Pi Network ($Pi) Plummets 45%—Honeymoon Phase Over as Reality Bites

Mining hype meets market gravity: Pi Network’s token crashes nearly half its value as early adopters cash out. The ’mobile-mined’ crypto darling now faces its first true stress test.

Wake-up call or dead cat bounce? Traders scramble after Pi’s 7-day chart looks like a cliff dive. Meanwhile, Bitcoin maxis smugly adjust their laser eyes.

Behind the plunge: Liquidity crunch hits as mainnet migration stalls. Whitepaper promises collide with exchange realities—turns out, printing digital money on phones wasn’t the hard part.

What’s next? If history repeats, the ’community’ will now pivot to blaming ’weak hands’ and ’FUD’ rather than the economics of 35 million pre-mined tokens. Stay tuned for the obligatory ’BUY THE DIP’ tweets from influencers who got their allocations for free.

Pi Coin plunged 45% after a brief rally fueled by Consensus 2025 announcements, with indicators and on-chain data signalling weakening momentum and a bearish outlook unless new catalysts emerge.

- Pi Coin is down 45% from its recent high, currently trading at $0.6984.

- Market cap rose 95% in 5 days and then dropped $3.7B within 3 days.

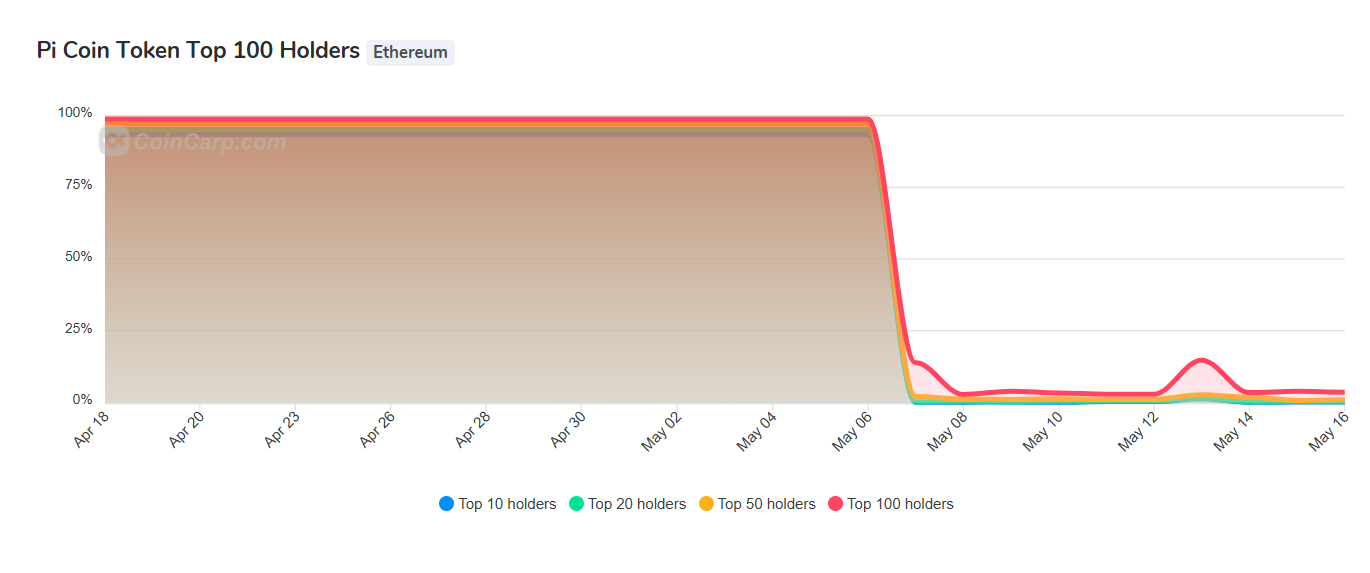

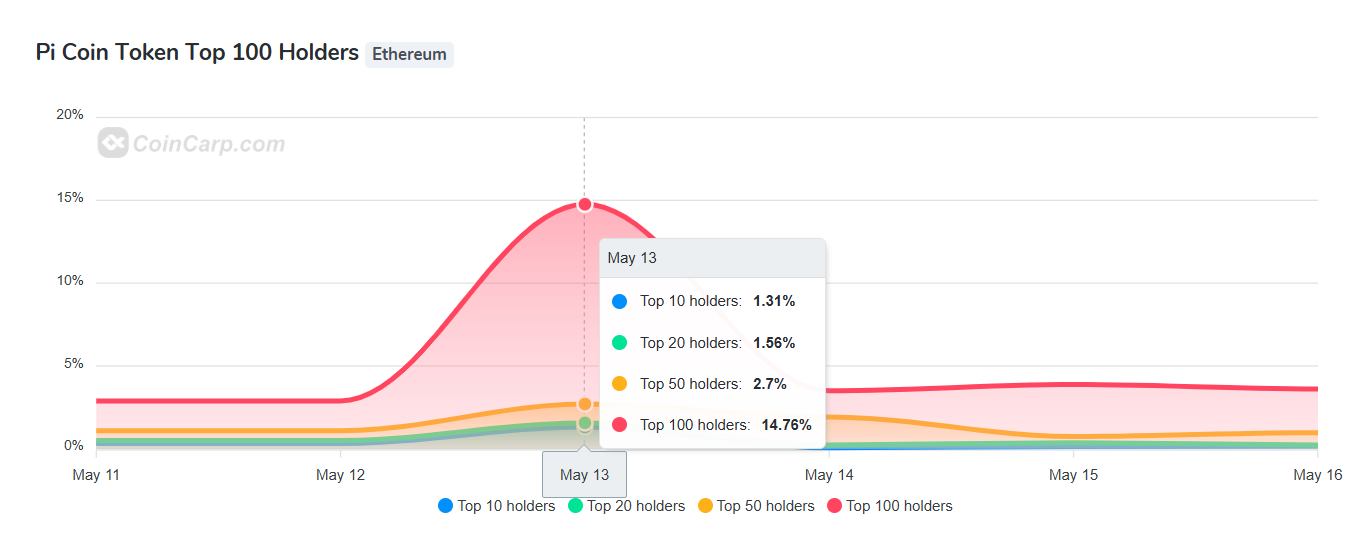

- Top 100 wallet concentration fell from 98.76% to under 5% from May 6 to May 16.

- EMAs at $0.79–$0.85 have turned into resistance, confirming bearish momentum.

- Analyst outlook remains cautiously bearish amid fading indicators and failed support.

