Ethereum Price Rally: 7 Bullish Signals Pointing to an Imminent Surge

The crypto market is buzzing as Ethereum shows classic signs of a breakout. Here''s why ETH could be gearing up for its next major rally.

1. Institutional Demand Spikes Grayscale''s Ethereum Trust premium flipped positive this week—a rare signal that big money is positioning for upside.

2. Gas Fees Crater to 6-Month Lows Network congestion has evaporated, dropping transaction costs to levels that historically precede retail FOMO cycles.

3. Staking Exodus Turns to Influx After Shanghai withdrawals, deposits are now outpacing exits as validators chase ETH''s 5.3% yield (triple Treasury notes).

4. DeFi TVL Breaks Resistance Total value locked just crossed $30B again—institutional DeFi adoption is quietly accelerating.

5. Futures Backwardation Ends The futures curve normalized this week, eliminating a key overhang from the derivatives market.

6. Stablecoin Supply Ratio Drops Traders are swapping stablecoins for ETH at rates last seen before the 2023 Q1 rally.

7. The ETF Speculation Cycle Begins BlackRock''s ETH futures filing dropped last Friday. Wall Street''s playing catch-up—as usual.

Of course, none of this matters if Bitcoin decides to crash. But for once, the smart money and the chain metrics agree: Ethereum''s engine is warming up. Just don''t tell the SEC.

Ethereum may be under pressure on the charts, but behind the scenes, bullish signals are rapidly stacking up. Despite a 1.82% drop today and a 26.75% decline over the past year, a prominent crypto analyst known as Unipcs—also referred to as “Bonk Guy”—has outlined several key factors that could spark a powerful ETH rally.

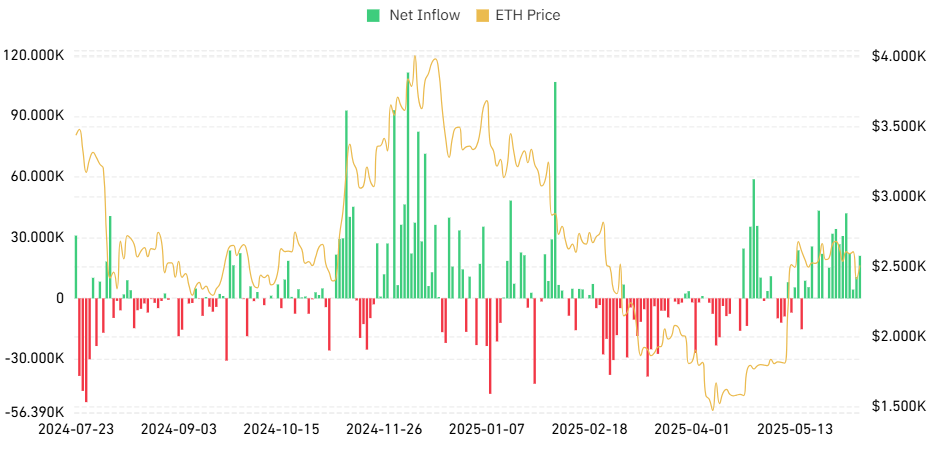

Ethereum ETFs See Massive Inflows

One of the most bullish trends cited by Bonk Guy is the consistent inflow into ethereum exchange-traded funds (ETFs).

According to Coinglass data, ETH ETFs have now posted 15 consecutive days of positive inflows.

