Vanguard’s $10T Bitcoin Bet: Is This the Rocket Fuel for BTC’s Next Price Surge?

Wall Street's sleeping giant just woke up—and it's hungry for Bitcoin. Vanguard, the $10 trillion asset manager long dismissed as 'your grandpa's index fund,' just dropped a nuclear bid on crypto's flagship asset. What happens when passive investing's Death Star turns its lasers on BTC?

### The Institutional Floodgates Are Officially Off

This isn't another hedge fund dipping toes in—it's the entire pension-industrial complex doing a cannonball into the deep end. Vanguard's move shreds the last remnants of 'Bitcoin is too risky' FUD. The real question? Which $10T manager blinks next.

### Price Targets? Try Price Tsunamis

Forget 'when moon'—we're talking 'which galaxy.' Last institutional wave took BTC from $20K to $69K. This time? The math gets terrifying (or thrilling, depending on your leverage). Only catch? Wall Street's about to 'help' us decentralize—with 37 layers of custodial wrappers and a 2% management fee.

### The Cynic's Corner

Nothing makes trad-fi embrace disruption like seeing 8-figure revenue streams evaporate. Welcome to the 'if you can't beat 'em, ETF 'em' phase of crypto adoption.

Bitcoin (BTC) price closed the second week of July in a bullish Morubozu candlestick after consistently rallying above the prior resistance range between $109k and $111,872. The flagship coin has since opened the third week of July in a robust bullish momentum, especially after hitting its all-time high (ATH) of about $122,838 on Monday, during the early European trading session.

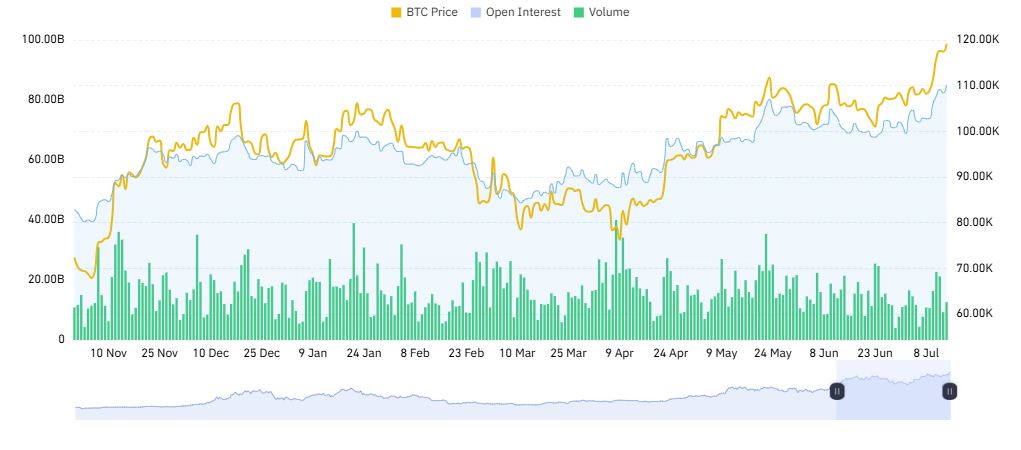

The Bitcoin pump into the price discovery phase is heavily bolstered by the high demand in the spot market amid record peaks in futures and derivatives trading. According to market data from Coinglass, Bitcoin’s Open Interest (OI) surged to a new ATH of $85 billion amid heavy liquidation of short traders.

Vanguard Joins the Bitcoin Wagon

For the past years, Vanguard Group Inc., has given pessimistic views on bitcoin and the wider crypto market. The Pennsylvania-based asset manager, with around $10 trillion in assets under management, referred to Bitcoin as inappropriate for long-term investors.

However, recent U.S. SEC filings show a different picture. The Vanguard Group owns more than 20 million shares, nearly 8 percent of Strategy Inc., a top-holder of Bitcoin with 601,550 coins at the time of this writing.

Remarkably, Vanguard has possibly surpassed Capital Group as the top investor of Strategy.

What’s Next for BTC Price?

As Coinpedia has pointed out, BTC price is now in the euphoric phase of the 2024/2025 crypto bull market catalyzed by the rising demand from institutional investors and clear regulatory frameworks. From a technical analysis standpoint, BTC’s bullish sentiment is bolstered by the weekly Relative Strength Index (RSI) that recently surged above the 70 level for the first time year to date.

Additionally, the weekly MACD indicator shows an increasing bullish histogram with the MACD line above the zero line.

In the 2-hour timeframe, the bullish sentiment is visible through higher highs and higher lows, an established characteristic of a rising trend. As a result, it is safe to say that a rally towards $150k is much more likely to happen than a drop below $100k in the NEAR term.