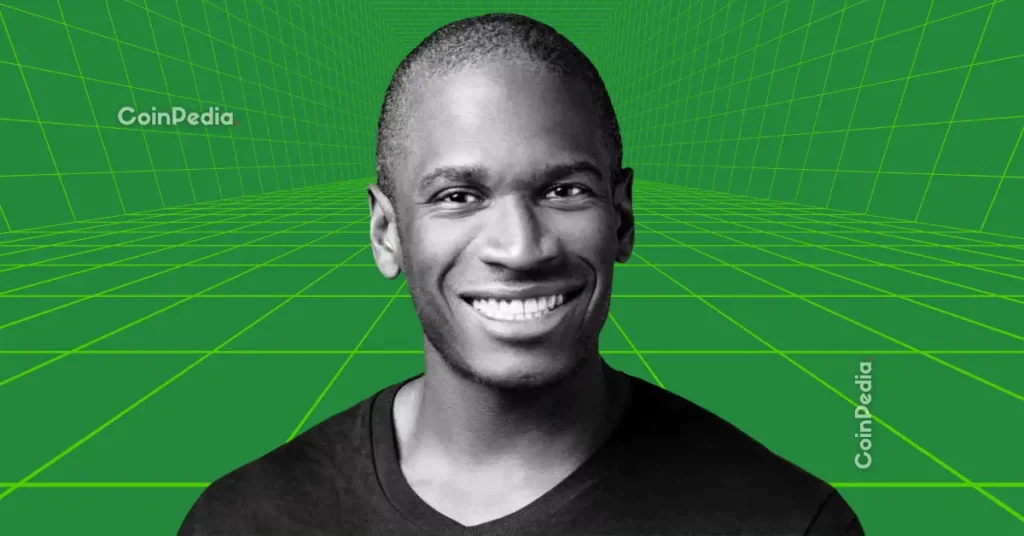

Arthur Hayes Dumps Ethereum, Bets Big on DeFi Tokens in Strategic Pivot

BitMEX co-founder Arthur Hayes makes a major portfolio move, selling Ethereum to load up on DeFi tokens. The shift signals a calculated bet on the next wave of crypto finance.

From Blue-Chip to Frontier Bets

Hayes isn't just rebalancing—he's repositioning. The move away from Ethereum, a foundational layer-one asset, toward more speculative DeFi tokens suggests a hunt for asymmetric returns. It's a classic crypto play: secure profits from established winners and funnel capital into higher-risk, higher-potential protocols.

Reading the Market's Tea Leaves

This isn't casual profit-taking. When a figure like Hayes pivots, the market pays attention. The trade implies a thesis that DeFi's narrative and utility cycle is poised to outperform the broader smart contract platform sector in the near term. It's a vote for application-layer innovation over infrastructure.

The DeFi Gambit

Which tokens? Details are scarce, but the target is clear: protocols redefining lending, trading, and yield. Hayes is likely targeting projects with strong tokenomics, real revenue, and unsustainable yields—at least until the music stops. After all, what's finance without a little leverage and hope?

The play is clear: reduce exposure to the 'digital oil' and go all-in on the refineries and gas stations. Whether this is genius foresight or just another high-stakes roll of the dice remains to be seen. In crypto, conviction is just a trade away from being a regret.

Crypto veteran Arthur Hayes has deposited another 682 $ETH ($2M) into Binance, continuing his strategy of selling ethereum to invest in high-quality DeFi tokens. Over the past week, Hayes sold a total of 1,871 $ETH ($5.53M) and acquired 1.22M $ENA ($257.5K), 137,117 $PENDLE ($259K), and 132,730 $ETHFI ($93K), signaling a strong shift toward DeFi opportunities.