5 Best Crypto Lending Platforms in 2026: Your Deep Market Review for Maximum Yield

Crypto lending just cut the banks out of the equation—and the yields are getting aggressive.

Forget parking digital assets in a cold wallet. The new wave of decentralized finance platforms lets you put your Bitcoin, Ethereum, and stablecoins to work, generating passive income while you sleep. It's a direct challenge to traditional savings accounts, which offer returns so low they barely beat inflation—if you're lucky.

What Makes a Top Platform in 2026?

The landscape has matured. Security is non-negotiable, with institutional-grade custody and smart contract audits becoming the baseline. Transparency is key; users demand clear visibility into loan collateral and liquidity pools. The winners this year aren't just about the highest APY—they're about sustainable, reliable yield generation without the hidden risks.

The 5 Contenders Dominating the Market

Five platforms have separated themselves from the pack. Each offers a unique blend of supported assets, loan terms, and yield mechanisms. Some cater to DeFi purists with fully permissionless protocols, while others offer a familiar, regulated gateway for newcomers. The choice hinges on your risk tolerance and which part of the crypto ecosystem you believe in most.

Beyond Interest Rates: The Real Value Proposition

It's not just about earning more crypto. These platforms provide critical liquidity to the broader market, fueling trading, borrowing, and innovation. They're the engines of the decentralized economy. For the user, it means your portfolio isn't just sitting there—it's actively building the future of finance, and paying you for the privilege. A far cry from your bank, which still charges fees for the 'service' of holding your money.

The race for your crypto is on. The question isn't if you should lend, but where.

In today’s crypto world, the option to have access to liquidity and not sell your assets has become a valuable portfolio management technique. Crypto-backed loans offer an accessible method of borrowing Bitcoin or other digital assets with competitive rates and simple repayment options. These services include a vast number of users who can choose either the decentralized lending model or the ease of centralized platforms.

For this guide, we conducted a deep review of the current crypto lending market. Our assessment considered key factors, such as platform security, supported assets, transparency of terms, lending conditions, user experience, and overall reliability.

Below, we highlight 5 of the most notable crypto lending platforms based on this analysis:

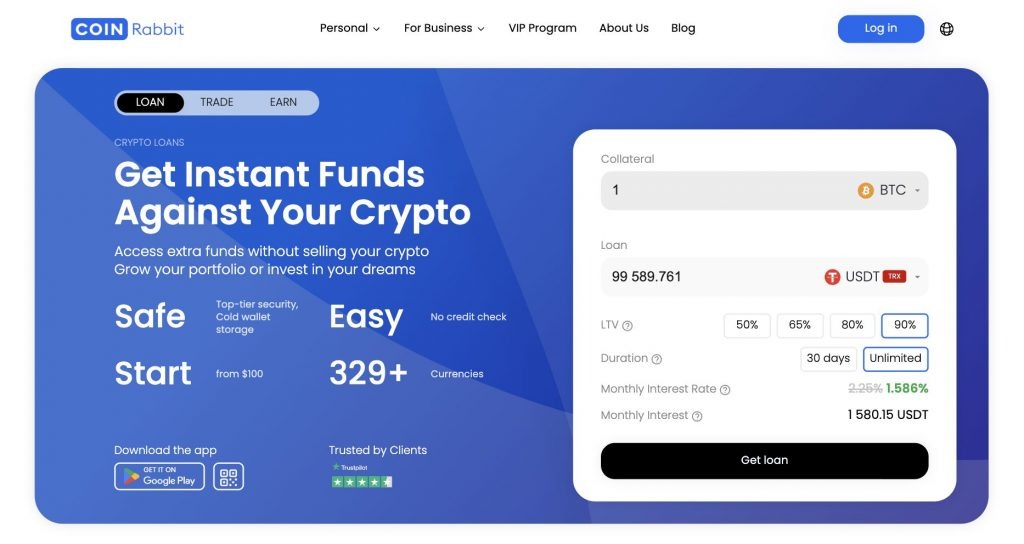

1. CoinRabbit – Best Crypto Lending Platform for Effortless Borrowing

CoinRabbit is an all-in-one platform that was introduced in 2020. It is worth considering to get quick liquidity against Bitcoin, Ethereum, and 300+ other cryptos. A simplified procedure requires 10-15 minutes and enables borrowing crypto in 12+ stablecoins without credit checks or other paperwork.

- Leverage assets with up to 90% LTV

- Supports 300+ cryptos as collateral

- Open-ended options as well as fixed-rate loans are available

:

- Receiving a loan takes 10-15 minutes; no complicated steps

- 24/7 professional human support

- Collateral is never rehypothecated, stored in cold wallets with multisig access

- Private program for high-volume borrowers

:

- Doesn’t offer the same open-protocol visibility as DeFi options

- Is relatively newer compared to giants like Binance.

