🚀 Bitcoin to $250K? Top Analyst Ignites Market Frenzy as Bull Run Accelerates

Bitcoin’s price surge has analysts dusting off their moon math—and skeptics rolling their eyes. Here’s why this rally feels different.

The $250K Gambit: Greed or Genius?

One chart-flipping analyst just slapped a quarter-million-dollar target on BTC, citing "institutional FOMO" and a supply crunch. Traders are either loading up or laughing all the way to their less-volatile bond funds.

Liquidity Tsunami Ahead

With spot ETFs now hoarding coins like digital Scrooge McDucks and miners hodling tighter than a bank during a bailout, the squeeze could get ridiculous. Cue the usual suspects: "This time it’s different!" (Spoiler: Wall Street still can’t price crypto without a dartboard.)

The Punchline?

Whether Bitcoin hits $250K or crashes back to reality, one thing’s certain: the financial circus just got a new trapeze act. Buckle up.

The US spot Bitcoin ETFs purchased 24,108 BTC in the past week and outpaced the 3,150 BTC mined on average. Besides, the BTC liquidation heatmap shows high-leverage zones as the 24-hour heatmap reveals stacked liquidity at major levels, hinting towards the big players setting traps. Therefore, great volatility is approaching with the markets primed and loaded, as the BTC’s next price action could be highly explosive.

The historical chart of Bitcoin price shows that the token attracted massive liquidity during the second half of 2022, when the price marked lows around $15,000. The volume increased to as high as $3 million, hinting towards huge participation of the traders. Since then, the volume has plunged heavily and has remained stuck below 500K. Now, when the BTC price is rising to new highs, the volume remains largely lower.

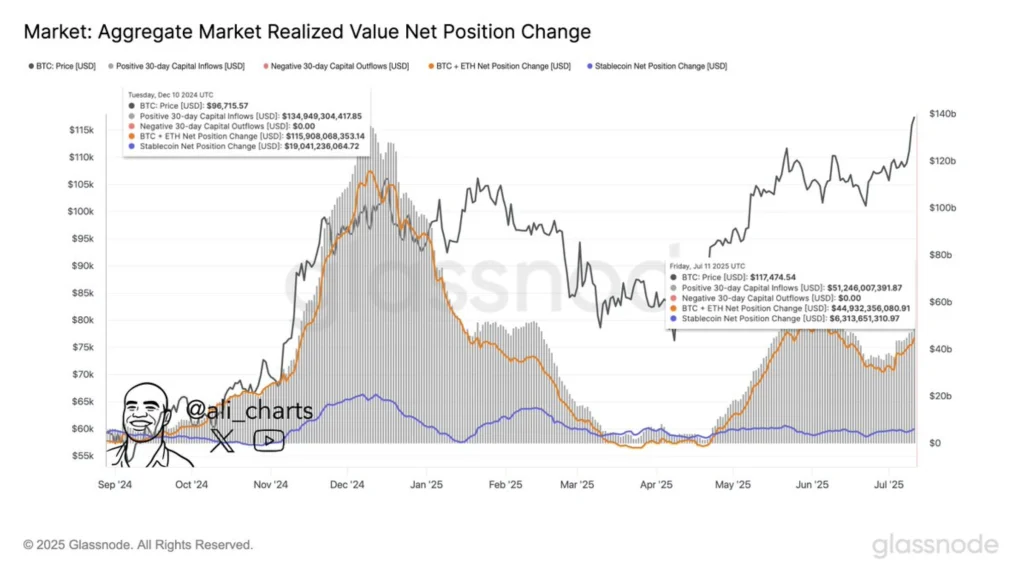

The data from glassnode shared by a popular analyst, ALI, highlights the drop in volume compared to that of the Q4 2024 breakout. Back in December 2024, when Bitcoin smashed the psychological barrier at $100,000, over $135 billion flowed into the crypto market. Meanwhile, with the BTC price trading above $122,000, the inflows are restricted to around $50 billion. This suggests a massive difference in capital participation.

The difference in the capital participation could be mainly due to excessive involvement of institutions like hedge funds, ETFs or asset managers. This indicates the markets are maturing and becoming more stable, unlike the previous rallies where the retailers had held a huge dominance. This further indicates the token has more potential to go long and may even reach $150K in Q3, 2025, as predicted by a popular analyst, Michael van de Poppe, who claims the bitcoin (BTC) price may find its peak around $250K.