Cardano Bulls Charge Back: ADA Breaks $0.80, Eyes $0.85 as Momentum Builds

Cardano’s ADA isn’t just surviving—it’s thrashing bearish fatigue. The crypto just clawed back past $0.80, and traders are already betting on a sprint to $0.85. Technicals scream bullish, but let’s see if the ’smart money’ remembers how to read charts this time.

Price action? Clean. Sentiment? Greedy. Wall Street’s reaction? Probably still stuck explaining Bitcoin to their compliance teams. ADA’s move isn’t just a rebound—it’s a middle finger to sideways markets.

Key Takeaways

- ADA reclaimed $0.80 after bouncing from $0.71, forming a bullish higher-low structure.

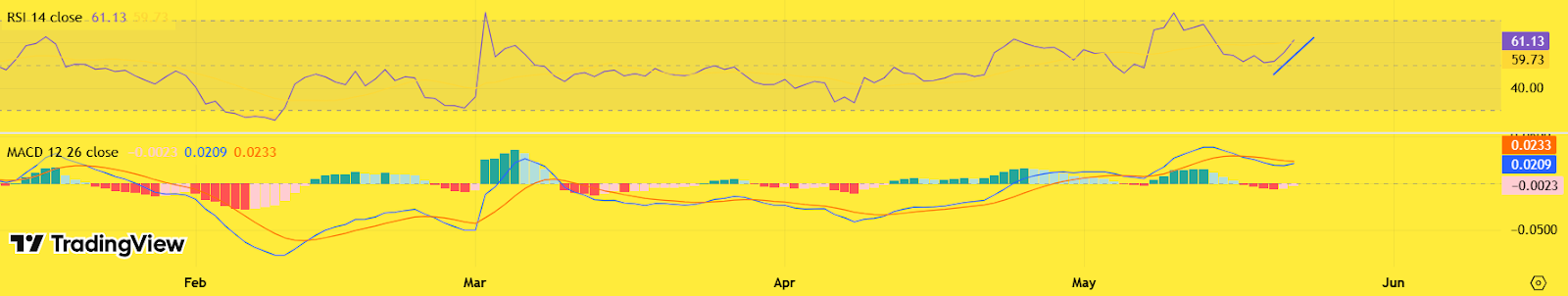

- Momentum flipped positive, with RSI > 60 and MACD showing a fresh bullish crossover.

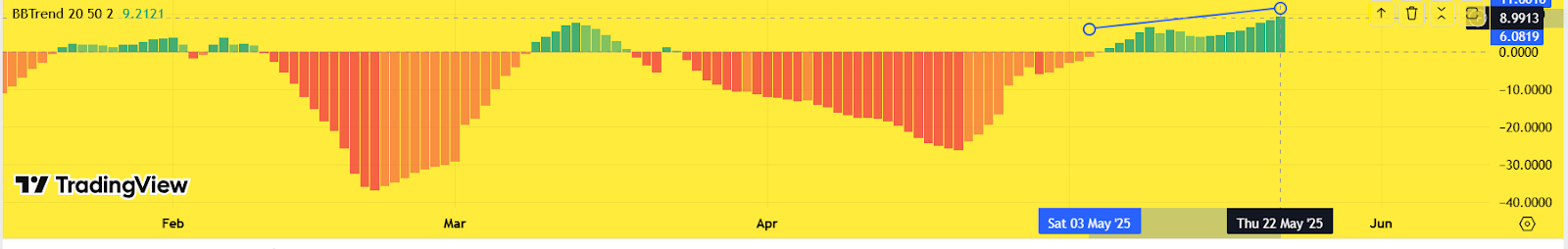

- BBTrend surged to +5.22, signaling strong volatility and breakout potential.

