Bitcoin Smashes Past $90,000 — Here’s Why Analysts Still Warn of Downside Risk

Bitcoin just powered through another major psychological barrier. The flagship cryptocurrency reclaimed the $90,000 level, a move that has the market buzzing with both excitement and a healthy dose of skepticism.

The Bull Case: Momentum Is Real

You can't argue with the price action. Breaking $90k isn't just a number—it's a signal. It suggests institutional flows are still finding their way in, retail FOMO might be kicking in, and the macro narrative for digital scarcity is holding strong. Each resistance level that crumbles adds fuel to the thesis that we're in a new paradigm.

The Bear Whisperers: What Could Go Wrong?

Not everyone is popping champagne. Veteran analysts are pointing to the ghosts of cycles past—overheated derivatives, excessive leverage in the system, and the simple, brutal math of profit-taking. They see a market that's run hard and might need to catch its breath. A pullback here wouldn't invalidate the long-term trend; it would just be the market doing what it always does, which is separate the impatient from the committed.

The Tightrope Walk Ahead

The next few weeks will be a classic tug-of-war between conviction and caution. Every dip will be called a 'buying opportunity' by bulls and a 'topping signal' by bears. Meanwhile, traditional finance pundits will likely dismiss the entire move as speculative froth—right up until their own firms finally launch a spot ETF.

Bitcoin's climb continues, but the higher it goes, the louder the calls for a correction become. In crypto, the only thing more predictable than a bull run is someone warning you it's about to end.

After the rebound from the local lows below $85,000, the Bitcoin bulls have been gaining significant strength. The price has now surged above $90,000, following a consolidated weekend, hinting towards a sustained ascending trend for the rest of the week. The volume has been raised gradually since the early trading hours, pushing the BTC price higher from the local lows close to $87,600. The recent reversal could seem like a healthy reversal, but in the long run, it could be yet another short-term bounce, resulting in a deeper correction.

Bitcoin (BTC) has pushed back above $90,000, reclaiming a psychologically important level after a sharp sell-off earlier this month. Price is up nearly 2% on the day, but the broader structure still reflects caution rather than confirmation. Despite the rebound, Bitcoin remains well below its recent highs and is trading inside a compressed range. For traders, the key focus is whether this move signals renewed strength—or just another pause before volatility returns.

On the daily chart, bitcoin is consolidating inside a symmetrical triangle, formed after the breakdown from the $100K–$103K support zone. This pattern reflects indecision following heavy distribution, with lower highs capped beneath descending resistance. OBV remains weak, suggesting accumulation has not yet resumed convincingly. A breakout above $92K–$94K could open the door toward $98K, while failure to hold current levels risks another move toward the $85K–$82K demand zone. Direction hinges on the next expansion in volume.

Is Bitcoin Price Heading Below $40,000?

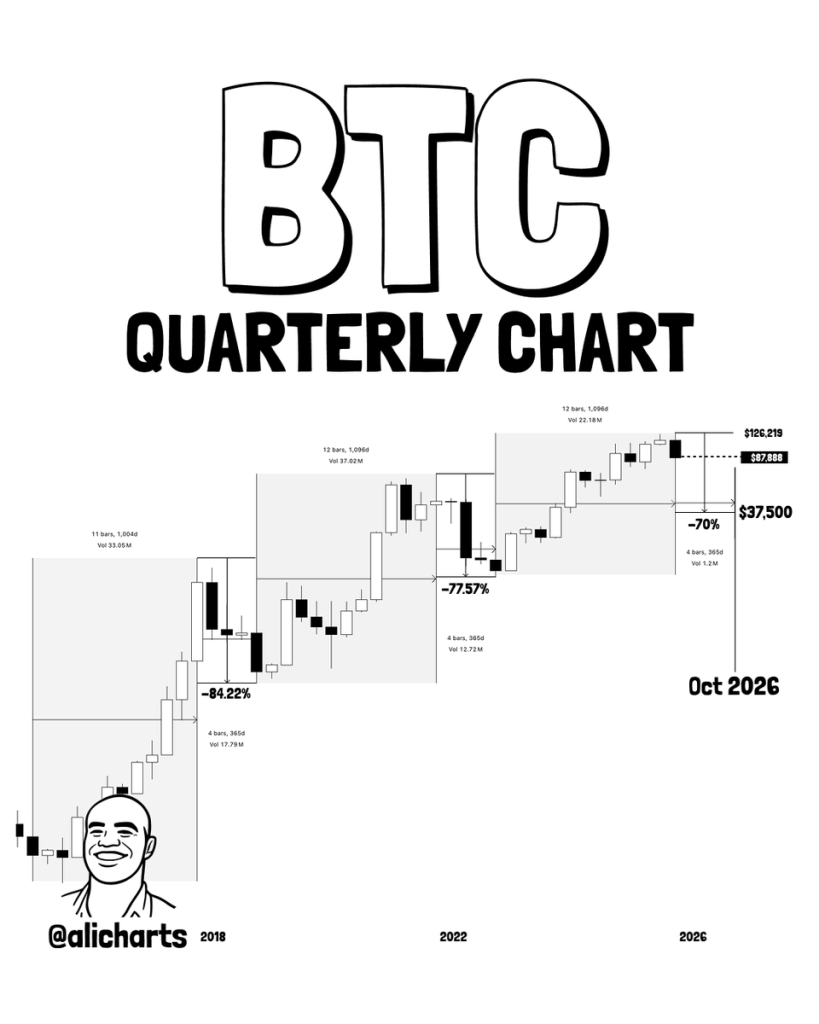

A widely shared quarterly chart of Bitcoin by analyst Ali is drawing attention for what it suggests about long-term market structure rather than short-term price direction. By zooming out to multi-year candles, the chart highlights how Bitcoin’s biggest rallies have historically been followed by deep, extended corrections. With BTC recently trading above $90,000, the chart has reignited debate around whether sharp pullbacks are still part of Bitcoin’s natural cycle—even at much higher price levels.

The quarterly chart illustrates a recurring pattern: after each major bull cycle, Bitcoin has experienced drawdowns of roughly 70–85% before establishing a higher long-term base. Previous cycles saw declines NEAR –84% (2018) and –77% (2022), while the projected scenario highlights a potential –70% correction from a future peak, pointing toward the $35,000–$40,000 zone. Importantly, this is not a timing forecast. It’s a macro framework showing that deep corrections have historically coexisted with Bitcoin’s long-term upward trend.

What’s Next for the BTC Price Rally?

In the short term, the daily chart shows Bitcoin (BTC) price compressing inside a triangle just above $90,000, signalling indecision and the likelihood of a volatility expansion rather than a clean trend continuation. In the long term, the quarterly chart reminds traders that even powerful bull cycles have historically included DEEP corrective phases without breaking Bitcoin’s broader uptrend. The key takeaway is that short-term structure may resolve either way, but long-term risk management must still account for large drawdowns as part of Bitcoin’s macro behaviour.