Bitcoin Price Looks Calm—But This Weekend Could Decide Everything. What Comes Next?

Bitcoin holds its breath. The weekend looms—a potential inflection point for the world's premier digital asset.

The Calm Before the Storm

Surface-level tranquility masks underlying tension. Trading volumes contract, volatility compresses. It's the eerie quiet that often precedes a decisive move. The market consolidates, gathering energy for its next directional lunge.

Weekend Warfare

Traditional finance snoozes. Crypto never sleeps. Weekend trading sessions have repeatedly rewritten Bitcoin's narrative, catching legacy players flat-footed. Liquidity thins, allowing sharper moves on lighter volume. A single catalyst—a regulatory murmur, a whale's wallet shift—can ignite the fuse.

Pathways from the Pivot

A breakout above resistance opens the floodgates. Momentum traders pile in, chasing the fear of missing out. Conversely, a breakdown below support triggers cascading liquidations. The automated sell-offs feed on themselves, a brutal reminder that in crypto, corrections aren't gentle—they're algorithmic.

The coming days will test conviction. They'll separate speculative froth from genuine capital allocation. Remember, in this market, weekends aren't for rest—they're for ripping your face off, or filling your pockets, often depending on which side of the trade the investment bankers are quietly positioned on.

The Bitcoin price has been experiencing significant price fluctuations since the start of the month, which has kept the volatility at the highs. As the price is heading towards the weekend, the rally appears to be largely calm. The volatility has compressed, ranges have tightened, and intraday swings have faded. However, a close observation highlights the hidden story—the US traders are actively selling into this consolidation. With the traders setting up their ‘buy-back’ plan, here’s what the upcoming BTC price action during the weekend may signify.

Bitcoin Price Remains Resilient, Not Underlying!

As covered in the previous composition, the bitcoin price is slowly absorbing the selling pressure, and hence, the traders may expect massive price action during the weekend. Meanwhile, the weekend trade typically brings thinner liquidity and slower price discovery, which is reflected in the current BTC price rally. With no major liquidation clusters and limited follow-through in either direction, the upcoming weekend trade is less likely to display a major breakout.

The above chart shows the BTC price replicating the previous pattern as it consolidates within range-bound levels. The current pullback could be the final pullback before the massive breakout if it perfectly aligns with the pattern. The RSI is also incremental, which is printing consecutive higher highs and lows, validating the bullish trajectory. The charts are perfectly lined up, suggesting the price breaching $100K in the first few days of 2026; however, the sentiments of the traders may prevent it from happening.

U.S. Traders Are Selling Into Stability

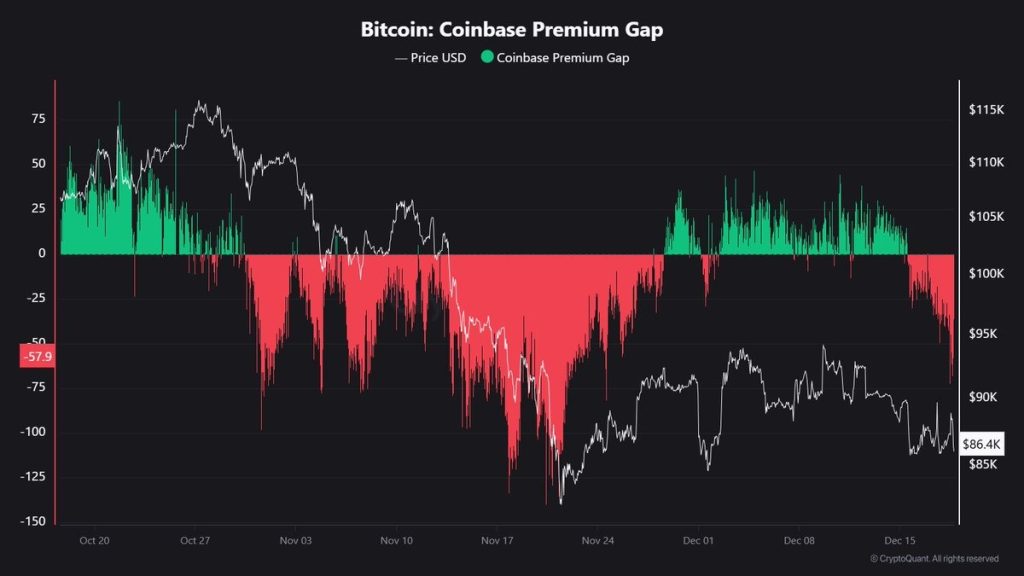

While Bitcoin’s price remains range-bound, the Coinbase Premium Gap has turned sharply negative, now NEAR -$57. This indicates that U.S.-based traders are selling at a discount relative to offshore markets, even as the price avoids sharp declines.

This behaviour suggests controlled distribution rather than panic. Selling is taking place during stable conditions, where liquidity allows for orderly exits. Importantly, price has not accelerated lower in response, which implies that demand is actively absorbing this supply.

For traders, this dynamic matters. When steady selling fails to push the price lower, it often marks a transition phase. The market either stabilises further or prepares for a directional MOVE once participation increases.

Key Price Levels to Watch Through the Weekend

Bitcoin (BTC) price is currently compressing between $86,000 and $89,500, which defines the immediate consolidation range. As long as the price holds above the $85,000–$86,000 support zone, the structure remains intact and signals absorption of U.S. selling pressure.

A sustained hold above $89,500 WOULD open the door for a retest of the $92,000–$94,000 resistance area, which marks prior supply and the breakdown region. That zone is likely to attract sellers again.

On the downside, a clean loss of $85,000 would weaken the current setup and expose the $81,500–$83,000 demand zone, where buyers previously stepped in aggressively.