Dogecoin Network Activity Surges to 6-Month Peak—Will $0.30 Become Support or Resistance?

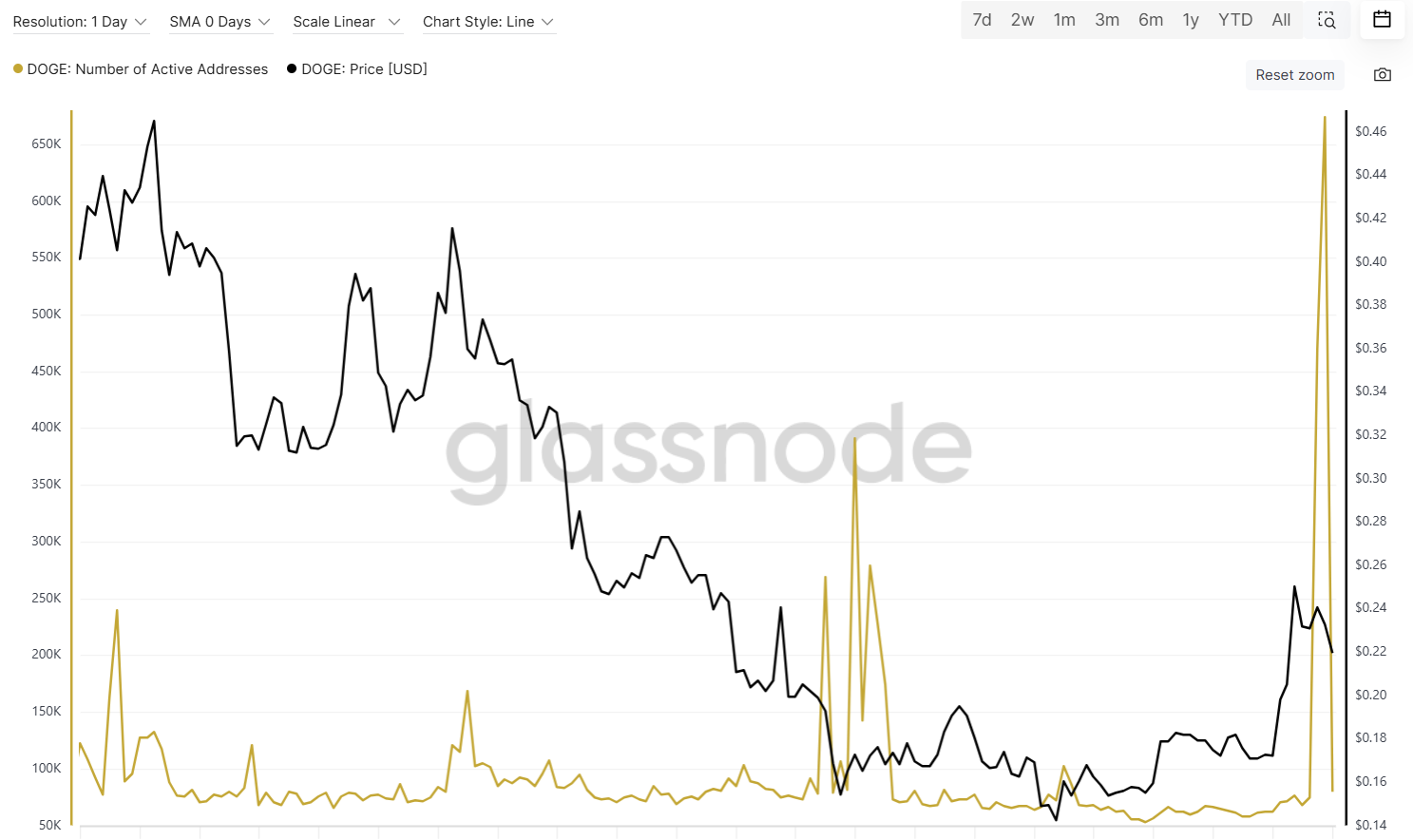

Dogecoin’s blockchain just woke up from its slumber. On-chain metrics show transaction volume and active addresses spiking to levels not seen since late 2024—right before that 40% memecoin massacre.

The $0.30 psychological barrier is back in play. Technical analysts are split: either DOGE consolidates here before another leg up, or we’re witnessing a classic ’bull trap’ before liquidity hunters drag it back down.

Meanwhile, Wall Street ’experts’ still can’t decide if this is a currency, a joke, or their next career-ending FOMO trade. Place your bets.

Dogecoin (DOGE) has seen a sharp increase in investor activity, with— the highest since November 2024.

This surge reflects strong retail interest, but the timing of the spike NEAR the local top ofsuggests it may have been driven by late-stage speculative buying.

