CRV Explodes 79% in 7 Days—Can Curve DAO Shatter Its 7-Month Peak?

DeFi's sleeping giant just woke up swinging. Curve DAO's native token CRV isn't just climbing—it's mooning with a 79% weekly pump that's got degens double-checking their charts.

The comeback kid?

After months of sideways action, CRV's vertical rally smells like a classic 'buy the rumor' play—though whether traders are betting on protocol upgrades or just chasing momentum depends on who you ask (and how much hopium they're huffing).

Breaking through resistance

Key technical levels are crumbling faster than a shitcoin's whitepaper. If this keeps up, we could see CRV retest heights not touched since crypto winter—back when 'FDV' was still a dirty word and VCs pretended to care about tokenomics.

The bottom line?

Whether this is sustainable growth or another case of 'number go up' theater, one thing's certain: in crypto, even zombie projects get their day in the sun—usually right before the next leverage flush.

Curve DAO has stunned the crypto market with a meteoric 79.32% price rally, over the past week and climbing 28.39% in the last 24 hours alone. With trading volume soaring by 72.78% to $727.58 million and the price reaching an intraday high of $0.993, CRV has officially broken free from months of consolidation.

That being said, technical and on-chain signals now suggest that CRV’s parabolic breakout is more than just a speculative spike. As it’s a move driven by real scarcity and structural shifts. Intrigued by the numbers and metrics? Read this crv price prediction for the short term.

Scarcity Drives the Price Surge?

One of the strongest reasons behind CRV’s rally is its growing scarcity across exchange platforms. Exchange netflows for CRV were at -2.67 million on July 16. This is a clear indication that more tokens are being withdrawn from trading platforms than deposited.

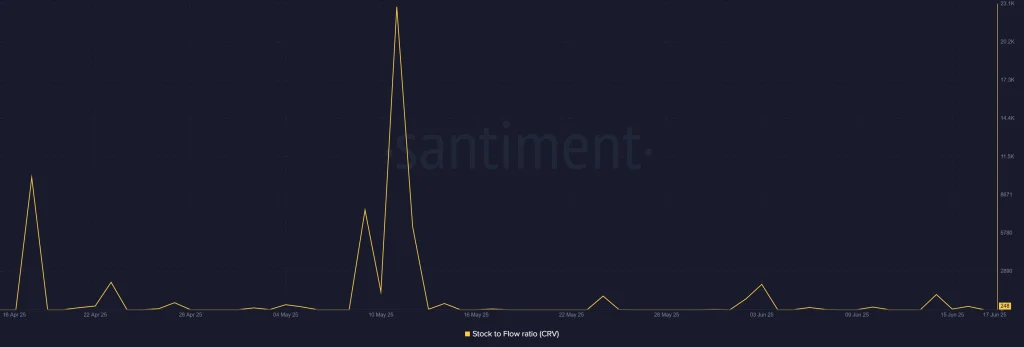

Complementing this is CRV’s Stock-to-Flow (S2F) ratio, which just spiked to its highest-ever level. A high S2F ratio means limited new issuance and high scarcity. This makes ideal conditions for price appreciation, which is evident in the case of CRV.

CRV Price Analysis:

On the daily chart, the CRV token has broken out of a descending triangle pattern. The breakout has occurred with strong momentum, as shown by the price leaping from $0.773 to a recent high of $0.9872.

Successively, Bollinger Bands show a strong expansion, confirming increased volatility and directional strength. That being said, RSI stands at an overbought zone of 84.99. Moving forward, the next resistance levels lie at $1.10 and $1.30, which align with historical supply zones. Meanwhile, a stop-loss at $0.89 can help manage risk in case of a freefall.

FAQs

Why is CRV price rising so fast?CRV is rising due to a technical breakout and on-chain signals showing reduced token availability on exchanges and heightened scarcity.

Is now a good time to buy CRV?Momentum is strong, but RSI suggests short-term overbought conditions. Entry should be taken with caution and a stop-loss.

What are the next price targets for CRV?Immediate resistance lies at $1.10, with a potential extension toward $1.30 if the bullish momentum continues.