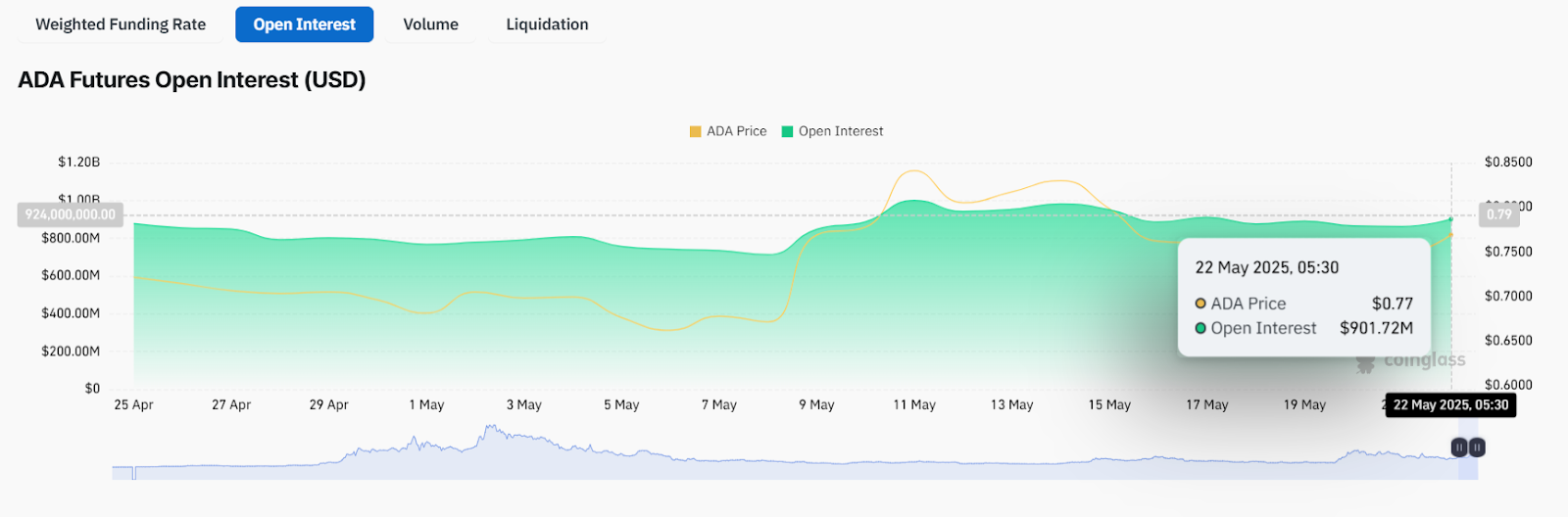

- Open interest hit $917M, marking its highest level in 2025 and confirming rising trader confidence.

Bitcoin hit a freshon May 22, pushing the—its highest reading in weeks. This surge in sentiment has triggered renewed momentum across major altcoins, withreclaiming the $0.80 mark and flashing signs of a bullish continuation. Will momentum hold into next week?

ADA/USD Structure Recovery Backed by Momentum Shift

Cardano’s price action has seen sharp turns in 2025. On, ADA surged from— its biggest one-day spike this year, a gain of. But profit-taking led to a DEEP correction, bottoming out at, a.

Since then, ADA has been rebuilding, climbing to, then briefly correcting to, before bouncing back above.

This climb is supported by a bullish structure of higher lows. Price now trades above a rising trendline, with key support at(0.236 Fib) and resistance at(0.5 Fib). A break above this zone could open the door to(0.618 Fib) in the short term.

.recovered fromon May 19 to above, reflecting improving buying strength.completed a bullish crossover on May 21–22, with expanding green histogram bars signaling fresh momentum.

Most notably, the, which tracks directional strength using Bollinger Band volatility, flipped from negative to— its highest reading in months.

This confirms rising volatility alongside bullish price action, helping validate the breakout attempt.

Volume trends further support the move. After a quiet start to May,, with— the highest in 2025. This signals rising conviction among traders and real capital inflow behind the price push.

Short-Term Forecast: Bullish, With Caution

If ADA holds above the $0.75–$0.77 support band this week, a retest of the $0.85 level is likely. A clean breakout above $0.853 could accelerate gains toward $0.93–$0.94 in the next 7–10 days.

However, failure to sustain above $0.75 WOULD expose ADA to downside risk toward $0.72 or even $0.647 in a broader pullback.

Verdict: Bullish Bias with Near-Term Upside

The technical and on-chain picture supports a bullish bias for ADA in the short term, especially if momentum sustains above key Fib levels. While resistance at $0.85 may cause temporary friction, the overall structure favours upside continuation, potentially targeting $0.93 within the next 10 days.