BCH Rockets Past $500—Next Stop $525 as Bulls Take Control

Bitcoin Cash isn't asking for permission—it's taking prices higher with a vengeance. The $500 breakout just got steamrolled, and now traders are eyeing that $525 like a Wall Street banker eyes a taxpayer bailout.

Momentum builds as BCH defies gravity

The charts don't lie: this isn't some timid grind upwards. We're seeing proper FOMO now—the kind that makes crypto skeptics quietly check their old wallets. Liquidity's getting eaten up faster than a hedge fund's management fees.

What's fueling the surge?

Could be the Bitcoin ETF spillover effect. Could be shorts getting squeezed into oblivion. Or maybe—just maybe—the market finally remembers what happens when a major crypto asset gets criminally undervalued while VCs dump their 30th shitcoin of the month.

One thing's certain: when BCH gets moving like this, it doesn't stop at round numbers. That $525 level isn't just psychological resistance—it's the next domino waiting to fall.

Bitcoin Cash has emerged as one of the top-performing cryptos today, rallying over 4.38% to $500.36. This price surge comes amid a strong bullish wave, which has pushed BCH’s market cap to $9.93 billion and daily trading volume up by 22.01% to $635.68 million. With technical indicators aligning and on-chain activity shifting, the trend appears to be favoring buyers in the short term. Curious enough? Join me, as I decode the possible short term Bitcoin Cash price targets in this analysis.

On-Chain Data Gives Mixed Signals?

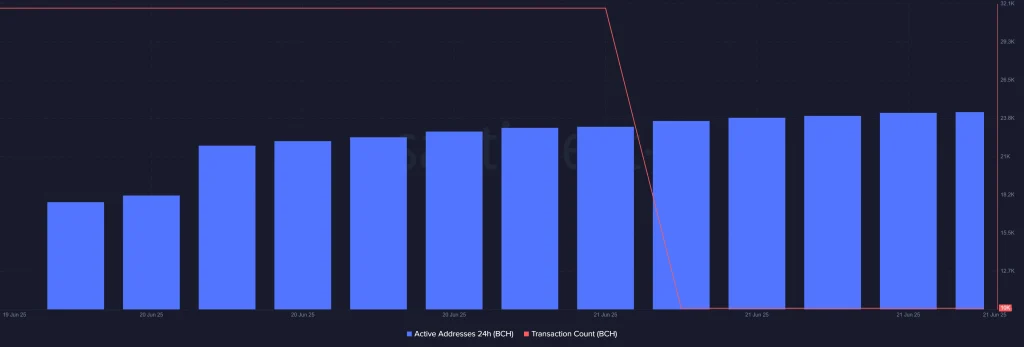

The on-chain metrics present a mixed but an intriguing picture. According to Santiment data, the number of active addresses in the past 24 hours has seen a consistent uptick from June 19 to June 21. This signals increasing user participation and growing interest in the BCH network. However, this positive development is contrasted by a steep drop in transaction count, which plummeted dramatically on June 21.

This divergence may suggest that although more unique users are interacting with the network, the number of actual transactions per address has decreased. Which I believe could be possibly due to fewer transfers per wallet or larger-value transactions being consolidated. Such behavior can occur during accumulation phases, where users prepare for a MOVE rather than engaging in frequent trades.

Bitcoin Cash (BCH) Price Analysis:

Bitcoin Cash has broken out toward the upper band of an ascending channel, closing at $504.8 with a daily gain of 4.56%. The candlestick shows a strong buying wick from the $481.5 low, suggesting bulls are defending lower levels aggressively. Currently, BCH is trading above both the middle and upper bands of the Bollinger Bands, which is a sign of continued bullish pressure.

The 20-day SMA sits at $453, which is well below the current price. If momentum continues, the next resistance lies at $525, the upper edge of the channel. On the downside, $478 acts as a crucial support, aligned with the previous consolidation zone and lower channel boundary.

Keen on stacking some BCH? Read our Bitcoin Cash (BCH) Price Prediction 2025, 2026-2030!

FAQs

Why is Bitcoin Cash surging today?Bitcoin Cash is rallying due to increased market interest, higher volume, and bullish technical patterns.

Is it a good time to buy BCH?With BCH trading NEAR $504 and RSI nearing overbought, a breakout above $525 could confirm continuation. However, a drop to $478 could be on the cards.

What is the price of Bitcoin Cash today?The price of 1 BCH token at the time of publication is $500.36, with an intraday gain of 4.38%.