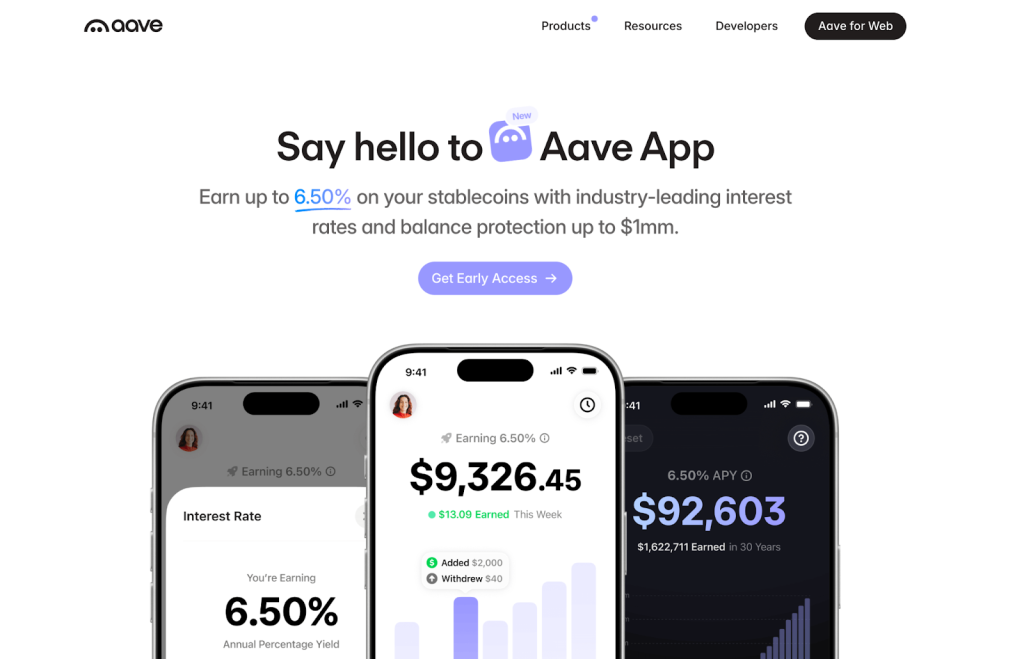

2. Aave – Best DeFi Crypto Lending Platform

Aave continues to be a mainstay of DeFi and runs on multiple blockchains to allow non-custodial borrowing and lending through liquidity pools. The users are able to provide money to earn yields or borrow with collateral such as WBTC, ETH, stablecoins, and ERC-20 tokens; LTV varies by asset.

- Rates automatically change according on supply, demand, and liquidity

- Lend and borrow money on supported chains like Ethereum and Avalanche

- Community-driven governance with regular audits

- Requires DeFi expertise for risk monitoring

- Uncollateralized loans for DeFi tactics that don’t require upfront funding

- Collateral is locked in smart contracts

- Users retain full control of their assets; the protocol never holds collateral directly

- May be complicated to enter for beginners

- Possible weaknesses of smart contracts

- Gas costs during network overload

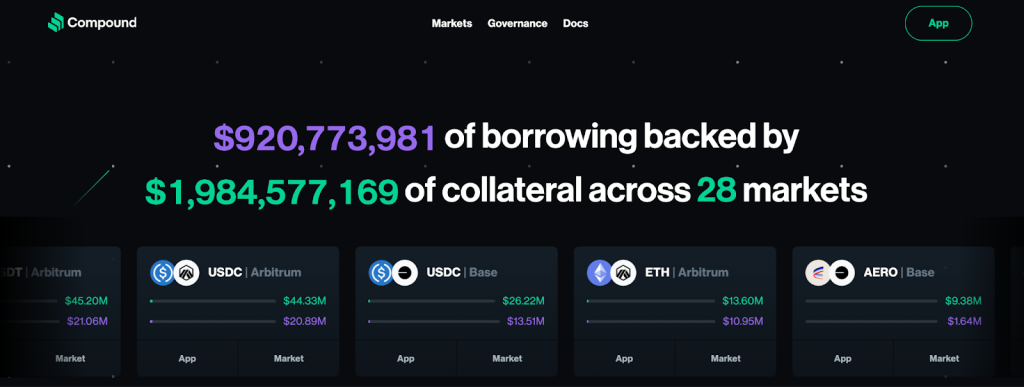

3. Compound – Best DeFi Platform for Algorithmic Rates

Compound is a DeFi protocol launched in 2018, which enables users to lend and borrow cryptocurrencies through algorithmic liquidity pools on ethereum and other compatible chains. It supports over-collateralized loans, with borrowing limits determined by pool liquidity and dynamic interest rates.

