Bitcoin Soars Past $108k as Institutional FOMO Ignites Rally—Dead Cat or New Bull?

Institutional money floods back into Bitcoin, catapulting prices above $108k—but skeptics whisper ''dead-cat bounce.''

Wall Street''s latest crypto crush sends BTC soaring—just in time for another round of ''this time it''s different'' euphoria.

The real question: Are whales accumulating or just painting the tape before dumping on retail (again)?

One thing''s certain: Traders are sweating bullets as volatility returns with a vengeance. Buckle up.

Bitcoin (BTC) price rallied over 3 percent, on Monday, June 16, to trade about $108,551 during the mid-North American session. The flagship coin broke out of a consolidation formed during the weekend after teasing potential capitulation following the Middle East tension.

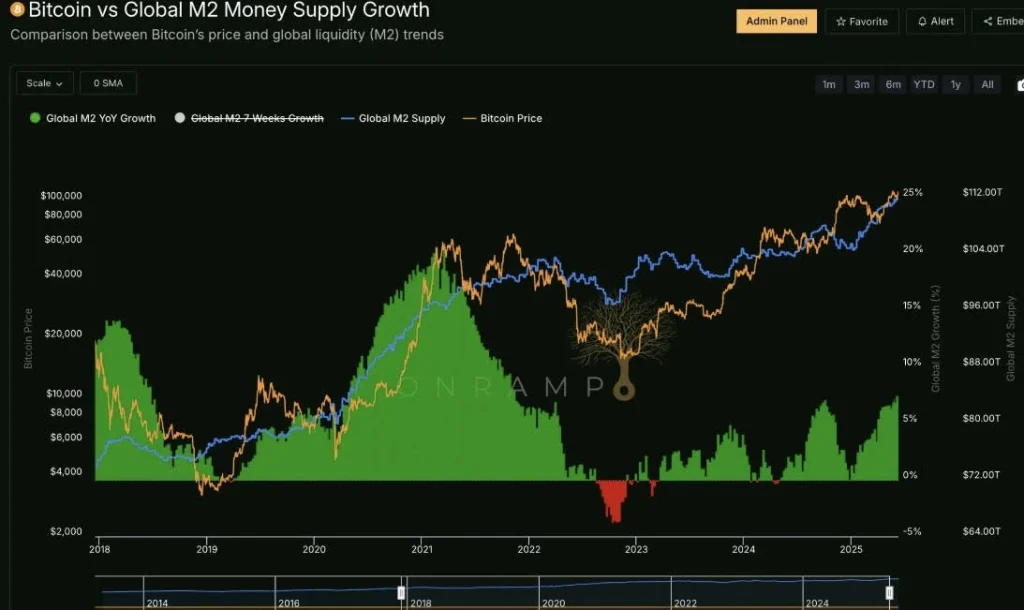

As a result of today’s rebound, optimism of further market rally increased traders’ greed. Moreover, Bitcoin and the wider cryptocurrency market are well-positioned to benefit from the rising global money supply amid anticipated Quantitative Easing (QE) in the United States.

Major Forces Behind Bitcoin Rebound

Bitcoin price recorded bullish sentiment on Monday after Gold price posted its highest daily close on Sunday. The flagship coin has continued to benefit from macroeconomic tailwinds amid the ongoing geopolitical tensions in the Middle East and between Russia and Ukraine.

The demand for Bitcoin by institutional investors remains elevated as shown by its gradual decline of the overall supply on cryptocurrency exchanges. As Coinpedia reported, Strategy and Metaplanet have continued to lead other companies to aggressively accumulate more BTCs for their respective treasuries.

According to market data analysis by CoinShares, Bitcoin led all the other digital asset investment products in net cash inflow last week with about $1.3 billion. Meanwhile, Bitcoin’s volatility will continue in the coming days as the Fed prepares to release the FOMC Statement and its benchmark interest rate.

BTC Price Analysis and Short-term Expectation

In the daily timeframe, BTC price has been consolidating in a symmetrical triangular pattern since hitting its all-time high of around $112k in mid-May. The short-term bullish expectations for Bitcoin remain palpable, especially after a consistent rebound above $107k in the past 24 hours.

The bullish sentiment is also bolstered by the 1-hour MACD line, which has already crossed above the zero line. Additionally, the 1-hour Relative Strength Index (RSI) has already rallied about the 70 percent level, which suggests the bulls are in control of the market.

However, if BTC price retraces and consistently closes below the support range between $101k and $104k, a rejuvenated bearish sentiment will be confirmed.