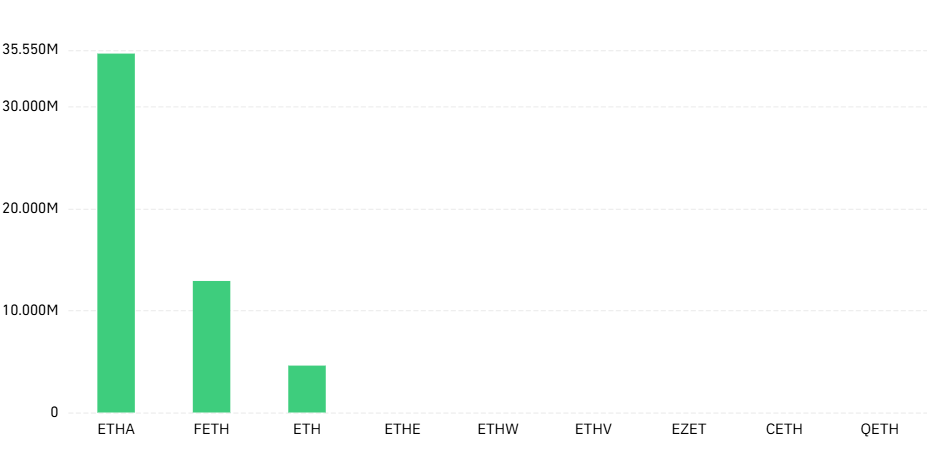

- BlackRock’s ETHA led with $35.2 million in a single day

- Fidelity’s FETH followed with $12.9 million

- Grayscale’s ETH added $4.6 million

On, ETH ETFs recorded a massivein inflows—marking the highest single-day inflow for Ethereum ETFs so far this month.

Corporates Are Holding Ethereum

Bonk Guy notes a shift among institutions adopting Ethereum as a treasury asset. In a headline-grabbing move,closed a, led by, to implement one of the largest Ethereum treasury strategies in public markets.

This signals growing corporate confidence in ETH, mirroring the Bitcoin-focused approach seen with MicroStrategy.

ETH Staking Approval in ETFs May Be Near

Regulatory signals suggest thatcould soon be allowed in ETF structures. If approved, it could unlock significant institutional inflows and act as afor Ethereum.

Short Squeeze Ahead?

The analyst also pointed out that many funds and traders are currently shorting ETH. Should the price reverse upward, it could, amplifying gains as traders rush to cover positions.

Meanwhile,have hit record highs, showing surging user engagement and strengthening the case for long-term growth.

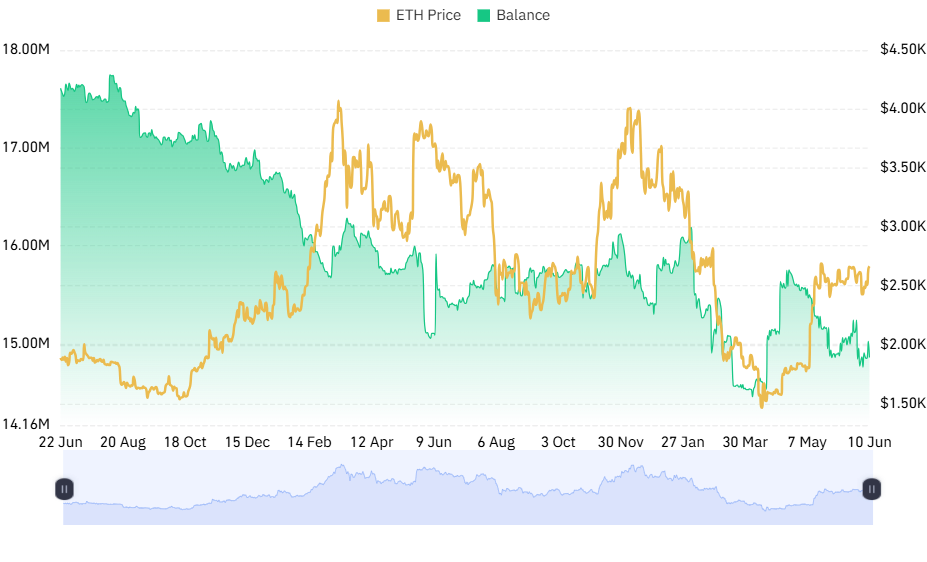

ETH Supply on Exchanges Is Shrinking

Ethereum supply on exchanges is dropping fast—a sign that traders are moving assets to cold storage or staking, reducing sell pressure.

Notable 30-day ETH outflows include:

- Bitfinex: -572,946 ETH

- Coinbase Pro: -2,149 ETH

- OKX: -13,627 ETH

- Kraken: -6,428 ETH

- Bithumb: -19,572 ETH

In total,including Binance and Coinbase saw a combined.

All-Time High Staking and Layer 2 Boom

The Ethereum ecosystem is also expanding, with, locking up a significant portion of supply.

Moreover,are showing explosive growth, pointing to increasing scalability and mainstream adoption.While Ethereum’s price performance may look disappointing in the short term, on-chain data, ETF inflows, treasury adoption, and growing network activity all hint at a potentialon the horizon.