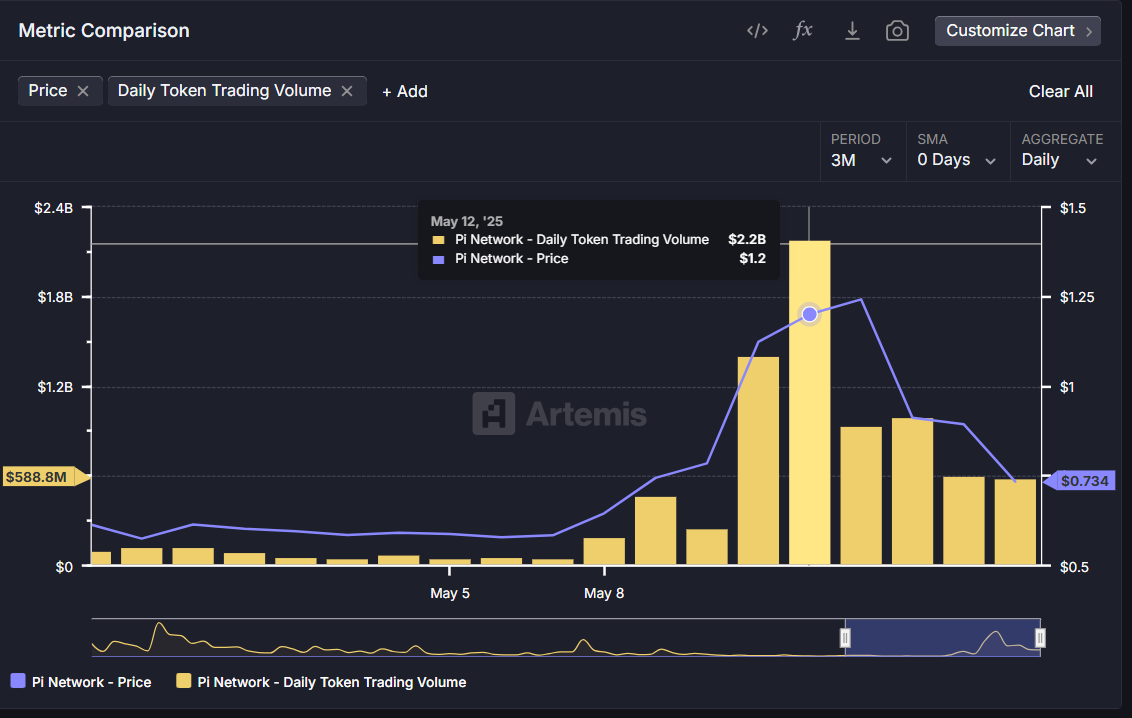

Pi Network (PI) is currently trading at $0.6984, down over 45% from its recent high of $1.57 with market cap now at $5.1B. From May 8 to May 13, Pi’s market cap jumped from $4.5B to $8.8B, almost doubling in just five days. But by May 16, it had fallen back to $5.1B, losing over $3.7B in value in just three days.

This sharp drop came after a short-lived price boost caused by major announcements — including the shutdown of Pi’s central node and the launch of a $100M Pi Network Ventures fund, both revealed during Consensus 2025 (May 13–14).

The fast rise and fall show that Pi’s price still reacts quickly to news rather than steady growth. While the rally briefly caught market attention, the rapid drop has heightened caution among traders.

PI/USDT Technical Analysis: Indicators Show Weak Momentum and Bearish Bias

The rally that started onlifted PI above $1, peaking at, driven by major news. But buying power faded just as fast.

Now, Pi trades under the— stacked between— which have flipped into resistance. Thehas turned bearish, with the line almost crossing below the signal. The histogram, though not yet red, is narrowing, signalling fading buying pressure. The, now at, points to neutral-to-bearish momentum.

The, which reflects buying vs. selling pressure, has dropped over, indicating a slowdown in net accumulation. Resistance sits at $0.79–$0.85.

Pi Coin is now testing key support levels at $0.68 and $0.59, which were important price zones before the rally on May 8. Instead of moving sideways in a range, the price has dropped from the peak and is now settling where buyers previously stepped in, waiting for a fresh trigger to MOVE again

A fall belowcould open the way to. The Analysis of the PI network remainsunless Pi reclaims its EMAs with strong volume.

Pi On-Chain Metrics: Wallet Concentration Shift and Volume Drop

Volume surged to, then dropped to, down, suggesting a fading HYPE cycle.

The CoinCarp chart, which displays wallet distribution by holder ranks, shows that thedropped sharply fromto, before settling under.

On May 13 specifically, the top 10 holders owned just, and the top 50 held. This dramatic shift likely reflectsrather than actual retail distribution. The rapid redistribution during the rally aligns with bearish technical indicators, showing that major holders possibly took profits during the hype phase..

Conclusion: Event-Reactive Sentiment Keeps Pi Coin Volatile

Pi Network’s 45% rally and the subsequent steep correction were driven by, notably from announcements made during.

This reflects howstill drives Pi’s price more than fundamental progress. The rapid market cap swing — a— reveals how sensitive Pi remains to major headlines.

Going forward, potential catalysts such as aorcould reignite interest. Until then,, and traders should monitor support zones closely for further downside risk or relief bounce attempts.