Ethereum Explosion Imminent: 4 Bullish Signals Point to ETH Price Surge in July 2025

Ethereum's gearing up for a breakout—and the charts are screaming buy.

Whale Accumulation Spikes

Big money's quietly loading ETH bags while retail sleeps on Bitcoin ETFs. Classic.

Defi TVL Nears Record Highs

Billions pouring back into protocols as gas fees stabilize. Yield farmers are awake.

Staking Exodus Reverses

Post-Shanghai withdrawals plateau—validators digging in for the long haul.

Options Market Flips Bullish

Call volume dominates as traders bet against Wall Street's 'crypto winter' narrative.

Will ETH 2.0 finally decouple from BTC's leash? The smart money's voting yes—while traditional finance still can't tell a wallet from a Venmo account.

Ethereum (ETH) is showing signs of a potential breakout after a volatile performance over the past year. After plunging 22.7% year-over-year and a steep 45.3% in Q1 2025, ethereum bounced back with a 36.5% surge in Q2, driven mainly by a strong May return of 41.1%.

Now, as Q3 kicks off, ETH is gaining momentum again. Starting July at $2,403.98, Ethereum has already climbed over 6% to reach $2,593.60. In the past week, it has added 5%, hinting at renewed bullish energy.

“Ethereum Is a Powder Keg,” Says Analyst

Crypto analyst Eric Conner took to X to call Ethereum a “powder keg,” suggesting that multiple bullish signals are aligning for a potential explosive MOVE upward.

Here are the key drivers behind his thesis:

1. Stablecoin Growth Shows Strength

Ethereum’s role as the backbone of the stablecoin ecosystem continues to shine. At its recent peak, stablecoins on Ethereum reached a $251B market cap. Currently, they hold $126.31B, with a $888.92M increase in just seven days. Tether leads with $64.12B, followed by USDC at $38.10B and Ethena’s USDe at $5.09B.

This consistent demand signals strong on-chain activity and confidence in Ethereum’s infrastructure.

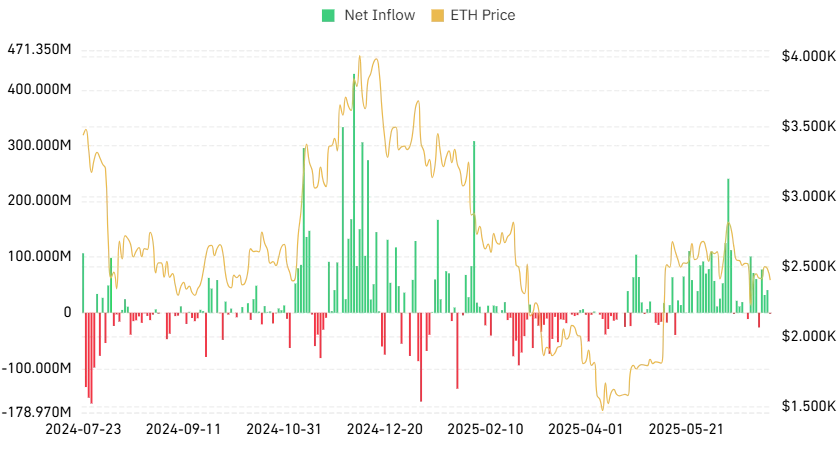

2. ETH ETFs Attract Institutional Money

Spot Ethereum ETFs are gaining traction fast. In June alone, they recorded over $1.17B in net inflows. Even in July, inflows remain positive despite daily fluctuations—BlackRock’s ETHA and Grayscale’s ETHE pulled in $54.8M and $10M, respectively, on July 1.

The trend highlights growing interest from traditional finance, a bullish sign for ETH’s long-term prospects.

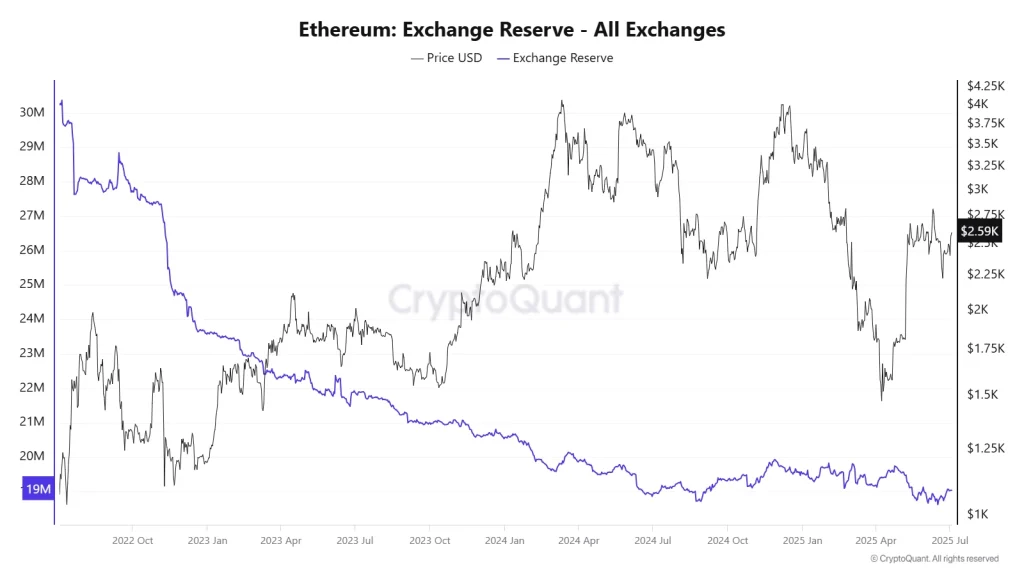

3. Exchange Supply is Shrinking

According to CryptoQuant, the ETH supply on centralized exchanges has steadily declined from 19.51M at the start of 2025 to 19.03M now. Less supply on exchanges means buying pressure can trigger quicker price moves, a crucial setup for a potential breakout.

4. Whales Are Loading Up

Wallets holding 1,000 to 10,000 ETH accumulated over 800,000 ETH per day during a week in June—the most aggressive buying since 2017. This strong accumulation happened even as ETH slipped 1.62% in June, showing that large players are betting big on a bullish turnaround.

Final Thoughts

With surging ETF inflows, growing stablecoin activity, shrinking exchange reserves, and whale accumulation, Ethereum could be on the verge of a major breakout. If ETH can flip the $2,600 resistance, a rapid price rally may follow.