MicroStrategy’s Bitcoin Bet Pays Off: MSTR Shares Rocket as Crypto Holdings Near $60B

Wall Street scrambles to keep up as Michael Saylor’s corporate Bitcoin playbook hits a $59 billion jackpot—proving once again that crypto volatility cuts both ways.

While traditional finance analysts clutch their spreadsheets, MicroStrategy’s stock surge highlights how institutional crypto adoption bypasses old-school valuation models. The company now holds roughly 1% of all Bitcoin in circulation—a position that would make even Satoshi raise an eyebrow.

Funny how ’reckless speculation’ suddenly becomes ’visionary investing’ when the numbers turn green. The suits will still tell you it’s different this time.

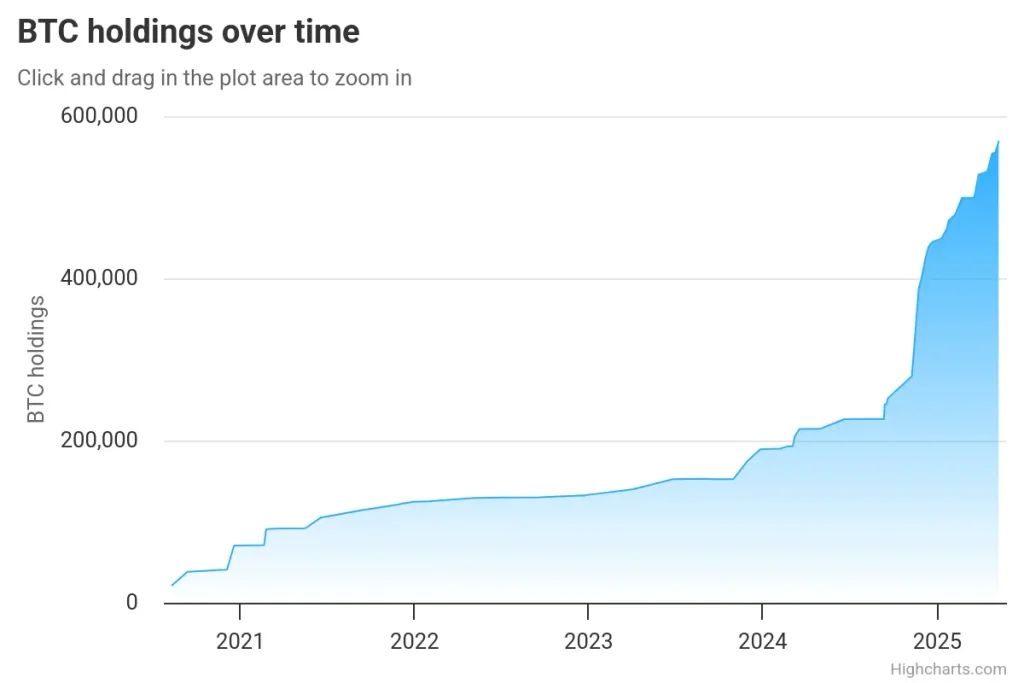

MicroStrategy is doubling down on Bitcoin. In its 12th acquisition of 2025, the company has purchased an additional 13,390 BTC for approximately $1.34 billion. This boosts its total holdings to a staggering 568,840 BTC—equivalent to 2.7% of Bitcoin’s circulating supply.

With over $39.4 billion invested, MicroStrategy’s BTC stash is now valued at $59.23 billion, generating unrealized profits of nearly $19.83 billion.

Corporate Bitcoin Adoption: MicroStrategy Leads the Charge

MicroStrategy stands tall among public companies holding Bitcoin, outpacing major players like Tesla, Coinbase, Galaxy Digital, and Metaplanet. The company’s aggressive accumulation strategy has made it the largest corporate holder of BTC worldwide.

Since January, MicroStrategy has added 122,440 BTC across 12 separate purchases. Its most recent acquisition occurred on, when it spent $1.34B to acquire 13,390 BTC—marking yet another bold move in its long-term crypto investment plan.

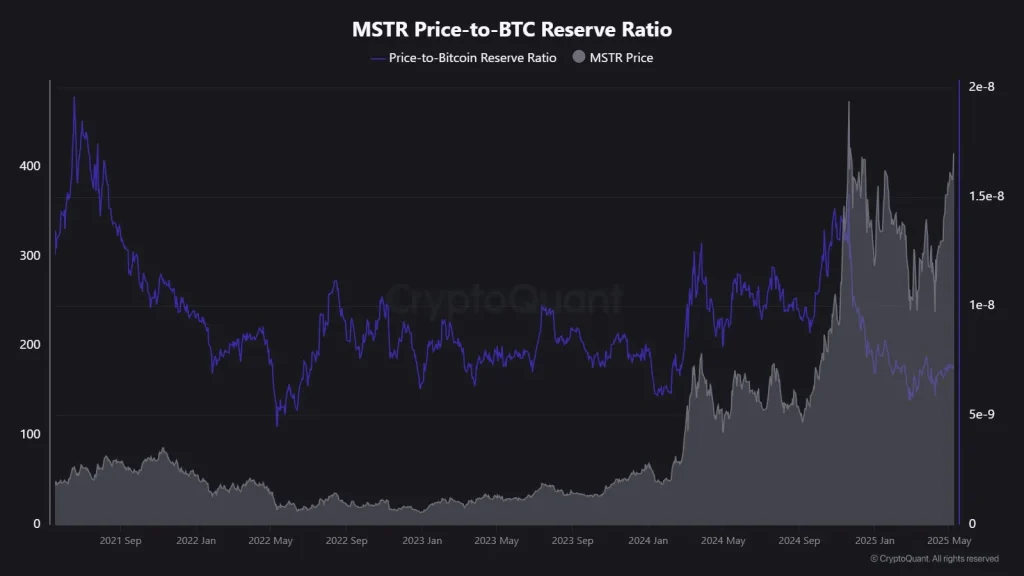

MSTR Price-to-BTC Reserve Ratio: What It Reveals

Thefor MicroStrategy currently stands at. This means investors are paying $7.27 for every $1 of Bitcoin the company holds. MSTR stock is trading around, having surgedyear-to-date andthis month alone—fueled by bullish sentiment around Bitcoin and corporate crypto exposure.