SharpLink Goes Big on ETH: $145M Mega-Transfer & BlackRock’s New Co-CEO Joins the Game

SharpLink just dropped a bombshell—$145 million moving into Ethereum as Wall Street's heavyweights circle crypto like vultures. BlackRock's freshly minted co-CEO is now in the mix, because nothing screams 'mainstream adoption' like a trillion-dollar asset manager playing with digital Monopoly money.

Here's the playbook: A nine-figure warchest getting deployed into ETH while traditional finance 'experts' scramble to pretend they understood decentralized tech all along. The move reeks of institutional FOMO—but hey, when the suits start buying, the bull runs get interesting.

Cynical take? This is either the smartest hedge against fiat collapse or the most elaborate bag-holding scheme since mortgage-backed securities. Either way, grab your popcorn.

SharpLink is making bold moves to ramp up its ethereum treasury. According to data from Lookonchain, SharpLink transferred $145 million USDC to Galaxy Digital’s OTC wallet, which means that another big Ethereum buy is likely on the way.

SharpLink(@SharpLinkGaming) transferred 145M $USDC to Galaxy Digital OTC wallet to buy more $ETH 30 mins ago.https://t.co/ei8uTlXObD pic.twitter.com/hdT4pbnYyP

— Lookonchain (@lookonchain) July 26, 2025SharpLink Taps BlackRock Veteran as Co-CEO

Sharplink also made a bold executive move recently, as it appointed Joseph Chalom, the former digital assets strategist of BlackRock as Co-CEO. With his deep expertise in crypto markets, Chalom will now lead the company’s $1.3 billion Ethereum treasury strategy.

Chalom played a key role in launching the iShares Ethereum Trust (ETHA), now the world’s largest ETH exchange-traded product with over $10 billion in assets. At BlackRock, he led major digital asset partnerships with firms like Coinbase, Nasdaq, and Circle, and held top roles including interim Deputy COO and COO of BlackRock Solutions.

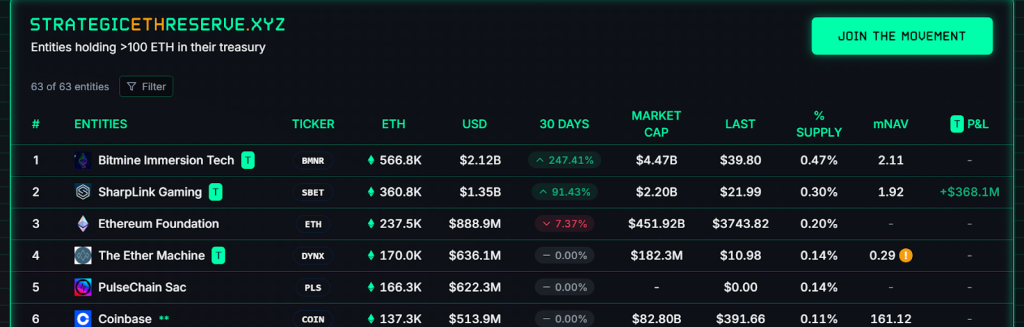

SharpLink has been on an ETH buying spree, scooping up over 360,000 ETH worth $1.3 billion in just weeks. Sharplink has 360,807 ETH worth $1.33B, in its holdings with 95% of it staked or deployed via liquid staking.

BitMine Immersion recently announced a massive Ethereum purchase, 566,776 ETH worth over $2 billion. It has now overtaken SharpLink’s ETH stash, claiming the top spot among corporate ETH holders.

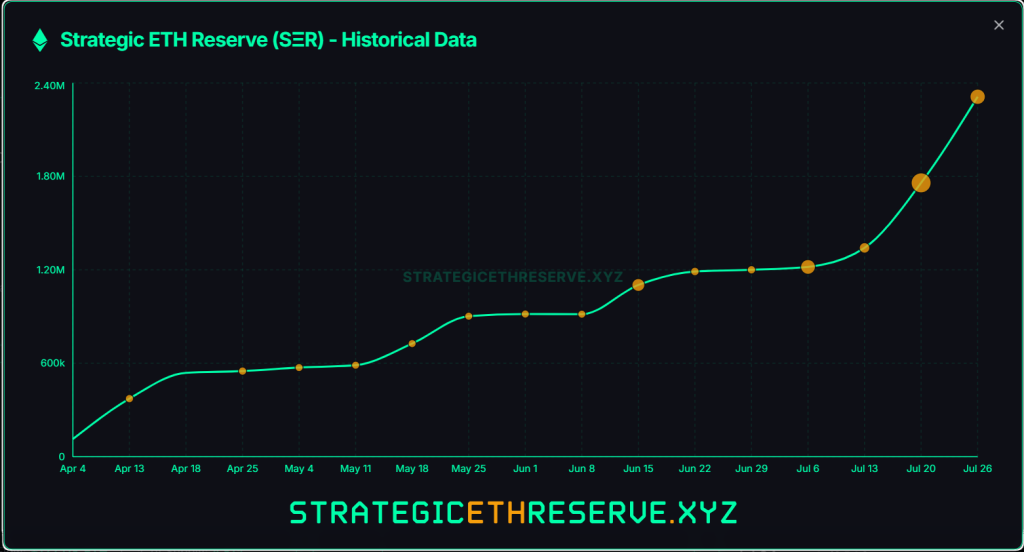

A total of 2.31 million ETH, worth $8.65 billion, is now held in strategic reserves by 63 participants, accounting for 1.92% of Ethereum’s total supply. Ethereum treasuries have skyrocketed from $23 million to $8.6 billion in just a few months months. BitMine and SharpLink are leading the charge, backed by crypto heavyweights Tom Lee and Joseph Lubin. The ETH treasury race is real and it’s accelerating fast.

Ethereum ETF inflows have also been doing great lately. BlackRock’s Ethereum ETF (ETHA) is on a tear, adding 120K ETH worth $430M on Friday alone, pushing total holdings to nearly 3 million ETH. Spot ETH ETFs have posted 16 straight days of inflows and outperforming Bitcoin ETFs by a huge margin.

Whales and Fresh Wallets Drive ETH Surge

Fresh wallets are on a buying spree as 42,788 ETH worth $159 million were added today alone. Since July 9, eight new wallets have scooped up a massive 583,248 ETH worth $2.17 billion. Analyst Ali Martinez also notes that whales have been loading up over the past two weeks as they have snapped up 1.13 million ETH worth a staggering $4.18 billion.

He also shared that 170 new whales holding over 10,000 Ethereum have joined the network in the past month. This is a strong sign of growing institutional interest.

170 new whales holding over 10,000 Ethereum $ETH have joined the network in the past month. This is a strong sign of growing institutional interest! pic.twitter.com/q06HrHx9iE

— Ali (@ali_charts) July 26, 2025Is $5,000 Next?

Ethereum whale-held supply is dipping, but prices keep climbing. This is a key shift since June 2025. Unlike February’s pump, this trend points to healthier, sustainable growth, and not a pump by few big-players.

Ethereum is up 24% this week and 56% this month. With strong institutional inflows, major treasury buys and record ETF demand, analysts note that if TH flips the $3,800–$4,000 zone into support, $5,000 is not far.