Bitcoin Smashes 2nd Straight Week of Bullish Inflows – Is the Mega Rally Finally Here?

Wall Street's money faucet is dripping straight into crypto again. For the second consecutive week, Bitcoin investment products are seeing fresh capital inflows—and the charts are starting to whisper about a potential explosion.

The Institutional Greenlight

When the suits start stacking sats, retail pays attention. These inflows suggest big players are positioning for what comes next—whether that's ETF approvals, halving momentum, or just good old-fashioned FOMO.

Technical Tinderbox

BTC's price action has been coiled tighter than a Wall Street banker's bonus structure. Two weeks of sustained buying pressure could be the spark that lights the fuse.

Just remember: in crypto, 'inevitable breakout' sometimes means 'brutal fakeout.' But with traditional finance finally playing nice with digital gold? This time might—might—be different. (Then again, Goldman Sachs will probably find a way to sell volatility as a 'structured product' by Q3.)

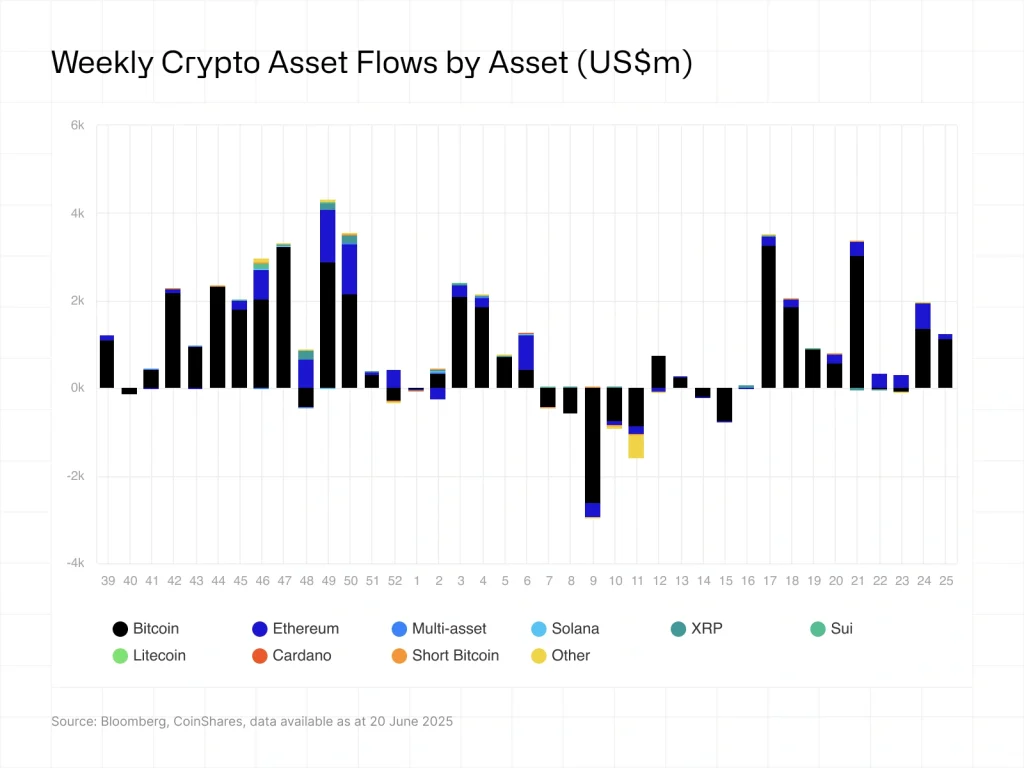

Bitcoin (BTC) demand by institutional investors has remained high amid rising fears of short-term crypto market capitulation. According to market data from CoinShares, Bitcoin’s investment product recorded the second consecutive week of cash inflow last week of about $1.1B.

As a result, the BTC’s investment products have posted a net monthly FLOW of about $2.38 billion and a year-to-date cash inflow of around $12.7 billion. The United States led in net cash inflows of about $1.25 billion, while Hong Kong and Switzerland posted a net cash outflow of about $32.6M and $7.7M respectively.

Is Bitcoin Price Ready for a Bullish Breakout?

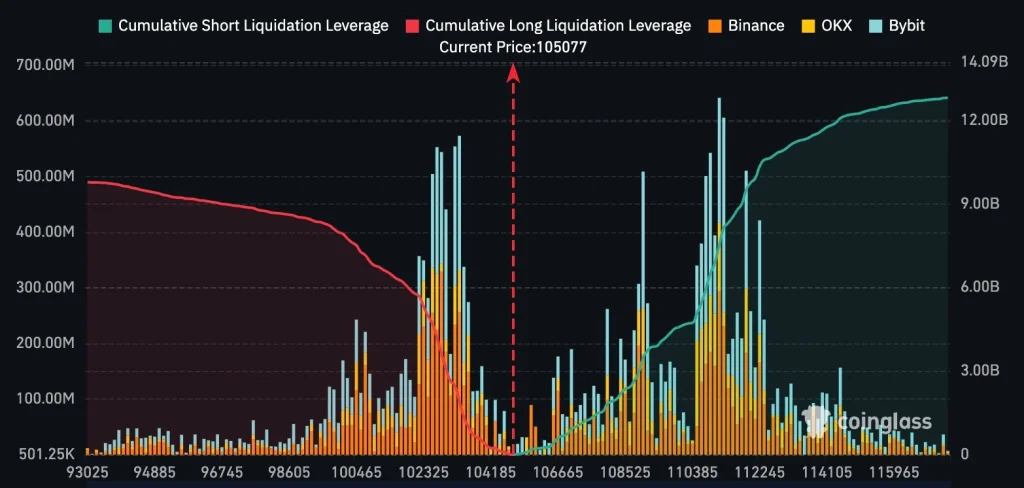

Bitcoin price has rebounded over 3 percent to trade about $104,100 on Monday, June 24, during the mid-North American trading session. The flagship coin, however, faces a significant resistance range between $110k and $112k.

In the weekly timeframe, BTC price has been forming a potential macro double top coupled with a bearish divergence of the Relative Strength Index (RSI).

With the market data from Coinglass showing more than $12 billion in cumulative short liquidation leverage, BTC price faces further bearish sentiment in the coming weeks.

As Coinpedia reported, crypto analyst Benjamin Cowen thinks that the wider crypto market, led by BTC, will record lower lows in the coming months and potentially establish a local low in August or in September, 2025.

From a technical analysis standpoint, if BTC price consistently closes below $100k in the coming week, a selloff towards the support level around $96k will be inevitable.