- Algorithmic interest rates that fluctuate with market conditions

- No fixed maturity dates; interest accrues continuously block-by-block

- Fully on-chain operations with audited smart contracts

- Supports Ethereum-based assets including ETH, WBTC, and major altcoins

- Decentralized and intermediary-free

- Collateral locked securely and is never rehypothecated

- High flexibility for both short-term and long-term borrowing strategies

- Requires over-collateralization, limiting borrowing power to available pool liquidity

- Entry barrier is relatively high

- Dynamic rates can lead to unexpected increases during high demand

- Ethereum gas fees for transactions which can spike during congestion

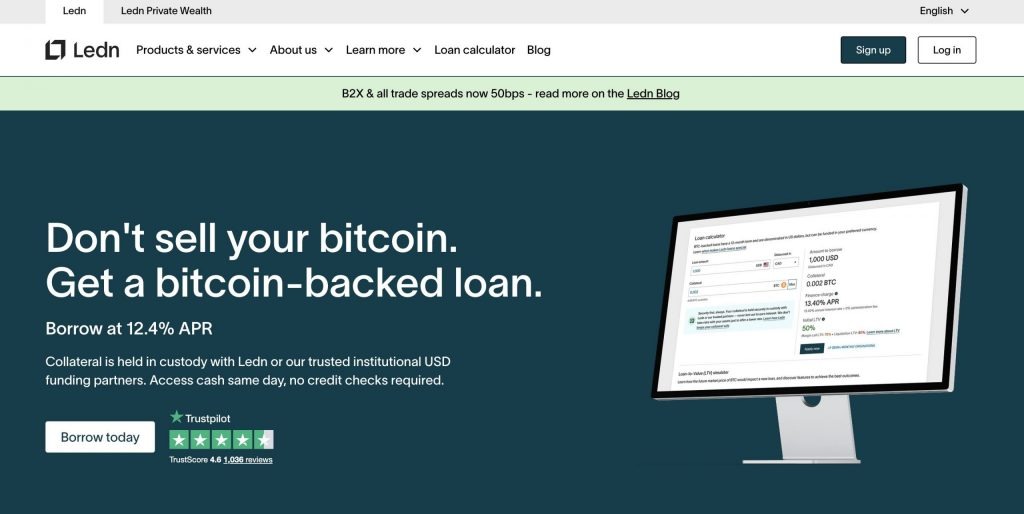

4. Ledn – Best Bitcoin Lending Platform

Ledn, founded in 2018, prioritizes transparency and safety for BTC holders. It offers USD loans, collateral is held in segregated, on-chain custody verified quarterly by independent auditors like The Network Firm LLP. All users can also verify holdings via Merkle Tree proofs.

- On-chain custody

- LTV ratios average around 50%

- Supports only BTC as collateral

:

- Strong security with proof-of-reserves exceeding 100% of liabilities

- Fiat payouts are processed in hours

- Focus on long-term HODLers without selling

:

- Lower LTV limits borrowing amounts

- Geared more toward institutional or serious retail users rather than high-leverage seekers.

5.

Binance Loans provides effortless collateralized borrowing directly from the crypto wallet. It supports BTC, ETH, BNB, and major stablecoins, offers flexible variable-rate loans with anytime repayment or fixed-term plans. LTV reaches up to 80% for select assets, which suites active traders within the Binance ecosystem.

- Flexible & fixed loans

- BTC, ETH, XRP and other major cryptocurrencies as collateral

- Loans can reach up to 80% of the collateral value

- The minimum borrow amount is 50,000 USDT

- Integration with Binance’s financial ecosystem

:

- Loan durations can be adjusted to meet individual borrower needs

- Collateral is held in centralized custody

- Global accessibility

:

- Collateral may be rehypothecated

- Extensive platform features may overwhelm lending-focused users

FAQ

Crypto lending refers to the borrowing of fiat, stablecoins or other cryptos with a set of digital assets such as BTC as collateral. Lenders provide liquidity to pools where they earn an interest, and the borrowers receive the money without selling. The repayment with interest is not liquidated in case of a decline in the value of collateral.

Crypto lending can be profitable, especially for users who approach it strategically and choose reliable platforms. Many investors use it as a way to put their idle assets to work and generate steady returns without actively trading.

Focus on such aspects as interest rate, LTV, security measures, number and types of cryptocurrencies supported. You can experiment with the diversification of assets in CeFi and DeFi with returns, and do audit and geographic checks.