Bitcoin Price: Will It Shatter All-Time Highs This Week?

Bitcoin teeters on the edge of history—again. As bulls and bears clash, the crypto kingpin flirts with its ATH threshold. Here’s why this week could spark fireworks—or a faceplant.

The Setup: Liquidity vs. Leverage

Whales are circling while retail traders pile into leveraged positions. Derivatives markets scream 'overheated,' but spot demand hasn’t blinked. Classic crypto.

The Catalyst: Macro Meets Meme

Fed whispers and ETF flows are doing the tango with degenerate gamblers—sorry, 'visionary investors'—pumping shitcoins. A perfect storm for volatility.

The Bottom Line

Whether Bitcoin moons or craters, Wall Street will still charge 2% fees to lose your money slower than a DeFi rug pull. Place your bets.

Bitcoin could once again knock on the door of its previous ATH of $111,970, as it is now trading at $107,666. With a 5.71% gain over the past 7 days and a 32% spike in 24-hour trading volume, bullish momentum is clearly in the works. So coming to the big question now, “Join me, as I explore what on-chain and price action data are signaling.

On-Chain Metrics Hint at a Healthy Rally?

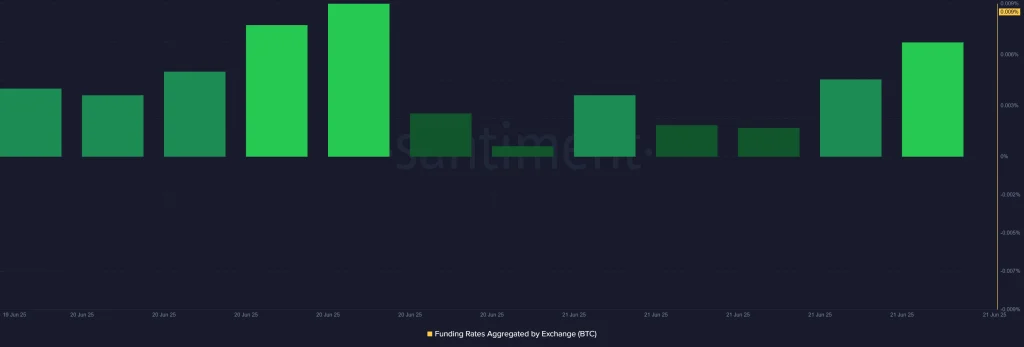

Funding Rates Stay Balanced

Funding rates across major exchanges remain slightly positive, maxing out around 0.009%, indicating that while traders are optimistic, excessive leverage hasn’t yet entered the market. The dip in funding on June 21, followed by a steady rebound, suggests a healthy cooldown and a reduction in overheated long positions, which is an ideal condition for a sustainable push higher.

Exchange Netflows Turn Negative

BTC exchange outflows have overtaken inflows after peaking on June 20. Outflows mean that traders are moving their coins off exchanges, likely into cold storage, which is often interpreted as a sign of long-term confidence. The drop in exchange inflows also suggests there’s less selling pressure in the short term, increasing the probability of an upward continuation.

Bitcoin Price Analysis

Bitcoin’s price is currently up 0.29% on the day and 5.71% over the past week, with a daily high of $108,798. The 32% surge in 24-hour volume supports the breakout move and hints at renewed market participation. The narrow gap of just ~3.8% from the ATH places Bitcoin within striking distance. And if current momentum holds, a test of the $112k level seems increasingly possible.

It is worth noting that a move above $108.8k, the recent high, WOULD likely trigger breakout trades and short squeezes. However, bulls must stay cautious of potential resistance around $110k, a psychological barrier before the ATH retest.

Curious about BTC’s long term target? Read our bitcoin (BTC) Price Prediction 2025, 2026-2030!

FAQs

How close is Bitcoin to its all-time high?Bitcoin is less than 4% away from its ATH of $111,970.

Can Bitcoin hit a new ATH this week?Yes, strong volume, neutral funding, and outflows suggest BTC could break ATH this week.

What could trigger a breakout above ATH?Sustained volume, continued exchange outflows, and a clean break above $108.8K may trigger an ATH push.