Crypto Bloodbath: $1B+ Liquidations as Macro Winds Slam Digital Assets

Another day, another 'black swan' event—or so the suits would have you believe. Today's crypto rout saw over a billion dollars in positions vaporized as traditional market tremors sent shockwaves through digital assets.

No safe havens here. Bitcoin got sucker-punched, altcoins faceplanted, and even your grandma's 'safe' staking yields got compressed. The usual suspects—Fed jitters, Treasury yield acrobatics, and that one hedge fund manager's suspiciously timed tweet—all played their part.

Meanwhile, exchanges raked in liquidation fees while tweeting 'HODL' memes. How's that for financial infrastructure?

The crypto market has witnessed a significant downturn today, with the total market capitalization dropping by 2.93% to $3.21 trillion. In contrast, trading volumes have surged by 39.75%, reaching $144.4 billion, suggesting a wave of panic selling or forced exits. Amidst this volatility, crypto ETF outflows recorded a sizable $267.1 million withdrawal. Surprisingly, the Fear & Greed Index remains relatively stable at 46, indicating neutral sentiment despite sharp market reactions.

Why Did the Crypto Market Crash Today?

The following catalysts triggered a domino effect of selling across major tokens.

Crypto Liquidations Hit $1 Billion

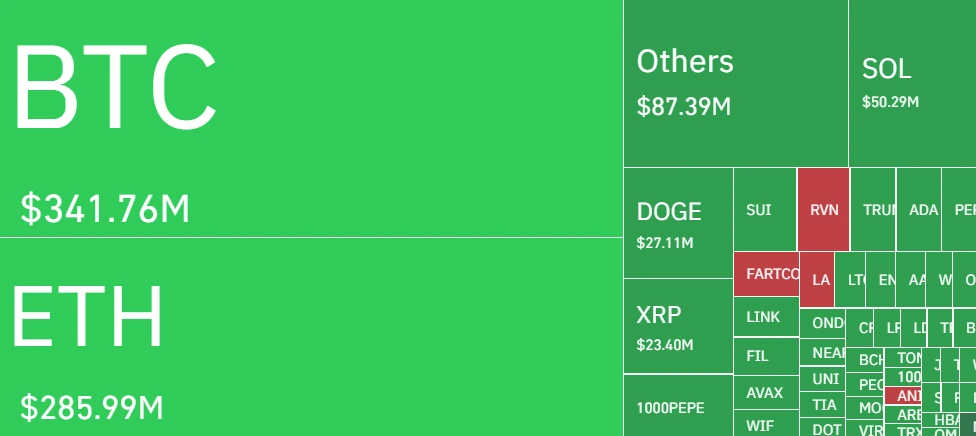

In the past 24 hours, the crypto market bore over $1 billion in liquidations, a majority of which were $900 million+ worth of long positions. Short liquidations made up just around $100 million, clearly reflecting the bull trap that caught over-leveraged buyers off guard. Bitcoin alone saw $341.76 million in liquidations, followed closely by ethereum at $285.99 million.

Top exchanges like Bybit with $352M, and Binance with $248M led the tally in liquidated positions, with more than 89% of these being long trades. This steep wipeout not only intensified the sell-off but also hints at growing nervousness among traders, especially those relying on Leveraged gains.

What to Expect Next?

Despite today’s fall, the neutral score in the Fear & Greed Index suggests the market isn’t in a full-blown panic yet. Looking at the chart, the total crypto market cap has slipped from above $3.3 trillion to $3.17 trillion, signaling a break below key support. The 9-day SMA at $3.23T now acts as a resistance. If the market fails to reclaim this level soon, further downside toward $3T is likely.

If you are keen on Bitcoin’s future, our Bitcoin (BTC) Price Prediction 2025, 2026-2030 is a must-read!

FAQs

Why did long trades dominate liquidations today?The sudden market drop caught bullish traders off guard, forcing overleveraged long positions to liquidate in masses.

Should investors sell now?Not necessarily. Neutral sentiment and upcoming macro data suggest it’s better to wait for clearer direction before making rash moves.