every trader’s watching the $120K level like hawks. Break past it, and the path to $146K opens up. Fail? Cue the ‘told you so’ tweets from crypto skeptics. Technicals suggest momentum is building, but markets love to humiliate the overconfident.

### The $146K Dream: Why This Target Isn’t Crazy

Fibonacci extensions and whale accumulation paint a bullish picture. Institutional inflows are creeping up, and the ‘number go up’ brigade is out in force. Even Wall Street’s latecomers are nibbling—though they’ll probably panic-sell at the first 5% dip.

### The Wildcard: Macro Mayhem

Fed rate cuts, election chaos, or a surprise ETF rejection could throw wrenches in the rally. But let’s be real—since when has logic stopped crypto? Buckle up.

Bitcoin price is showing strong bullish momentum as it breaks out of a descending trend. This technical formation, often associated with trend continuation, signals the potential for a significant upside move. With key support holding NEAR $113.7K, BTC appears poised to retest the $120K resistance zone. Meanwhile, the extended targets are around $134K–$146K. The breakout has also coincided with increased whale accumulation and a steady rise in network activity, hinting at growing market confidence.

Will Bitcoin maintain this breakout and surge toward new highs, or is a pullback still on the cards?

Why Is the $120,000 Range Important for Bitcoin Price?

Soon after marking a new ATH above $122,000, bitcoin didn’t face a strong pullback in the form of a correction. Besides, it maintained a range-bound consolidation between $117,500 and $119,800 for more than 10 to 12 days. This indicated the bulls holding a strong grip over the rally, but the bears were silently mounting liquidity around $120,000.

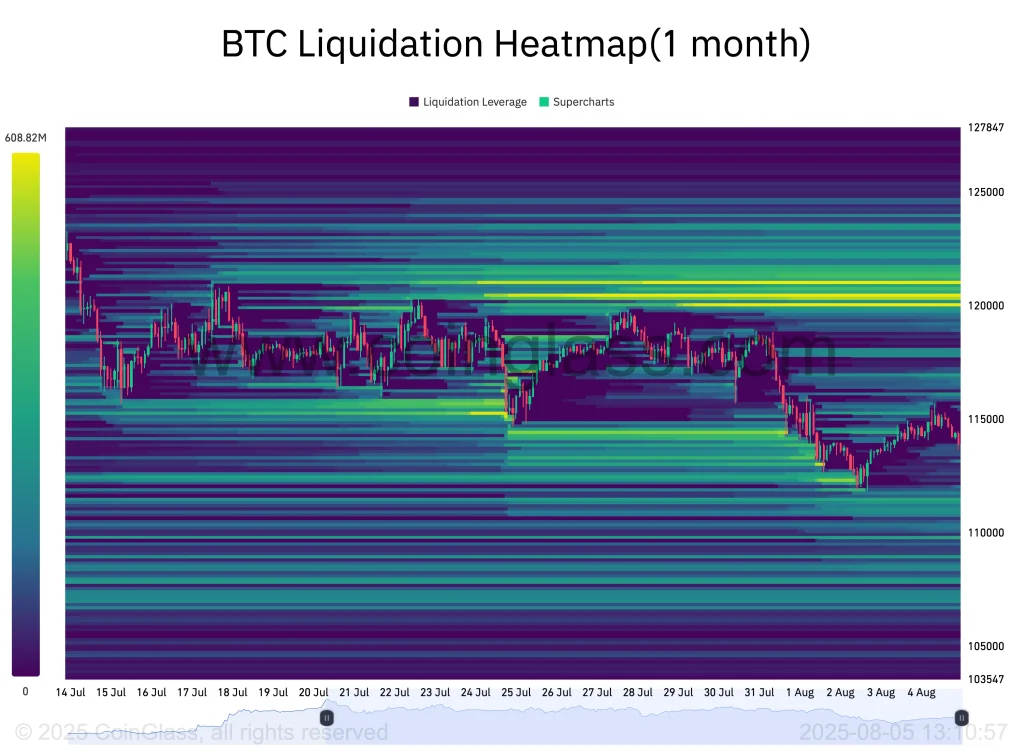

The liquidation heatmap from Coinglass suggests nearly $2.5 billion in liquidity has piled up between $120,000 and $121,000. Once the BTC price hits $120,000, $600 million could be liquidated in the first phase. If Bitcoin manages to withstand the volatility within the range, then a new ATH could be on the horizon. This may not be confined to $125,000 or $130,000, as it may extend beyond $140,000.

What’s Next—Will BTC Price Rise Above $121,000?

Bitcoin price has been experiencing high volatility in the past few days, resulting in a 5% to 6% drop that was fueled by the US tariffs. However, the token bounced off the crucial support levels, which is nothing but the ascending trend line that it has held since April. With this, the bulls seemed to have jumped into action, but failing to elevate beyond $115,300 may cause trouble for the BTC price rally.

The BTC price in a wider perspective is stuck within a rising wedge pattern, triggering a bounce from the ascending support. However, the levels remain consolidated below $115,300, which is a major concern at the moment. Meanwhile, CMF had triggered a recovery from the lows below 0 but failed to rise above the range. Besides, the MACD shows a drop in the selling pressure, which places the BTC price rally at the crossroads.

Hence, to rise above the bearish influence, the Bitcoin (BTC) price needs to secure a range above $118,000, surpassing the local barrier at $115,500. However, the major challenge is around $120,000, breaking which could initiate a fresh bullish spell.