🚀 Ethereum Rockets 40% in July as ETF Mania Pumps $726M Into Crypto

Wall Street's latest gold rush sends ETH into the stratosphere—just don't ask about the landing.

ETF Cash Firehose Hits Crypto

Institutional money flooded Ethereum at a record pace last month, with ETF inflows hitting $726 million as traders chased the 40% price surge. The smart contract platform turned into a speculative rocket ship—fueled by the same financial players who called it a 'scam' three years ago.

Gas Fees Meet Wall Street Fees

Traditional finance's embrace comes with irony: the 'decentralized' asset now dances to the tune of SEC-approved products. Meanwhile, blockchain purists grumble about centralization while cashing out profits.

This isn't adoption—it's financialization. And like all good bubbles, everyone's invited until the music stops.

The crypto market today is showing strong bullish momentum, with the ethereum price emerging as the clear leader. On July 14, Bitcoin price briefly touched $123,000 before cooling off.

While BTC posted a modest 0.7% gain in the past 24 hours, ethereum surged by 7.3%, XRP by 7.7%, BNB by 3.4%, Solana by 5.2%, Dogecoin by 7%, and Cardano by 3.7%, signaling a potential altcoin season.

Why Ethereum Is Soaring: Spot ETFs See Historic Inflows

Ethereum’s price explosion is largely driven by unprecedented inflows into U.S. spot Ether ETFs. According to data from Coinglass, July 14 saw a record-breaking $726.6 million net inflow into ETH ETFs—the largest daily intake since launch.

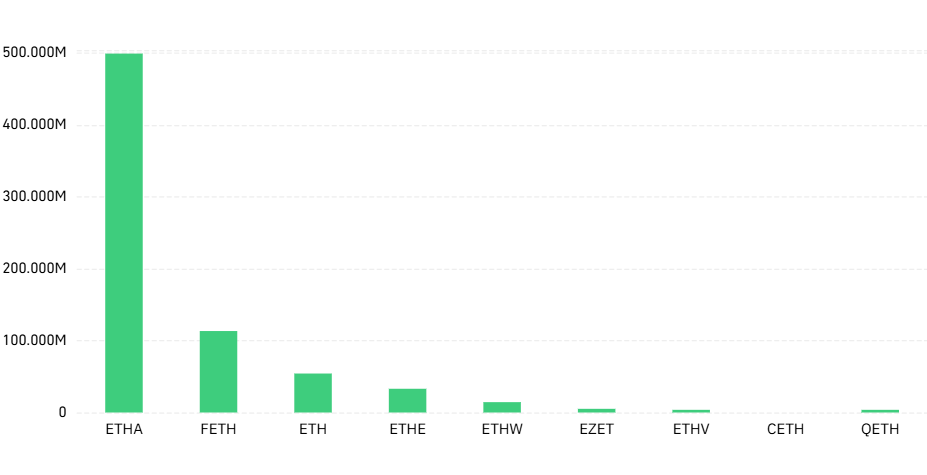

Here’s a breakdown of the top ETF inflows:

- BlackRock’s ETHA: $499.2 million

- Fidelity’s FETH: $113.3 million

- Grayscale ETHE: $33 million

- Grayscale ETH: $54.2 million

- Bitwise ETHW: $14.4 million

- Franklin’s EZET: $5.1 million

- VanEck’s ETHV: $3.7 million

- Invesco’s QETH: $3.7 million

Combined, these ETFs now hold over 5 million ETH, nearly 4% of Ethereum’s total circulating supply (120.7M ETH).

- Also Read :

- Top Altcoins to URGENTLY Accumulate on the Dip

- ,

Ethereum Supply Crisis? ETF Demand vs. ETH Issuance

Ethereum’s net issuance is unable to keep up with institutional demand. Over the past 24 hours:

- ETH issued by the network: ~$6.74 million worth

- ETH purchased by ETFs: Over 107x that amount

This massive imbalance between issuance and ETF buying could lead to supply-side pressure, potentially driving ETH prices even higher in the short term.

ETH Price Performance: A 40% Monthly Rally

As of writing, Ethereum is trading at $3,378.77, marking a 40.4% increase since July 1, when it stood at just $2,403.27. The 14-day price gain stands at 30.5%, highlighting growing institutional interest and strong investor sentiment.

Is Altcoin Season Here?The latest price action suggests a full-blown altcoin rotation is underway. As Bitcoin dominance shows signs of retreat, capital appears to be flowing into Ethereum and other major altcoins, which are now posting larger gains than BTC.

Never Miss a Beat in the crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Why is Ethereum price going up today?Ethereum’s price is rising due to record inflows into U.S. spot Ether ETFs. On July 14, over $726 million flowed into ETH ETFs, led by BlackRock and Fidelity. This surge in institutional demand is driving Ethereum’s bullish momentum.

What caused Ethereum to cross $3,300?The price breakout above $3,300 was fueled by massive spot ETF purchases, far outpacing new ETH issuance. ETFs bought over 107 times more ETH than was created by the network in the last 24 hours.

How much ETH do spot ETFs hold now?As of today, spot Ethereum ETFs hold over 5 million ETH, which accounts for approximately 4% of Ethereum’s circulating supply.

Is this the beginning of altcoin season?Yes, Ethereum’s outperformance and the rotation of capital into XRP, Solana, Dogecoin, and others suggest that altcoin season may be starting.