US Drops Long-Awaited Crypto Regulation Bomb—Market Braces for Impact

After years of regulatory limbo, Washington finally unveils its crypto rulebook. Will it legitimize the industry or strangle innovation in its crib?

The bill’s fine print reveals landmines—and loopholes—for exchanges, DeFi, and institutional players. Meanwhile, Wall Street quietly adjusts its algo-trading parameters (because nothing stops a banker’s arbitrage hustle).

Key takeaways: Stricter KYC requirements, clearer tax reporting, and—of course—a shiny new oversight role for the SEC. Because what crypto needs is more paperwork.

Prediction: Compliance costs spike, shitcoins vanish, and Bitcoin maximalists smugly remind everyone they called this years ago. The revolution just got notarized.

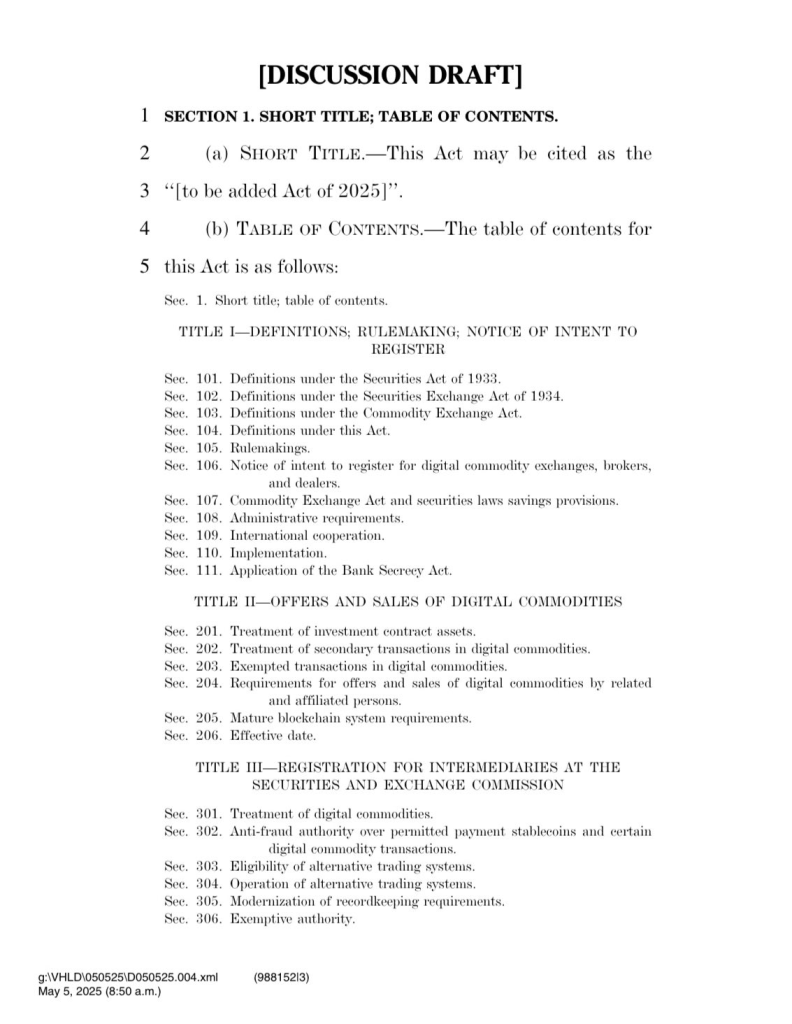

The U.S. has finally dropped the much-anticipated, and it could be a game-changer. Released by the House Financial Services and Agriculture Committees, the new draft attempts to draw a clear line between who regulates what in the crypto space.

SEC vs CFTC: A Split in Oversight

Unlike the earlier, which drew heat for weakening the SEC’s role, this updated bill strikes a more balanced approach. Thewill continue to oversee crypto tokens that are considered investment contracts, while thewill take the lead on crypto commodities.

According to Paradigm’s Justin Slaughter, the bill keeps the CFTC in the driver’s seat but allows the SEC some control until projects prove they are truly decentralized.

Interestingly, there’s now a formalA project must not be under the control of a single party, and large holders (those with over 10%) must be disclosed while it remains centralized. The bill also defines when a blockchain is considered “mature.”

Notably, a blockchain must be open, functional, and not centrally owned — with no more than 20% held by any single party.

Retail investors also get a break. They no longer need to meet high income or wealth requirements to participate. This opens the door for everyday people to invest in crypto, not just the wealthy elite.

DeFi and Stablecoins Get Some Clarity

that are fully automated and don’t hold user funds might also avoid strict regulations under this bill. It also addresses, providing a definition for them but not classifying them as securities.

This comes as a separate, faces political pushback in the Senate.