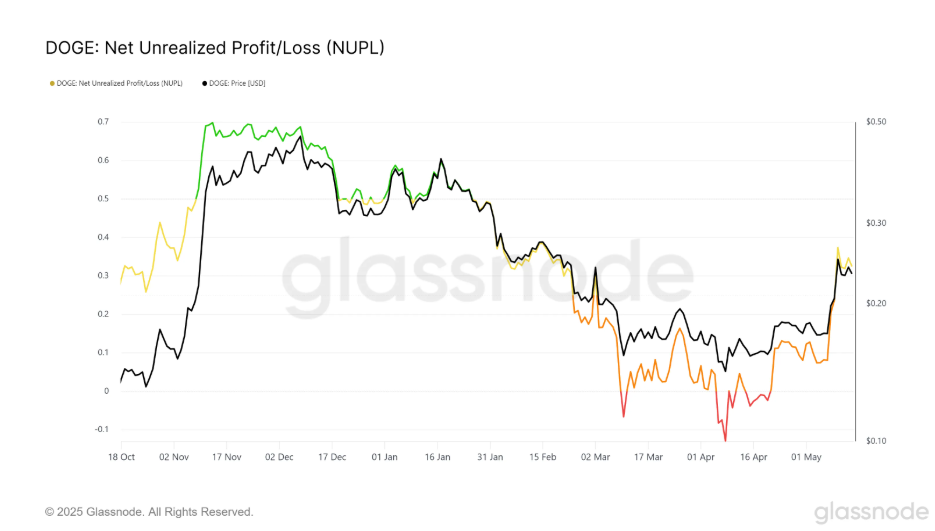

Profits Rise, Optimism Returns

The Net Unrealized Profit/Loss (NUPL) indicator has returned to the “Optimism” zone, showing that the majority of Doge holders are now in profit.

While this reflects increased confidence, elevated unrealized profits can lead to selling pressure if resistance levels are not broken convincingly.

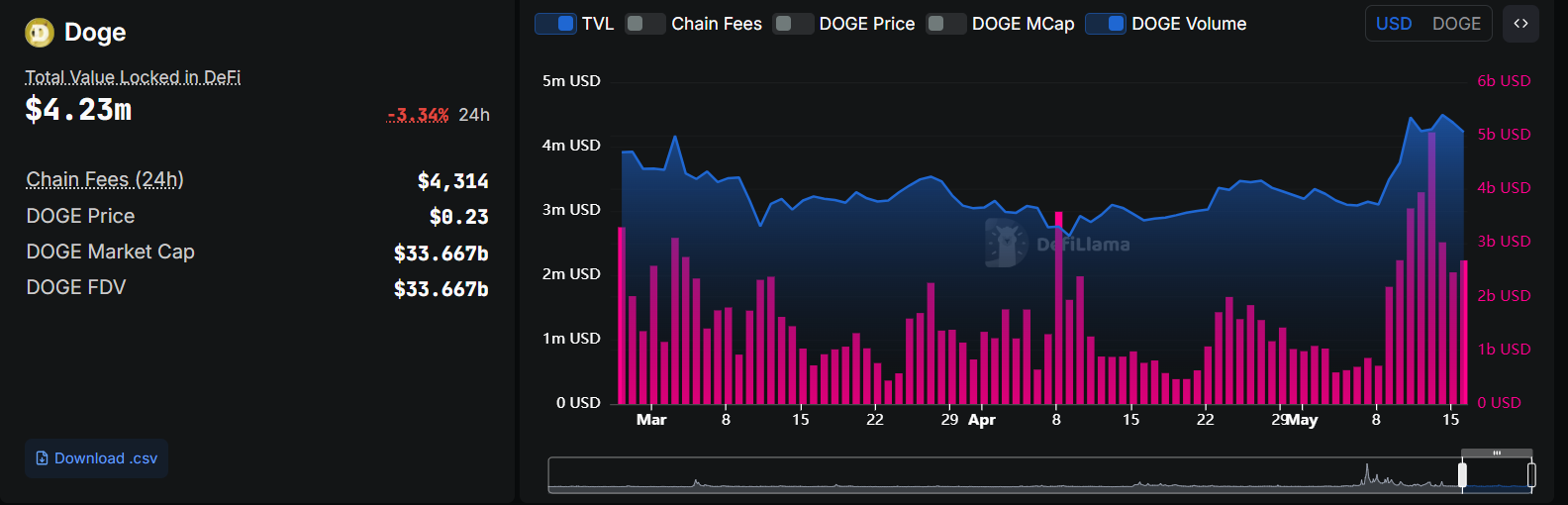

Volume Outpaces Utility

Despite daily trading volume exceeding $5 billion during the recent price surge, Dogecoin’s DeFi total value locked (TVL) remains under $5 million. This highlights a significant gap between price action and network utility, suggesting that the rally was driven more by sentiment and speculation than actual usage growth.

DOGE/USDT Stops at Key Support as Momentum Weakens

Dogecoin is consolidating around $0.225 after facing rejection at $0.245. Despite this pullback, the broader trend remains intact, with price holding above the 20, 50, 100, and 200-day EMAs. This cluster, especially around theis a key support range. Holding above it keeps the bullish structure valid.

Momentum however is showing early signs of weakness, the MACD line is facing towards down and may flip, while RSI has dropped to 62, indicating neutral sentiment after previously reaching overbought levels.

, it may remain range-bound or revisit support levels near $0.220. A breakdown below this could open downside targets at $0.198 or even $0.145.

Conversely, a breakout above $0.245 with strong volume could trigger a MOVE toward

The Dogecoin price is holding above key EMAs near $0.220, keeping the bullish structure intact. However, weakening MACD and a cooling RSI suggest fading momentum.

DOGE remains in a tight range between $0.220 and $0.245, with traders watching for a breakout or breakdown from this zone.

DOGE Faces Key Decision Zone Between Hype and Structure

Dogecoin’s on-chain activity shows strong retail interest and rising profits, but the lack of fundamental utility and declining volume point to a speculative rally. Technically, DOGE is holding above key EMAs, but fading momentum suggests uncertainty.

A breakout above $0.245 could confirm bullish continuation toward $0.30, while a drop below $0.220 may trigger a deeper correction to $0.198 or $0.145. For now, DOGE remains range-bound, and traders should watch for a clear move before committing to direction.