🚀 21Shares Spot ONDO ETF Filing Sparks 30% Price Surge Speculation

Wall Street's crypto craving just got a fresh fix—21Shares just dropped a spot ONDO ETF filing, and traders are already pricing in a 30% moonshot.

### The ETF Effect: Crypto's Pavlovian Response

Another day, another ETF hype cycle. Remember when Bitcoin ETFs were the shiny new toy? Now it's ONDO's turn under the institutional spotlight. The market's reaction? A collective 'buy first, ask questions later'—classic crypto.

### Why This One's Different (Or Is It?)

Unlike the parade of meme coin ETFs clogging the pipeline, ONDO's got actual DeFi infrastructure behind it. But let's be real—since when has fundamentals stopped a good old-fashioned FOMO rally?

### The Cynic's Corner

Just what we needed—another financial product for hedge funds to overlever into before dumping on retail. At least the volatility will be entertaining.

Buckle up. The SEC's approval stamp could send ONDO into orbit—or leave bagholders staring at charts like bereaved widows. Either way, grab popcorn.

As crypto legislation gains momentum, investor focus is shifting from meme coins to tokenized real-world assets (RWAs). Seizing the moment, 21Shares has filed a preliminary application with the U.S. SEC for a spot ONDO ETF, signaling a major step in bridging DeFi with traditional finance.

21Shares Files for Spot ONDO ETF: Here’s What It Means

On Tuesday, 21Shares submitted its proposal for the “21Shares ONDO Trust”, a spot ETF designed to track the real-time price of ONDO, the native token of Ondo Finance. The fund will hold ONDO tokens directly and follow the CME CF Ondo Finance-Dollar Reference Rate for pricing.

- Custodian: Coinbase

- Structure: Passive investment (no leverage)

- Creation/Redemption: Cash or in-kind basis

The trust is engineered to offer institutional-grade exposure to a DeFi token without speculative risk, potentially attracting TradFi investors into the growing RWA sector.

Trump-Linked Platform Is Betting on ONDO

World Liberty Financial a DeFi platform reportedly connected to the TRUMP family, has taken a position in ONDO. As per Nansen data, it acquired $250,000 worth of ONDO tokens in December, currently holding 342,000 ONDO valued at about $383,000.

Yet, this investment remains a small portion (0.2%) of their $208 million portfolio, which is heavily concentrated in stablecoins, Wrapped ETH, and Bitcoin.

Ondo Finance Acquires SEC-Registered Broker to Power RWA Push

Earlier this month, Ondo Finance acquired Oasis Pro, an SEC-registered broker-dealer, FINRA member, and Alternative Trading System (ATS). The move enhances Ondo’s ability to issue and manage tokenized securities, a key pillar in its RWA strategy.

Through Ondo Chain, the project envisions becoming the blockchain backbone for Wall Street, integrating real-world assets into decentralized finance ecosystems.

RWA Market Outlook: Institutions Are Taking Notice

According to RWA.xyz, the value of tokenized real-world assets on-chain has surged 58% in 2025, reaching nearly $25 billion. ethereum dominates with a 55% market share, mainly through tokenized private credit and U.S. Treasury assets.

As more ETF issuers explore RWA-based products, ONDO’s ETF filing could ride the wave of institutional demand.

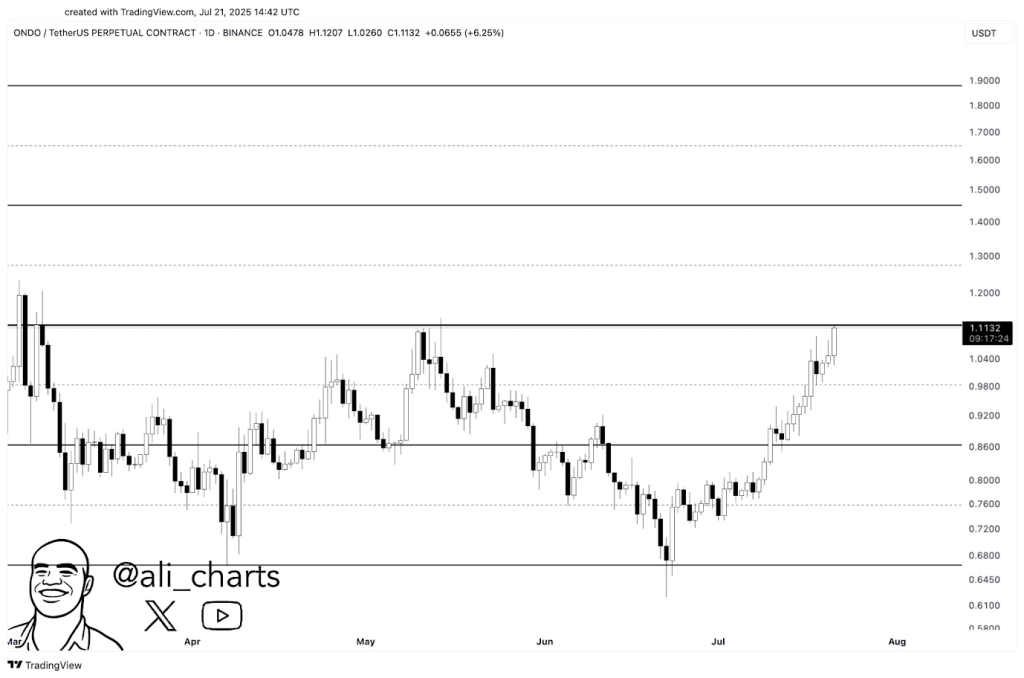

ONDO Price Today and Market Sentiment

Following the ETF news, Ondo Price rose 2.3% to $1.12, with a market cap of $3.5 billion and 3.1 billion tokens in circulation. Still, ONDO remains down 48% from its all-time high of $2.14 in December.

Key Technical Levels (Ali Martinez, via X):

- Resistance: $1.15 (previous rejections in March and April)

- Breakout Level: $1.26

- Upside Target: $1.50

- Downside Risk: $0.98–$0.80 zone if momentum weakens

It’s a proposed spot ETF that will track the price of ONDO tokens via a passive investment trust held by 21Shares.

Analysts see strong resistance at $1.15. A breakout above $1.26 could lead to $1.50, while failure could pull price back to $0.98–$0.80.